Camp USA Participant Resources

These resources for new and existing Camp Counselors are here to help answer any questions you have about the Camp USA program.

Quick Links

Introduction to InterExchange

InterExchange is your J-1 Visa sponsor and our team is here to support you throughout your program.

We are a nonprofit organization with more than 50 years of experience dedicated to promoting cultural awareness through a wide range of affordable and exciting work & travel, professional training, internship, au pair, camp, language learning and volunteer programs within the U.S. and abroad. InterExchange is designated by the U.S. Department of State to sponsor a variety of J-1 Visa Exchange Visitor programs.

As a proud J-1 Visa sponsor and cultural exchange organization, we encourage our participants and professional colleagues to learn about The Fulbright-Hays Act of 1961 also known as the Mutual Educational and Cultural Exchange Act of 1961. This important act enables the Government of the United States to:

- increase mutual understanding between the people of the United States and the people of other countries by means of educational and cultural exchange;

- strengthen the ties which unite us with other nations by demonstrating the educational and cultural interests, developments, and achievements of the people of the United States and other nations, and the contributions being made toward a peaceful and more fruitful life for people throughout the world;

- promote international cooperation for educational and cultural advancement; and thus assists in the development of friendly, sympathetic, and peaceful relations between the United States and the other countries of the world.

InterExchange Camp USA helps participants between the ages of 18-28 experience the uniquely American tradition of “summer camp”. The Camp Counselor J-1 visa allows participants to work as “camp counselors” at an American summer camp (between May 15th and September 15th). Once camp has ended, there is a 30-day grace period that allows participants to travel though the U.S and experience American culture.

Other InterExchange Programs

Au Pair USA is a 12-month program that gives young people, ages 18-26, the opportunity to experience the U.S. by living with an American host family and providing childcare. In return for their services, au pairs receive room, board, a weekly stipend, accident and sickness insurance, airfare and up to $500 to use toward college-level educational courses. This program can be extended for an additional 6, 9 or 12 months after successfully completing the original 12-month program.

Career Training USA assists international students and young professionals, ages 18+, with J-1 Visa sponsorship for internships and practical training programs in the U.S. Candidates may apply for the J-1 Visa internship option if they have already secured a position in the U.S., or they may apply to be placed with an employer through the Internship Placement Program. International students and recent graduates may work as Interns and pursue an internship for up to 12 months in a field related to their academic field of study. International working professionals may apply as Trainees and pursue training programs for up to 18 months in a field related to their occupational background. To be eligible, participants’ education and work experience must have been earned outside of the U.S.

Work & Travel USA offers international university students ages 18-28 the opportunity to live and work in the U.S. for up to 4 months during their summer vacation. Students work in entry-level positions at hotels, inns, amusement parks, national parks, retail stores and ski resorts. They receive a wage, assistance with housing, accident and sickness insurance, program support and an optional month for travel to explore the United States. Work & Travel USA also offers a 12-month program for citizens of Australia and New Zealand.

Working Abroad enables U.S. citizens, ages 18-30, to experience diverse work experiences overseas. Opportunities include Au Pair, English language instruction, work and volunteer abroad placements. We offer programs in Australia, Africa, Asia, South America and various European countries.

The InterExchange Foundation was established in 2007 to provide grants to motivated young Americans who want to contribute to worthy work or volunteer abroad opportunities. The Working Abroad Grant supports participants of select InterExchange Working Abroad programs, and the Christianson Fellowship supports individuals who have sought out and arranged their own work abroad programs. Many students study abroad every year, but far fewer take advantage of the opportunity to work, intern, or volunteer overseas. By providing financial assistance to talented candidates, we encourage young Americans to discover and contribute to the world and benefit from the unique and enriching insights one can only gain from living and working abroad.

International Cooperators

InterExchange is proud to work with International Cooperator (IC) companies and organizations in more than 60 countries. Our IC network represents a cross-section of the most exceptional and trusted companies involved in promoting and recruiting for cultural exchange programs.

Our ICs introduce InterExchange programs to prospective participants in their home countries and emphasize the benefits of spending time in the U.S. to expand their knowledge of U.S. culture and personal experiences. ICs collaborate with us to fulfill the goals of cultural exchange, so our international participants can enjoy learning opportunities in the U.S., while host employers and families can meet and learn about people from all over the world. One of the key responsibilities ICs fulfill is to recruit, pre-screen and select applicants who meet visa eligibility requirements and are prepared to make the most of the cultural exchange experience when working with host employers, families and host communities.

In addition to providing ICs with detailed information and guidance for marketing our programs in their home countries, we also provide content for orientations to teach participants about life in the U.S. and prepare them for adapting to a new culture and country. Each in-bound international participant is interviewed by either InterExchange staff or an IC to evaluate the candidate’s ability to be successful on the program. InterExchange maintains the exclusive responsibility of final acceptance to the program, as well as program monitoring. Every IC is an important part of the process for making sure that all participants are equipped for the challenges and educated on the benefits of joining one of our cultural exchange programs.

Participant Rights, Protections and Program Understanding

InterExchange makes it a priority to ensure that all our participants enjoy a safe, healthy and well monitored cultural exchange experience in the U.S.

The following information describes a baseline for conduct that our participants can expect from InterExchange and their hosts as well as their responsibilities during their visits to the United States through InterExchange programs. We’re happy to say that the majority of our participants and hosts consistently exceed these standards to create a truly memorable, life-changing cultural exchange experience for everyone involved.

During Their Programs, InterExchange Participants Can Expect:

- A safe, healthy and legal work environment.

- A safe, healthy and legal living situation.

- Opportunities to interact with Americans on a regular basis.

- Protection of their legal rights under United States immigrant, labor, and employment laws.

- Fair treatment and payment practices.

- Right to keep passport and other documents in their possession.

- Right to report abuse without retaliation.

- Right to contact the J-1 Visa Emergency Helpline of the U.S. Department of State.

- Right not to be held in a job against their will.

- Right to end their programs and return to their home countries.

- Right to request help from unions, labor rights groups and other groups.

- Right to seek justice in U.S. courts if warranted.

Participants Can Also Expect the Following Support From InterExchange Throughout Their Programs:

- 24 hour emergency assistance while working at camp.

- Resources and guidance throughout the application process and while in the United States.

- At a minimum, monthly contact and monitoring.

- Vetting and conducting due diligence to verify each host employer or host family.

- Available staff with extensive international experience and language skills.

- Available staff who can provide support for special situations if needed.

- Acting as a neutral advocate to help resolve any disputes that occur.

- Accident and Sickness insurance that meets or exceeds J-1 Visa regulatory requirements.

Participants in Our Programs Acknowledge That:

- The primary purpose of InterExchange cultural exchange programs is to interact with U.S. citizens, practice the English language, travel and experience U.S. culture while sharing their culture with Americans.

- They will abide by the laws of the United States as well as all state and local laws.

