Important Tax Information and Tax Forms

As J-1 Exchange Visitors, participants are considered “non-resident aliens” for U.S. tax purposes. This means:

- They must file a tax return at the end of their program.

- They should expect to pay income taxes but will usually not receive a refund of the taxes withheld.

- InterExchange staff are not tax professionals, so if participants have tax-specific questions, they should be referred to a qualified tax professional.

Taxes Participants Must Pay

- Federal income tax (required for all participants).

- State and local income taxes, depending on the location of the camp (some states have no personal income tax; others may tax up to ~8%).

- Note: Paychecks will almost always be slightly less than the stipend listed in the contract because of tax withholdings.

Taxes Participants Do Not Pay

- Federal Social Security tax

- Medicare tax

- Federal Unemployment tax (FUTA)

Important Exception: Some states deduct state unemployment tax, which participants are required to pay.

Mistaken Deductions

Sometimes employers accidentally withhold Social Security, Medicare, or FUTA taxes. If this happens:

- Participants should first ask their employer to correct the mistake and refund the deduction.

- If the employer cannot issue the refund, participants must file a request directly with the IRS using Form 843 (“Claim for Refund and Request for Abatement”).

Role of Cooperators

- Remind participants to check their pay stubs regularly. Look for deductions labeled FICA, FUTA, S.S., or Social Security—these should not be withheld.

- Help participants communicate with their employer if errors appear.

- If needed, direct participants to the IRS website or a tax professional for assistance.

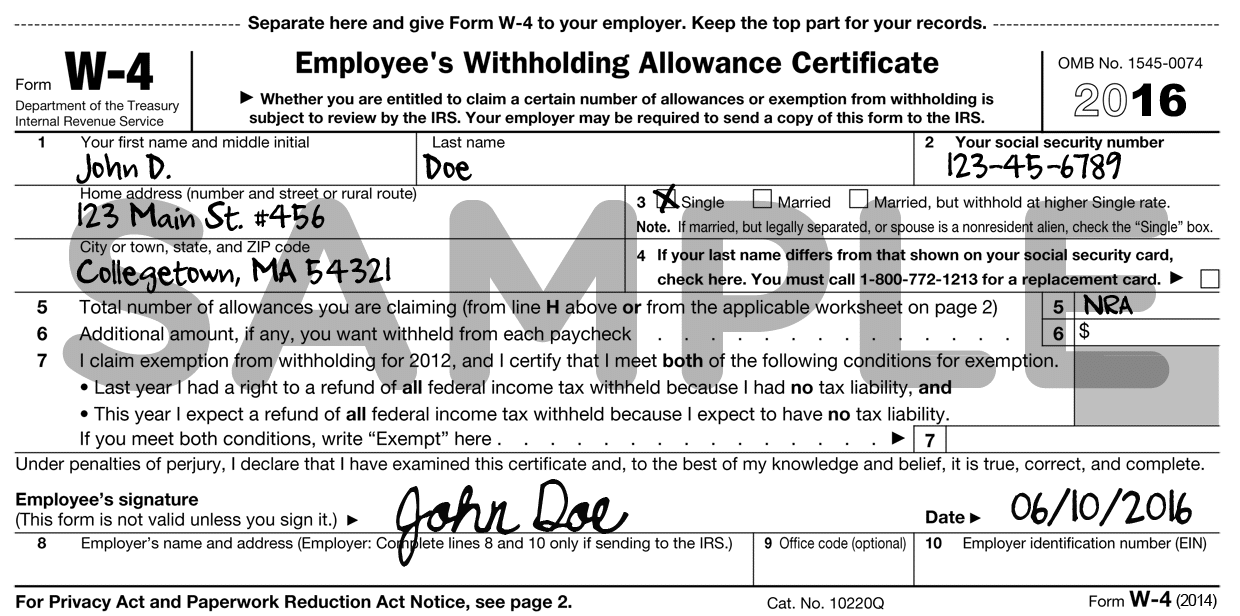

W-4 Form

All Exchange Visitors are required to complete a W-4 Employee Withholding Allowance Certificate when they begin working. This form determines how much federal, state, and local tax will be withheld from each paycheck.

Participant Responsibility

- The employer will provide the W-4 Form, and participants must complete and return it as soon as they start work.

- The W-4 form is used to calculate tax withholdings.

Correct Instructions for Nonresident Aliens

Many employers are not aware that J-1 Exchange Visitors are classified as “nonresident aliens” for tax purposes. This means that participants must follow the IRS Supplemental W-4 Instructions for Nonresident Aliens, not the general instructions printed on the form (which are for U.S. residents).

Key IRS Instructions for Participants

- Step 1(c): Check “Single or Married filing separately.”

- Step 4(c): Write “nonresident alien” (or “NRA”) in the space provided.

- Participants should not claim exemption from withholding in Step 4(c), even if they think they meet the exemption conditions listed on the form.

Role of Cooperators

- Remind participants to complete the W-4 right away when they begin work.

- Make sure they know to follow the nonresident alien instructions instead of the default W-4 guidance.

Filing a Tax Return

All J-1 Exchange Visitors are required to file a U.S. tax return after their program, even if they earned only a small amount of income. Cooperators should ensure participants understand the process and deadlines.

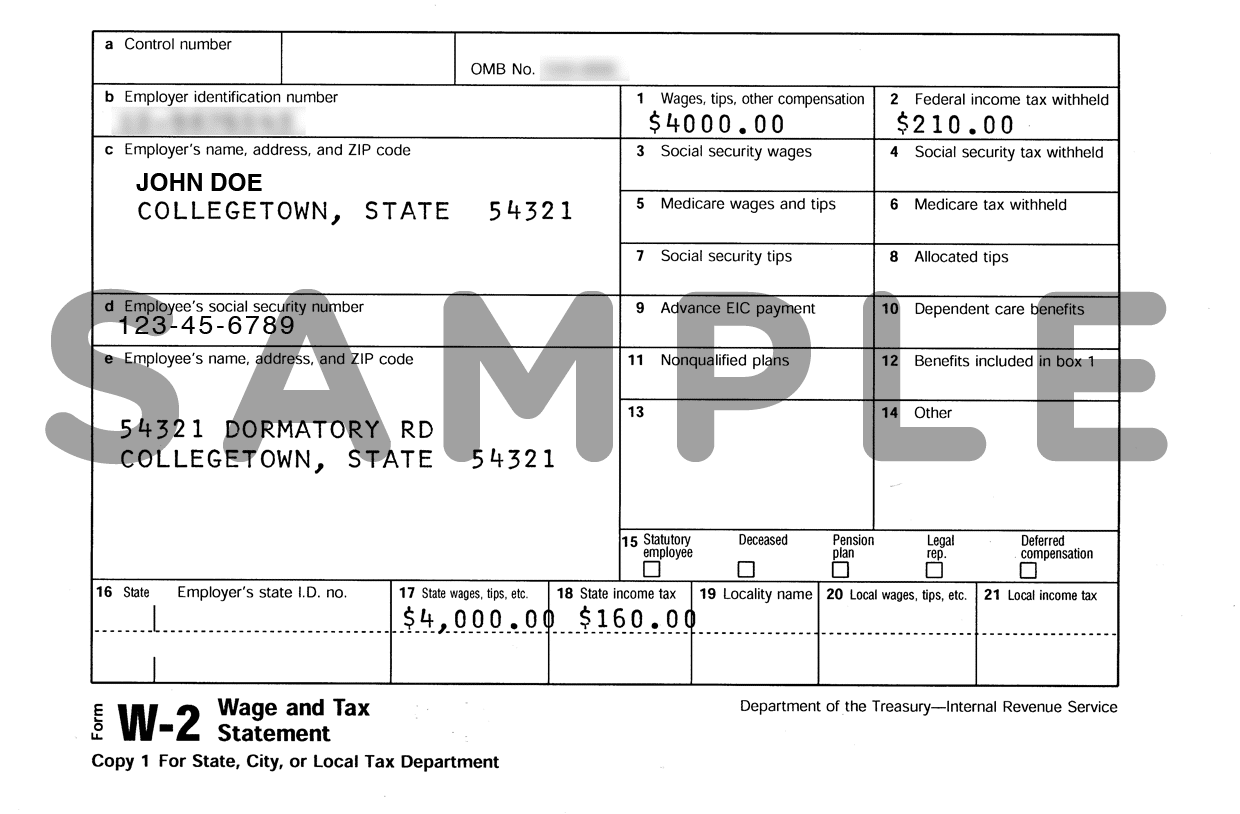

Step 1: Receive the W-2 Form

- Employers must send participants a W-2 Form by February 15th following the year of employment.