- They will abide by all rules and regulations applicable to U.S. Department of State Exchange Visitor programs.

- They have not come on a J-1 Visa program seeking permanent residency or employment in the U.S.

- They are expected to follow the guidelines of employment provided by their host employer or host family.

- InterExchange is their visa sponsor. A U.S. host employer or host family is not a visa sponsor.

- Any wages earned during the programs are only meant to help defray living expenses during the programs. Earning money is not the primary purpose of cultural exchange programs.

- Host employers and families may terminate their employment relationship with participants.

- Host employers and families do not have the authority to cancel the J-1 Visa. Only the U.S. Government or InterExchange has that authority.

- They must contact InterExchange in the event of an emergency or if any problems occur during the program.

- They will respond to all requests and inquiries sent from InterExchange.

- They are required to leave the United States at the end of their programs.

Frequently Asked Questions

Do you have questions about the Camp Counselor experience? We’ve got the answers to your most frequently asked questions here.

When is camp?

You may begin the camp program starting as early as May 15th and ending as late as September 15th. You will coordinate your exact dates with your camp director. Counselors arrive a few days early to undergo staff orientation and training before the campers arrive. This gives you time to bond with other counselors and get accustomed to life at camp! After your last day of work, you will be allowed 30 days of travel within the U.S.

Where are camps located?

Although we work with camps across the United States, most camps are located in the Northeast region, a few hours from major cities such as New York, Boston, and Philadelphia! Enjoy the outdoors while being a hop, skip, or jump away from a city that would be a great trip on a day off.

What is a camp counselor?

A camp counselor is the best job ever! In a nutshell, you’ll be in charge of leading day-to-day activities and helping campers have a ton of fun. No two days as a counselor will be the same. One day, you may be leading a hike, while the next helping your cabin prepare for the camp talent show! It’s a job that takes lots of energy but is really rewarding if you love working with kids. Learn more about the camp counselor experience from our participants here!

What kind of visa am I applying for?

Working at a U.S. summer camp requires applying for the J-1 Cultural Exchange Visa.

What is the difference between the Camp Placement, Self Placement and Returning Placement Programs?

- Camp Placement participants apply through InterExchange to find a camp job!

- Self-Placement participants are first-time international candidates who have accepted a job offer from a specific camp before submitting their application to InterExchange.

- Returning Placements are participants who have worked at a camp in a previous year and have secured a job offer by making arrangements with the camp directly. Camp Placement participants apply through InterExchange to find a camp job!

Am I eligible for the program?

Applicants from all countries can apply. If you’re between the ages of 18 and 28, comfortable working with children, proficient in English, and either a student, teacher, youth worker, or someone who can lead a specialized skill at camp, then you are eligible for the program!

What’s a “specialized skill,” you ask? Anything you are good at that can be of value to a summer camp is a specialized skill! Love to swim? Great with a video camera? A natural on stage? All of your talents can and should be highlighted in your application!

What types of camps can I work with?

There are all sorts of summer camps throughout the U.S. serving many different types of campers. No two camp locations are exactly alike, and many fall into multiple categories.

Just to name a few, there are:

- all-girls camps

- boys camps

- religious camps

- sports camps

- arts camps

- academic camps

- equestrian camps

Some camps serve children from underprivileged backgrounds and camps for people with special needs. Many camps combine these categories. For example, you could join an academic, all-boys camp that serves children from underprivileged backgrounds.

We encourage applicants to be open to as many camp types as possible and determine if they would be a good fit based on their interview. There’s no reason to limit yourself to a job opportunity before you get a glimpse into life at that camp.

Do I need any qualifications or previous experience?

The short answer is no, but it is helpful if you have some special skills or qualifications that you can offer. But it is far more important that you love working with kids and enjoy the outdoors. Previous childcare experience is always a plus, but you can apply without it! There are so many skills you can offer to a summer camp! A great attitude and a desire to work with campers are the main attributes camp directors want to see in applicants. Many directors value life experience over qualifications, so if you love drawing, don’t be afraid to list it as a skill on your application.

Can I get a visa in my home country?

Yes! Once accepted and placed at a U.S. summer camp, InterExchange can process the paperwork needed to apply for the J-1 Visa at a U.S. Embassy in your home country. We will walk you through all of the steps you’ll need to take to obtain a visa!

What is an International Cooperator (IC)?

InterExchange also works with independent agencies (international cooperators) based in countries outside the U.S. If InterExchange works with an international cooperator (IC) in your home country, they can help you complete and submit your application to us. You are not required to apply through an IC, but they can offer you great advice and guidance throughout the application process in your native language and home country. This is why if you apply to InterExchange through an IC, you’ll pay your fees directly to them. International Cooperator fees vary from country to country and are determined by each IC based on the services and benefits offered.

InterExchange only works with IC’s who charge fair program fees. If you have selected an agency in your home country and would like to apply through InterExchange, please get in touch with us to verify that the agency is approved to send candidates through InterExchange. We do not accept applications from unauthorized third-party agencies, and we request that you do not pay any fees to an agency without first verifying they have a contractual agreement with InterExchange. Similarly, if you would like help finding an international cooperator, please get in touch with us for a list of InterExchange-approved agencies in your home country. If we do not work with an agency in your country, you may still apply to InterExchange directly.

When should I apply?

Apply as soon as possible! The earlier you submit your application the better. Applications submitted after March 1st aren’t guaranteed to be accepted. Keep in mind that InterExchange will ask you to do a short interview before we accept your application, so plan accordingly and get your application in early!

How long is the application process?

The application can be completed in as little as one day; it depends on you! We encourage you to take your time with the application, consider your responses, and make your application stand out. But the key to submitting a stellar application is starting early!

How long does it take to get placed?

We try our best to find a placement for each participant. Since camp directors have the final say on who they’ll hire, we can’t guarantee a time frame. Some participants are matched one week after they are accepted into the program, while others wait several months. You should be prepared to wait until mid-June for a placement.

Can I travel before and after camp?

You can enter the U.S. up to 30 days before your program start date, but we recommend not arriving too early so you are refreshed and ready for camp. Your visa also grants you a 30-day U.S. travel period after camp! We highly encourage you to use the travel period after camp.

Am I allowed to find camp jobs on my own? We will handle the placement process if you have applied to our Camp Placement program. We work with hundreds of camps across the U.S., and we’ll match you with a job that fits your skill set and personality!

If you have applied to our Self or Returning Placement programs, you are responsible for finding your camp job independently. After you are independently hired and your camp sends you a contract, you can apply to our Self-placement or Returning Placement program to obtain your visa.

What is your refund policy if I cancel?

Program and SEVIS fees are non-refundable once you have accepted and signed your job offer. Any insurance fees paid are refundable before your program start date. If your visa is denied, you will receive a 50% refund of the program fee and a complete refund of the insurance fee.

Refund policies vary if you apply through one of our International Cooperators.