- The W-2 shows how much the participant earned and how much tax was withheld.

- Before participants leave camp, remind them to provide accurate mailing and email addresses so the W-2 can be delivered to them.

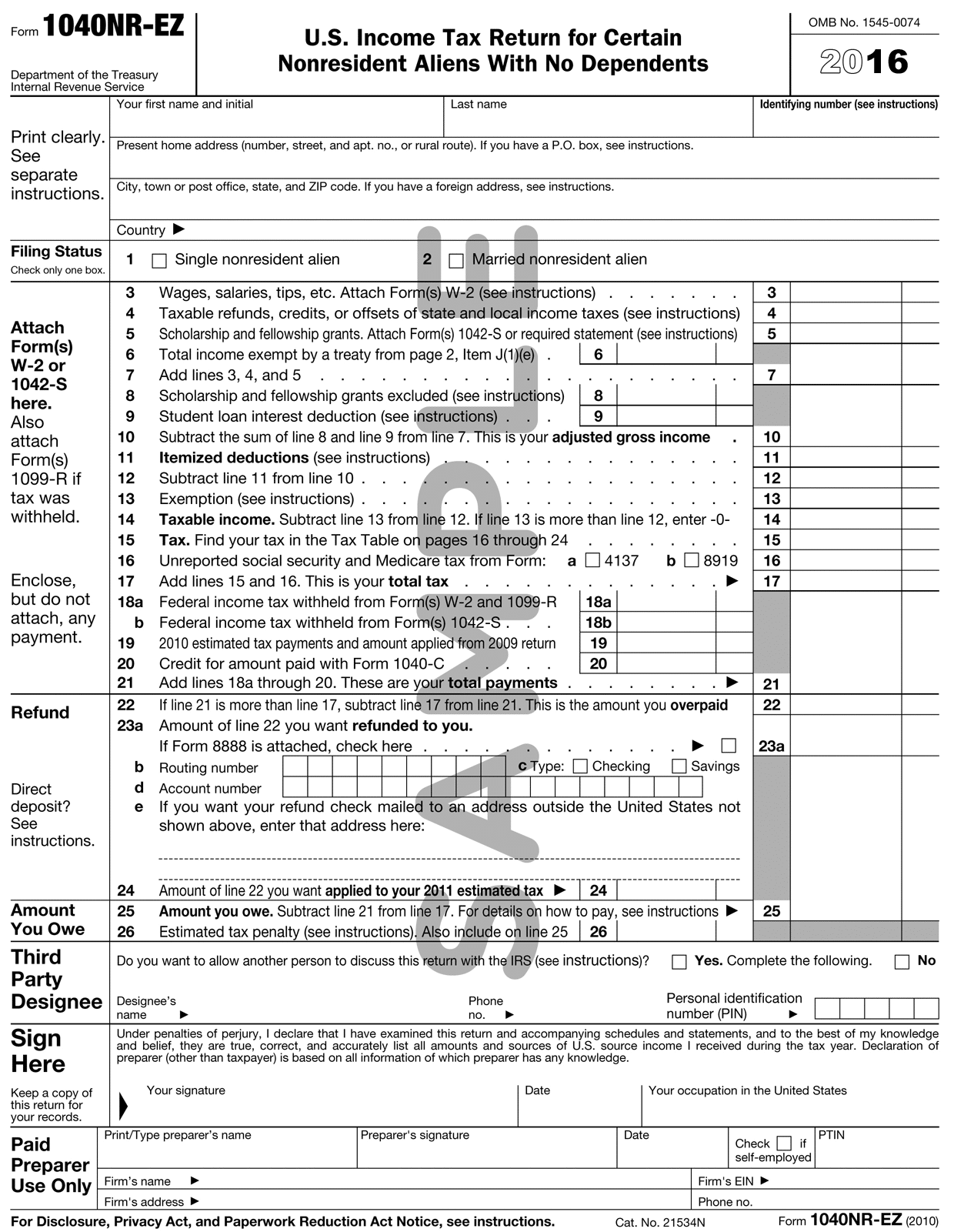

Step 2: Complete the 1040-NR Form

- Participants must file a 1040-NR (U.S. Nonresident Alien Income Tax Return)

. - They should carefully review the official IRS Instructions for Form 1040-NR before filling it out.

- Outcomes:

- If too much tax was withheld, participants will receive a refund.

- If not enough was withheld, participants must pay the balance owed.

- The filing deadline is April 15th of the year following their program.

- Many states also require participants to file a state tax return , in addition to the federal return. Each state has its own forms and requirements, usually available on the state’s Department of Revenue website.

Step 3: Submit Tax Forms

- Participants may mail their 1040-NR to the IRS address listed in the form instructions, or use an approved e-file service if available.

- Participants should always keep copies of all forms, receipts, and checks.

Mailing addresses:

- If payment is enclosed:

Internal Revenue Service

P.O. Box 1303 Charlotte, NC 28201-1303 USA - If no payment is enclosed:

Department of Treasury

Internal Revenue Service Austin, TX 73301-0215 USA

Refunds

- Refunds are usually issued as a paper check from the U.S. government. These may be difficult to cash in the participant’s home country.

- Direct deposit is possible only if the participant has a U.S. bank account at the time of filing. Participants should check with both their U.S. and home-country banks to explore options.

Role of Cooperators

- Remind participants about deadlines and required forms.

- Encourage them to check their mail and email regularly for their W-2.

- Help clarify that InterExchange staff are not tax advisors—if participants have detailed questions, they should seek assistance from a qualified tax professional or tax preparation service that works with nonresident aliens.

Frequently Asked Questions About Taxes

Will taxes be deducted from participant paychecks?