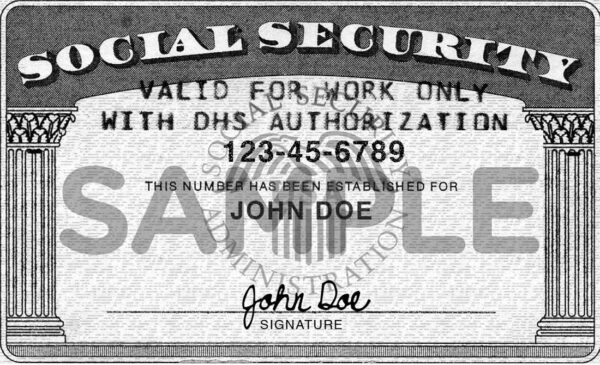

Why is a Social Security number needed?

Social Security numbers are generally assigned to people authorized to work in the United States. They are used to report your wages to the government and when filing your tax return. Also, when opening up a new bank account, most banks require either a Social Security number or proof of application for a Social Security number.

Camp USA Programs

InterExchange Camp USA helps participants connect with a U.S camp where they will be working alongside Americans as “camp counselors”. Camp USA applicants apply to one of three program categories: Camp Placement, Self Placement, or Returning Placement. While many of the details covered in this handbook are specific to Camp Placement participants, Self Placement and Returning Placement participants will also find many of the issues covered to be useful.

Our Role

As a J-1 Visa sponsor, InterExchange serves as the central contact point for U.S. camps, international participants and ICs. We take great pride in running our program with a personal approach, which is why we will stay in contact with you throughout the entire program. When you choose to participate in our program, you can expect:

- Personalized service from dedicated InterExchange Camp USA program professionals.

- Thoroughly screened host camps, evaluated by InterExchange

- DS-2019 Forms and visa application support

- 24-hour program support throughout the summer

Participant Requirements

InterExchange Camp USA recruits applicants who are:

- Between the ages of 18 and 28 during the summer of participation.

- Students, teachers, youth workers or individuals with specialized skills.

- Fluent in English and able to attend an orientation and interview in their home country.

- Experienced and/or enthusiastic about working with children in a camp environment.

- Highly motivated and committed to the program for 8 to 15 weeks.

Camp Placement Participants

Camp Placement participants are those who would like help finding an offer from a U.S summer camp. Camp Placement participants receive:

Access to our “matching system”

Camp Placement participants will gain access to our matching system. This allows them to view profiles for summer camps that are actively looking to host international staff. The camp directors are also able to view available applications and will contact applicants for an interview. Our matching system makes it easy to find an offer from a U.S summer camp.

J-1 Visa Documentation and Sponsorship

Once you have received and accepted an offer, InterExchange will provide you with a DS-2019 Form and your SEVIS receipt. These two documents allow you to apply for the J-1 Exchange Visitor Visa at a U.S embassy or consulate. The J-1 Visa allows you to enter the United States to work at your camp during the dates listed on your form. The J-1 visa also permits travel within the United States for an additional 30 days after the end date on your DS-2019 Form.

Insurance

All participants will receive accident and sickness insurance for the duration of their work contract, with the ability to extend as needed for an additional cost. The coverage will start the day before your camp contract begins and ends the day after your contract ends. To learn more about your insurance coverage, refer to the Insurance Information section of this handbook.

Orientation

Before you arrive in the U.S. you will be provided with a thorough online orientation. This orientation video is a mandatory program requirement, and will take approximately one hour to finish. During the orientation you will learn about your health insurance, safety tips, travel suggestions and many other helpful topics. Please contact us if you have any questions about the contents of your orientation.

In addition, you will receive an in-person orientation at camp, usually lasting between three and five days. However, because each camp is run differently, these orientations will vary in type and length.

Program Assistance

InterExchange Camp USA will provide you with 24-hour support for the duration of the program, including the 30 day grace period after camp. If there is an emergency that occurs after normal business hours (Monday – Friday, 9:30 a.m. – 5:30 p.m. EST) or on a holiday, you can reach a member of the InterExchange Camp USA team at our 24-hour emergency number: 1-917-741-5057.

Self and Returning Placement Participants

Self Placement participants are those who have received a job offer from a camp prior to submitting their application to InterExchange.

Returning Placement participants are those who have worked at a U.S. summer camp in a previous year and have decided to return for another summer.

Important: InterExchange is only permitted to sponsor a very limited number of participants who have previously worked at camp more than once. If an applicant is returning for their 3rd summer (or more), sponsorship is subject to availability.

If you are applying for the Self or Returning Placement program, you:

- Will not have access to the “matching system”

- Have already received and accepted a formal offer from a U.S summer Camp

- Are responsible for the cost of your travel to and from the U.S

- Will negotiate the terms of your offer directly with your camp

- Must satisfy and demonstrate eligibility for the program

The Self and Returning Placement programs include:

- J-1 Visa Documentation and Sponsorship

- Insurance

- Orientation

- Program Assistance

Matching Process

Camp Placement Participants

When or if your application is accepted, you will have access to the InterExchange “matching system”. The matching system helps participants find an offer from a U.S summer camp. This can happen in one of 3 ways:

- A Camp Director finds your application

Camp Directors are able to browse available applications. If a Camp Director puts your application “on review”, it means they are considering you for a position. If you are excited about this opportunity, reach out and introduce yourself! If you are not interested in the camp, you can remove your application and re-enter the matching system. Be sure to review the camp’s profile and contact InterExchange before turning down a camp. We’re here to help!

- You look for a camp and find one you’re interested in

After your application has been accepted, you will be able to browse profiles for each summer camp that is actively looking to host international staff. If you see a camp that you are interested in, you can send your application directly to them. The camp will have exclusive access to your application for 7 days. During this time, we recommend that you contact the camp to introduce yourself! Hopefully within a few days, they will contact you for an interview!

- InterExchange sends your application to a camp that is looking for someone like you

InterExchange has a close relationship with the camps we work with. We have been helping them find great camp counselors for many years and we know exactly what they’re looking for. If we see an available application that has the personality + skills that a camp is currently looking for, we will share the application with that camp.

Tips for a Successful Match

- Keep an open mind! You might already have an idea of the type of camp you’re looking for, the location of that camp or the position you’d like to be in. That’s great but don’t limit your options! If you do, you may miss out on a great opportunity!

- Be patient. Give the Camp Director a full week to review your application. Camp Directors are busy people. If you send your application to a camp, don’t be alarmed if they don’t reach out to you immediately.

- Check your email, including your SPAM folder! When your application is being reviewed, typically the Camp Director might email you. Sometimes these emails go to SPAM. Check your email regularly so you don’t miss out on a great opportunity!

- Don’t get discouraged and trust the process. Once you apply to a camp, they will either contact you for an interview or decline your application. Finding the right camp can take time but don’t get discouraged. You will find an offer from a great camp! Just be patient and trust the process!

- Ask for guidance and suggestions! Our Camp USA team has learned from so much experience in the camp world. If you are having a hard time finding a match or going through the process, ask for our help! We want you to find a job where you will succeed, and we are happy to help you in the process.

Accepting a Job Offer

It could take anywhere from a couple of days to several weeks, but you will eventually be matched with a great camp! If a camp would like to hire you, they will send you a job offer. This job offer will include the proposed position, arrival date, contract start date, contract end date, and total compensation amount. The compensation amount listed is what you will be paid but taxes will be deducted from this amount. For more information on taxes, refer to the Tax Information section of this handbook.

Please note: Upon receiving an offer, you will have five days to decide whether or not to accept it. Camps often are not able to hold a position any longer than that. If you decide you would prefer to keep looking, you can decline the offer. Keep in mind, if you decline an offer, that position will be offered to someone else and it will no longer be available to you.

Next Steps

Once you have accepted a job with camp, InterExchange will begin preparing the documents you will need in order to apply for your J-1 visa at a U.S. Embassy. Please stay in touch and we will guide you through the visa + embassy process. Once your visa is approved, you can book flights and prepare to travel!

Self and Return Placement Participants

Once your application has been accepted we will send it to the camp you have agreed to work at. The camp director will then log in to their InterExchange account to confirm the details of your offer. Once confirmed, you will need to login to your InterExchange account to formally review + accept the offer. Once you have done so, InterExchange will begin preparing the documents you will need in order to apply for your J-1 visa at a U.S. Embassy. Please stay in touch and we will guide you through the visa + embassy process. Once your visa is approved, you can book flights and prepare to travel!

Important Visa Documents

Once everything is confirmed, it is time to obtain your J-1 Visa. InterExchange will provide assistance during this process, but you will be responsible for filling out paperwork and interviewing at an embassy.

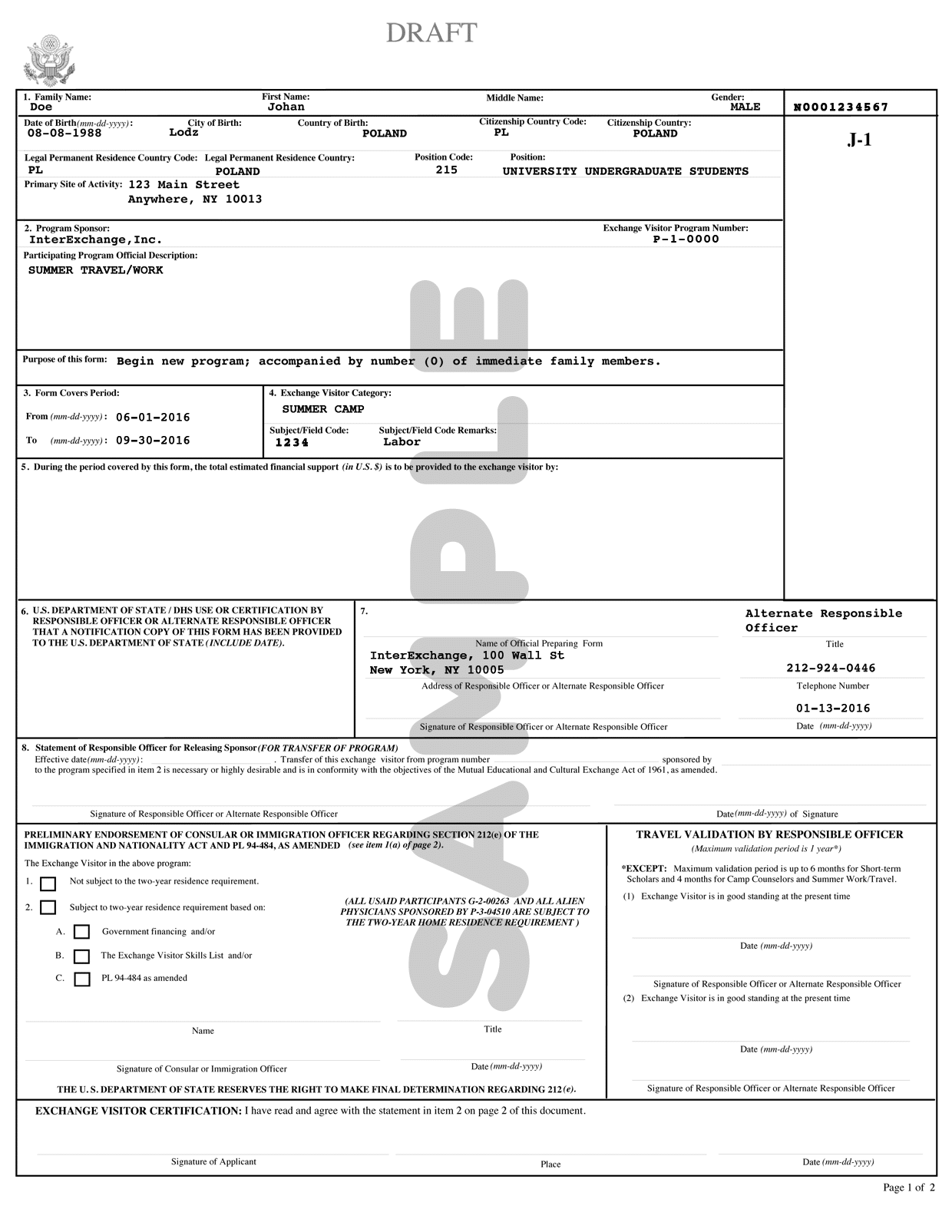

The DS-2019 Form

The DS-2019 Form is your proof of sponsorship. This is the form that allows you to legally work in the United States (provided that you also have a valid J-1 Visa) for a specified period of time. It is also the form that determines how long you can work and stay in the U.S.

InterExchange will provide you with this form. It will be uploaded to your InterExchange account when it is ready. You must PRINT out a copy to take with you to the embassy. They will NOT accept it in digital form.

The SEVIS Receipt (1-901 Form)

You will also need your SEVIS receipt (also called the I-901 Form). Once you have printed your DS2019 form, you can access your SEVIS receipt here. You must PRINT out a copy to take with you to the embassy. They will NOT accept it in digital form.

Please keep both of the documents in a safe place. Upon entry to the U.S, you will be asked to show your DS2019 and/or your SEVIS receipt. You will also need these documents in order to apply for a Social Security number once you have started working at camp.

DS-160 Form

The first thing you need to complete in order to apply for the J-1 Visa is the DS-160 Form. You can complete this form here. You will need to submit the DS-160 Form, your DS-2019 Form, SEVIS receipt and passport to the U.S. Embassy or Consulate in your home country in order to schedule a visa appointment. You can refer to this article for more information about completing your DS-160 and booking your visa interview. Please consult with your International Cooperator or the embassy’s website to determine if there are other forms you may need to submit with your application, as requirements vary by country.