Yes. By U.S. law, participants are required to pay federal, state, and local income taxes. Employers are responsible for deducting these taxes from each paycheck and sending them to the government.

- Taxes participants do pay:

- Federal income tax

- State income tax (varies by state)

- Local/city income tax (if applicable)

- Taxes participants do not pay:

- Social Security (S.S.)

- Medicare (FICA)

- Federal Unemployment Tax (FUTA)

If participants notice that no taxes are being withheld, cooperators should advise them to contact InterExchange immediately.

Can participants get a refund for taxes withheld?

Participants may receive a refund only if too much tax was withheld. They will not receive a full refund of all taxes paid—everyone who works in the U.S. is required to pay some income tax.

What if a participant leaves the U.S. without receiving a Social Security number?

Even if participants do not receive a Social Security Number (SSN), they are still required to file a U.S. tax return if they earned income.

In this case, they must apply for an Individual Taxpayer Identification Number (ITIN) when they file their tax return.

To do so, participants should:

- Complete a 1040-NR (Federal Tax Return).

- Submit an ITIN application (Form W-7). For this reason, they should select: “B – Nonresident Alien Filing a U.S. Federal Tax Return.”

- Include a certified copy of their passport.

Important:

If submitting a photocopy of the passport, it must be certified by one of the following:

- A Certified Acceptance Agent or IRS official

- The government agency that issued the passport (e.g., participant’s home-country passport office)

- A U.S. Embassy or Consulate (appointment required)

If participants already have a Social Security Number, they do not need to apply for an ITIN.

Cooperator’s Role:

- Remind participants that taxes are mandatory, not optional. Set the right expectations that the stipend on the job offer will be less after taxes are deducted.

- Help them understand which taxes they should and should not pay.

- Ensure they know that they must file a tax return, even if they return home without an SSN.

- Direct them to InterExchange or a tax professional for detailed assistance.