J-1 Visa

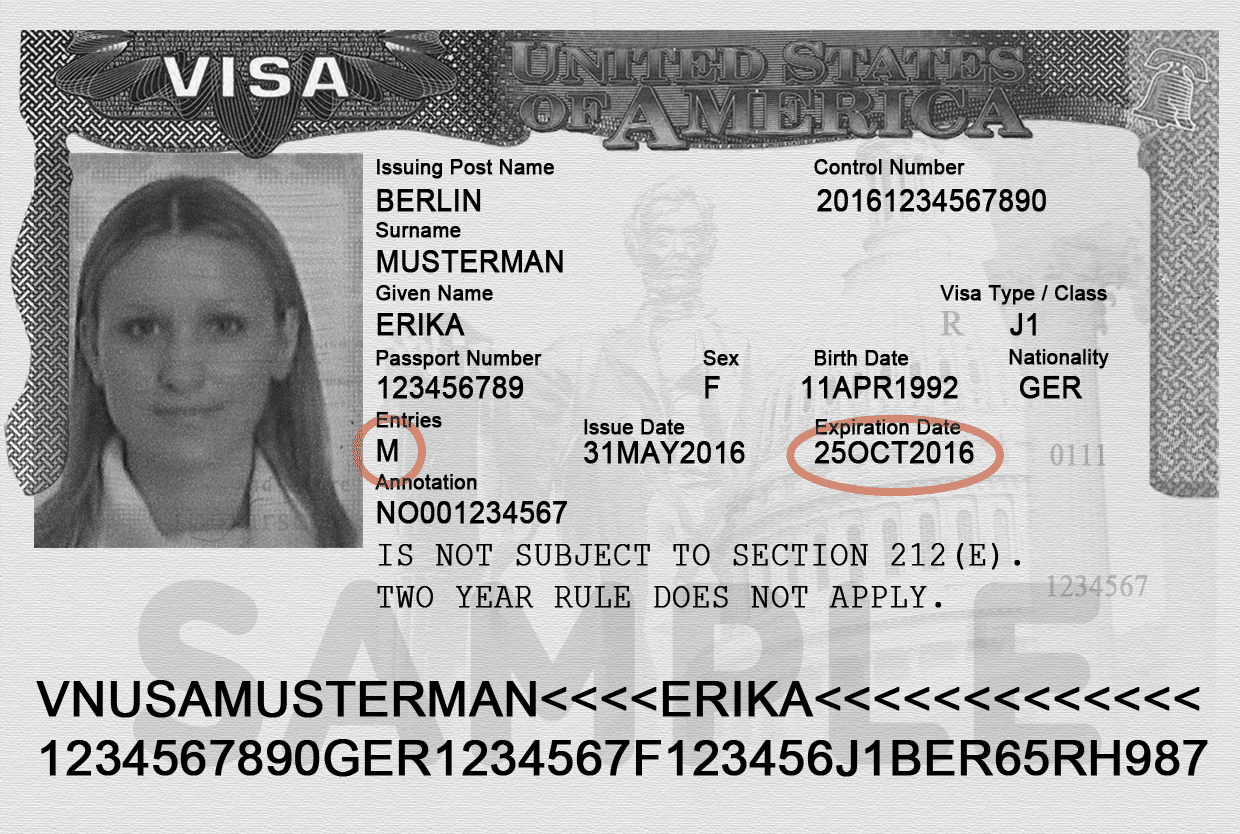

When you get your passport back from the embassy, if approved, your visa will be printed inside. The visa is the document that allows you to enter the United States and explains why you are traveling to the U.S. The J-1 Visa is an Exchange Visitor Visa, sponsored by InterExchange.

There are two items on the J-1 Visa that you should check:

- Entries. Under this heading, there will either be the number “1” or the letter “M.” If your visa has the number “1,” it is a Single Entry Visa. This means you can only enter the United States one time on this visa. If your visa has the letter “M,” it is a Multiple Entry Visa and it allows you to enter the U.S. several times. You could, for example, go to Canada during a weekend off and re-enter the United States. You should not plan on leaving and re-entering the United States during the 30-day travel period.

Important: If you have an “M” Multiple Entry visa and you plan to travel outside the U.S. and return, you must re-enter the U.S. before the expiration date on your visa and have your DS-2019 Form signed by InterExchange. Please note that, depending on your home country, you may be required to obtain a visa to travel to Mexico or Canada. Please contact the Mexican or Canadian consulate for information.

- The expiration date. You are only allowed to enter the U.S. until the expiration date stamped on your J-1 Visa (even if it is multiple entry) or until the end date of your DS-2019 Form, whichever is earlier.

Important Notes

You must return home within 30 days of your last day of work. InterExchange Camp USA will report all participants who do not return home to the U.S. Department of State and to their home countries’ embassies.

J-1 Visas issued by U.S. Embassies in some countries may have an expiration date that is later than the end date of this program. For example, you may find that the embassy has given you a visa that expires in two years, instead of four months. This does not allow you to stay in the U.S. for longer than the duration of our Camp USA program, which is indicated on your DS-2019 Form. Instead, it means that if you want to come back to camp next year, you may not have to apply to the U.S. Embassy/Consulate for a new J-1 Visa. However, you will still need to get a new DS-2019 Form. The J-1 Visa is not valid without a DS-2019 Form. Some countries also have early end dates. Please be sure you know when you need to return to your country.

Preparing for Your Trip to the U.S.

Pack Light

Pack lightly for your trip. Your airline will have baggage and weight restrictions, so remember to call or check the airline website before you go to the airport. Most airlines will only let you carry two bags and each must weigh under 32 kg (check your airline’s website for restrictions. There may be a charge per bag which may not be included in the price of the ticket). Remember that you will probably want to buy clothes and souvenirs when you are in the U.S., and if you plan to travel around after camp, it will definitely be easier if you travel lightly. Try to pack in a large backpack rather than a suitcase.

What to Pack

First, and most important, bring your passport, J-1 Visa, DS-2019 Form and SEVIS Receipt! You cannot get into the country without them so make sure you have them in a carry-on bag, not in the luggage you check-in. You should make a copy of each of these documents and keep them in a separate bag, just in case you lose your originals.

The following is a list of suggested items you should and should not bring with you to the U.S. You can also contact your camp for a more specific packing list.

Money: You should come prepared with enough money to cover initial expenses when you first arrive in the U.S. You may not get your first paycheck until several weeks after your arrival. We suggest a minimum of $800 to cover travel, food and other expenses.

Toiletries: Shampoo, soap, a toothbrush, toothpaste, a razor and deodorant are essential. You can buy a supply for the duration of your program once you arrive in the U.S., so just bring enough for one week. If you pack liquids in your carry-on luggage, you are not permitted to have more than 3 oz. (88 ml) in a bottle.

Medications (pack in your carry-on luggage): You should bring enough medication for the entire time you are in the U.S. Also, bring a note (written in English) from your doctor indicating the type of medicine you need, just in case you lose it. Your camp will require you to store your medicine at the infirmary. You will be able to pick up a dose of your medication as often as necessary. Check with your camp for any additional rules regarding medication. Some camps require medication to be in original bottles.

Shoes: Sneakers or trainers are mandatory. Do not buy the nicest, most expensive sneakers you can find. Instead, bring your old pair. Sneakers are relatively cheap in the U.S., so if you need a new pair, there is no better place to buy them! You will also want to bring a pair of flip-flops to wear to the pool or lake, and in the shower.

Clothing: You will need to bring T-shirts and shorts for the daytime, and jeans and at least one sweatshirt, jumper or light jacket for the evening. Remember that it can get very hot during the day but very cool at night. The clothing you bring should not be new or expensive. Also bring a nice outfit for parties at camp or outside on your days and nights off. This outfit must be appropriate for you to wear around children, even if you plan to wear it in the clubs of the big cities after camp.

Underwear & Socks: A week’s supply of underwear and socks is essential. If you have room, you will appreciate a few extra pairs of each, especially if you unexpectedly fall out of a boat or walk through a puddle in the dark!

Swimsuit & Towel: Often, camps will have a pool, a lake or both. You should bring at least one swimsuit and one towel with you. Your bathing suit must be modest and appropriate for camp. Leave your thongs and Speedos at home!

Sleeping Bag (optional): Many camps send campers and staff on overnight trips. On these excursions, your sleeping bag is all that separates you from the ground below. The sleeping bag will also double as an extra blanket on cool summer nights.

Rain Gear: In addition to being hot during the day and cold at night, it rains, too. You will need a waterproof jacket and a pair of waterproof boots. Umbrellas are not always a good idea. Many camps are in the mountains, and umbrellas can attract lightning during a storm.

Non Valuable cultural items: Many camps will provide an opportunity for you to share stories and information about your culture! It may be fun and helpful to have your flag, a popular toy, or even music available to share with the campers.

Additional Items: We suggest you pack a flashlight (torch), watch, alarm clock (battery powered), money belt or pouch and your international driver’s license. You might also want to bring a hat or visor, sunscreen and sunglasses for all the summer days you will spend outdoors!

What to Leave at Home

There are some items you definitely do not want to bring with you: expensive jewelry and family heirlooms should be left behind. Your camp may have a safe to lock them in, but you may not have access to a safe when you travel. You might also be tempted to bring your guitar overseas. It’s a great thing to want to share your gift of music, but remember that an instrument will get counted as a bag when you fly. Think carefully about bringing an expensive camera to camp as it could get lost or damaged.

Pack according to the job you will be doing at camp! If you are an adventure-training specialist, you may want to bring waterproof pants in addition to a waterproof jacket. Swim staff might want to bring 2 or 3 swimsuits.

Do not bring insect repellent with you. The repellents created for use in your home country may not be effective in America and may actually attract bugs to you! When you arrive in the U.S., buy some at any drugstore or supermarket.

Many camps send a sample packing list to all staff members. You should be aware that these lists are usually designed for the campers and not for the international staff. You will quickly learn when you arrive at camp that the children may have brought more clothes with them than you even own! It is important not to over pack. If you do forget to pack an item, don’t worry! You can buy what you need on your first day off or when you arrive at the airport..

Remember: If you are going to be upset if it is lost or ruined, don’t bring it to camp!

Sample Packing List

- Passport with J-1 Visa

- DS-2019 Form

- SEVIS Receipt

- Camp Contract

- International Driver’s License

- Pair of Boots

- $250 for travel

- Photocopies of All Documents

- Medications, including your doctor’s letter indicating type of medicine

- 2 Pairs of Shorts

- 1-2 Pairs of Jeans

- Pair of Athletic Pants

- 7 Pairs of Underwear

- Light Jacket

- 2 Sweatshirts

- 2 Swimsuits

- Nice Outfit for Social Events

- 6 T-Shirts

- Pair of Sneakers

- Shower Shoes/Flip-Flops

- 7 Pairs of Socks

- Pajamas

- Raincoat

- Sleeping Bag (optional)

- Toiletries (soap, shampoo, deodorant, toothpaste, toothbrush, etc.)

- Travel Book

- Alarm Clock

- Towel

- Hat

- Sunglasses

- Flashlight (Torch)

- Money Pouch

- Batteries for Electronic Devices

Arrival in the United States

Follow the instructions provided by your camp in order to determine which airport to fly into. Please bring a minimum of $500 USD to cover travel expenses, food, etc. We know you may be nervous when you get off the plane or unsure about where you should go. Just follow the instructions you have been given. The airport will have clear signs to tell you where everything is, so be sure to pay attention to them.

Your travel instructions will be listed in your account at CampUSA.org/login once you have been matched with a camp. Review them, and contact your camp director if you have questions about how to get to camp. There are often multiple transportation options from the airport. Taxi service is often expensive if you are on a budget, so if you opt to take a taxi, make sure you have enough money for your other expenses. Read the travel directions carefully, and don’t hesitate to ask airport employees for assistance if you are confused.

Upon arrival at the Airport

When you first arrive at the airport you should check into your airline and receive your flight ticket. At the same time you should also check your baggage, if necessary. Make sure any important items, such as your travel documents and money, are in your carry-on that will stay with you. Any items that go into your checked baggage cannot be accessed until you arrive at your final destination. You will then move on to security. As you come up to security you will need to place all of the items with you on the conveyor belt. Small items should be placed in bins. If you are bringing a laptop with you, you will need to take it out and place it into a bin of its own. Each traveler must remove their quart-sized plastic, zip-top bag of liquids from their carry-on and place it in a bin or on the conveyor belt for X-ray screening. X-raying separately will allow security officers to more easily examine the declared items.

You will also need to remove your shoes, belts, watches, coats or sweaters and place them into a bin as well. As your items are being checked you will go through a metal detector or a body scanner to check what you may have on your body. This requires you to step into an open machine and raise your arms while the machine scans your body. The process is very quick.

If you have a layover to change flights once you have entered the U.S. from abroad, you should remember that you typically need to receive and re-check your baggage before your next flight.

Entering the U.S through Customs

Once off the plane, you will immediately go to Customs and Border Protection (CBP) to gain admission to the U.S. You will tell the CBP officer you are a J-1 Exchange Visitor when you present your documents. You should be prepared to answer questions about where your camp is and how long you will be in the United States. Remember, the border officer you speak with ultimately has the final decision about whether or not to admit you into the United States, so have your information ready and be polite and honest.

When CBP’s inspection is complete the officer may stamp your passport. For up-to-date information on clearing Customs, check with the U.S. Customs and Border Protection.

Accommodation upon Arrival

If you are arriving earlier or later than camp suggested, you will likely need accommodation before you can arrive at camp or before they pick you up. This must be planned and reserved in advance.

If your camp has instructed you to fly into New York City, we suggest that you arrive a day or two early. Hostelling International (located at 891 Amsterdam Ave) is our suggested hostel if you choose to arrive early. Reservations will be at your own expense and should be made well in advance. Reservations can be made at their website.

If you’re looking for hostels or accommodation outside of New York, be sure to check out our Affordable U.S. Hostels and Special Discounts for recommendations.

If your camp is not meeting you at the airport, you will have to pay for any bus or train tickets to camp. Make sure you bring enough money to cover that cost. Save your receipt and give it to your camp upon arrival if they offer to reimburse for bus or train tickets.

Arrival to Camp

Once you have arrived at camp, you must log in to your InterExchange account to let us know you are there!

Your arrival check in has three parts. You must complete all three parts in order for InterExchange to activate you in SEVIS. First, confirm that you have arrived at camp. Second, confirm the U.S. Address you will be living at for the summer. This is most likely your camp’s physical address. You will also need to include a U.S. Phone number – it is okay if you do not have a number yet, you can use camp’s phone number. Last, you need to confirm the job you will be working for the summer. Once you have completed these steps, InterExchange will activate you in SEVIS within the next 24 to 72 hours. Your dashboard will show that you are active in SEVIS once this is complete. You will not be able to apply for your Social Security Number until you are active in SEVIS.

I-94 Arrival and Departure Procedure

The U.S. Customs and Border Protection (CBP) will document your arrival upon entry to the United States by sea or plane through your electronic I-94 record (DHS Arrival/Departure Record). Participants arriving by car (most common with Canadian or Mexican participants) will still be given a paper copy of this document.

CBP will make your electronic I-94 record available at their website. You can access and print your I-94 by visiting that site, clicking “Get Most Recent I-94,” and entering your information as it appears on your passport and visa. You should keep this printed copy with you when applying for important documents like your Social Security Number or other forms of identification in the U.S.

If you are not able to access your I-94 record online, you may need to wait a few more days for the CBP to process your arrival information. If this occurs, please check back periodically and reference the How to Use the Website and Questions/Complaints section on the website, or contact the CBP office directly.

If information on your I-94 record is incorrect, please visit a local CBP Deferred Inspection Site or port of entry. You can locate the closest CBP Deferred Inspection Site here.

The CBP will record your departure from the U.S. using information gathered at the time of your arrival into the U.S.; you do not need to present your printed I-94 record when leaving the U.S.

About Your Social Security Number

About Your Social Security Number

If this is your first time working in the U.S , you will need to apply for a Social Security card. If you already have a Social Security number, make sure to bring your card with you, you do not need to apply again.

Important: After you apply, it will take 4 to 8 weeks for your Social Security Card to arrive. You are allowed to work while you are waiting for your card. If your employer has questions about your eligibility to work because your card hasn’t arrived, ask them to call InterExchange at 1.800.597.1722.

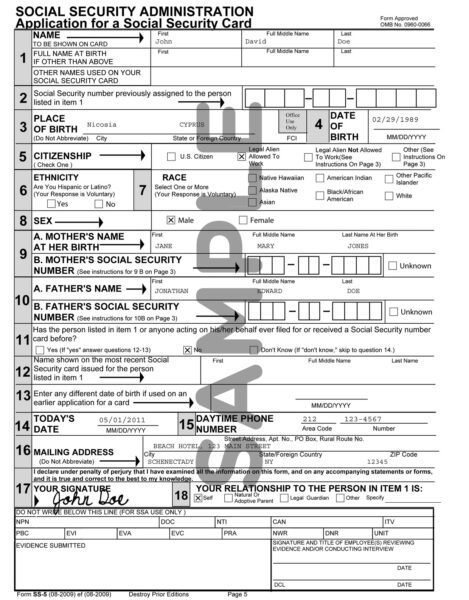

For those who have never had a Social Security number, you will apply for one in person at a local Social Security office. Use the Social Security Office Locator, to find the closest office. Your camp should help you with transportation to and from the office. To apply for your card, you must bring the originals AND two photocopies each of the following documents:

- Photo page of passport

- Visa page of passport with admission stamp

- DS-2019 Form (make a photocopy of both front and back)

- I-94 Record

- Form SS-5 (application form)

Important: When you apply for your Social Security Number (SSN) you will get a receipt letter. Make a copy of it for your personal records. Give the original receipt letter to your employer when you return from the office. The receipt is proof that you have applied for a Social Security number.

Remember! Read all instructions BEFORE you fill out the application. Here are some tips:

- Use your host employer’s address as your mailing address, including the name of your host employer’s business.

- For question #5 (CITIZENSHIP), check the box labeled “Legal Alien Allowed To Work.”

- For question #9A (MOTHER’S NAME AT HER BIRTH), write your mother’s family name when she was born, or her name before she was married.

- You can leave #6, #7, #9B and #10B blank.

Important: You will not be issued a Social Security number if you are not active in SEVIS. Make sure to wait at least 3-4 business days after confirming your arrival with InterExchange before applying for a Social Security number. Also, you will need to apply more than 2 weeks before your program ends. If you have a short program, or an issue with this, please contact us as soon as possible to ensure you are on a functional schedule.

Social Security Application Process

SSA = Social Security Administration

Use the Social Security Office Locator at https://secure.ssa.gov/ICON/main.jsp to find your closest office. You’ll need to bring the originals AND two photocopies of the following documents:

- Photo page of passport

- Visa page of passport with print out of I-94 record

- Dear Social Security Officer Letter

- Printed DS-2019 Forms that are signed using digital software (make a photocopy of both front and back)

- On July 20, 2023 the Social Security Administration published this directive to all offices to accept printed Forms DS-2019 that are signed using digital software or printed and signed in ink.

Call SSA to check status and inform InterExchange.

SSA:1.800.772.1213

InterExchange:

1.800.597.1722

Checking your application status

After you apply for your Social Security number, we recommend checking on your application status after seven to ten days. If you return to the office at which you applied, take all of your original documents as well as the receipt of application. Checking on your application status can minimize any delays or problems with your application. Your Social Security number may even be available to you prior to your card being mailed out. If you have any questions, please call the Social Security Administration’s toll-free number: 1.800.772.1213.

After you receive your Social Security number

It is your responsibility to notify your employer as soon as you receive your Social Security number. Your employer may ask to make a copy of your Social Security card (they will need the number for tax purposes), but you should retain the original card and keep it in a safe place. Do not laminate your card.

Protect Your Personal ID and Confidential Information

Your Social Security number is a lifelong number that is yours alone. Do not allow others to use your number. Record your number in a safe place in case your card is lost or stolen. Protect both your card and your number to prevent misuse.

If you have any questions or lose your card, please call the Social Security Administration’s toll-free number, 1.800.772.1213, or visit their website. You can also call InterExchange for guidance at 1.800.597.1722.

Social Security Locations

If there is no Social Security office close to your job site, you may consider applying for your number upon arrival in the U.S., in one of the major cities (New York, Chicago, Boston, etc.). If this is the case, you should prepare all documents prior to your arrival. Since people normally apply for Social Security cards near their place of employment, an officer may tell you to wait and apply once you have reached your job site. You may explain that there is no Social Security office near your job site. Therefore, you should apply in your arrival city. If the officer seems unsure about doing this, politely ask for a supervisor or the manager.

To locate the nearest office, check the Social Security Administration’s website.

Important Tax Information and Tax Forms

As an Exchange Visitor on a J-1 Visa, you are considered a “non-resident alien” for tax purposes. You must complete a tax return and you will likely not receive a refund on the tax you pay. Remember: InterExchange staff are not tax professionals. If you have tax questions, please consult a tax professional.

U.S. law requires that you pay Federal, State and Local Taxes. Your employer will deduct money from your paycheck every pay period. As an income-earning individual, you will be taxed on income from salaries, wages and tips. Your employer will submit the amount withheld directly to the federal government. Deductions for state and local taxes will vary. Some states do not have a personal income tax; others may tax income as much as 8%. Similarly, local taxes will vary but will be significantly less. This means that your paycheck will likely be a little less than the stipend amount in your work contract, since that number presented is pre-tax. That is normal.

Note: You will only be paying income taxes. You do not have to pay Federal Social Security Taxes, Medicare or Federal Unemployment Tax (Please note: some states may deduct state unemployment taxes, which you are required to pay). If your employer has withheld these taxes from your paycheck, please advise them of the mistake and request a refund. To verify that the proper taxes are being withheld from your paycheck, you should review your pay stub (the paper with your wage details that comes with your check). If you see deductions that say FICA, FUTA, S.S. or Social Security, please notify your employer promptly. If your employer is unable to issue a refund, contact the Internal Revenue Service Center and request IRS form 843 “Claim for Refund and Request for Abatement”. You will need to submit the completed IRS forms to the Internal Revenue Service Center.

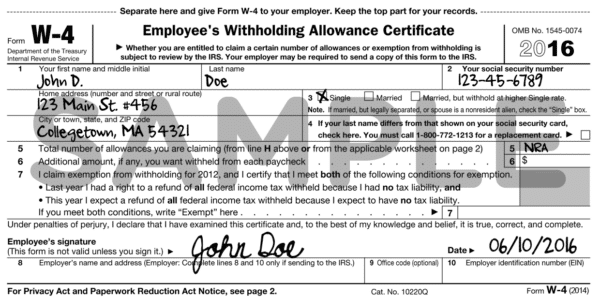

W-4 Form

For tax purposes, you are required to fill out a W-4 Employee Withholding Allowance Certificate as soon as you start working. Your employer will give you a W-4 Form, and it is your responsibility to complete and submit it to your employer. Based on the information you provide on the W-4 Form, your employer will calculate the amount of federal, state and local taxes to be withheld from your paycheck.

How to fill out your W-4

When filling out the current W-4 form it is recommended that InterExchange Camp USA participants follow Supplemental Form W-4 Instructions for Nonresident Aliens as provided by the IRS. Please follow the instructions there. Your employer may tell you to follow the instructions printed on the W-4, but this is not correct. The instructions on the W-4 Form are for U.S. residents.

Below are some instructions from the IRS:

- Step 1(c): Mark or check “Single or Married filing separately”.

- Step 4(c): Write “nonresident alien” or “NRA” in the space below Step 4(c).

- Do not claim that you are exempt from withholding in the space below Step 4(c) of Form W-4 (even if you meet both of the conditions to claim exemption from withholding listed in the instructions to the Form W-4).

Filing Your Tax Return

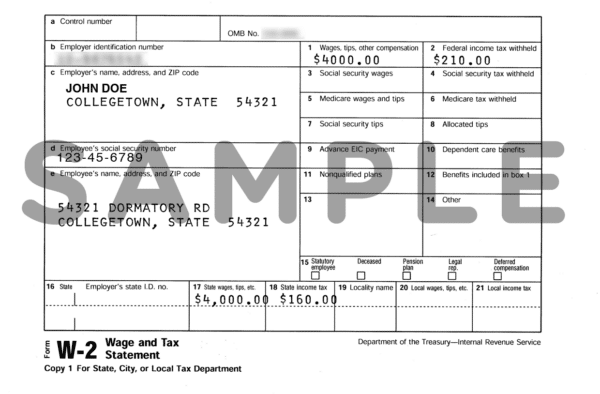

Step 1: Get Your W-2 Form

At the beginning of the calendar year after your summer of employment, your employer will send you a W-2 Form, which summarizes your earnings and taxes withheld from that year. They are required by law to issue your W-2 to you by February 15th. Before leaving your job, make sure camp has your contact information so they can send it.

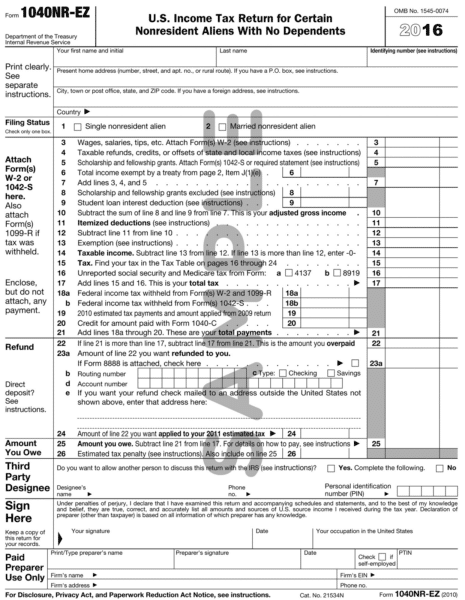

Step 2: Complete the 1040NR Form

Upon receiving your W-2 Form, you’ll need to fill out a 1040-NR (Non-Resident Aliens with No Dependents) tax form.

Make sure to review the Instructions for Form 1040-NR to avoid any mistakes.

If the total amount of money withheld from your paychecks was more than you were required to pay the government, they will issue you a refund. However, if the amount withheld from your pay was less than required, you must pay the government the amount of tax you still owe.

Your tax paperwork must be received by the IRS on or before April 15th of the year following your summer of employment.

Note: In addition to Federal tax withholdings, most states also require that additional taxes be paid to the state. There are separate forms for state and local taxes. The forms and requirements are different for each state. Your employer should be able to help you locate the necessary forms online.

Step 3: Mail in Your Forms

Once you have completed the forms, mail them to the address on the 1040-NR instructions or use an e-file service, if available.

Before mailing in your tax return:

Keep a copy of all your documents including the tax return and check.

If you are enclosing a payment, mail your payment and the Form 1040-NR to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

If you are not enclosing a payment mail your forms to:

Department of Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

If you are owed a refund, you will be given a paper check issued by the U.S. Government. Keep in mind that you may not be able to cash this check in your home country.

You may have the option to receive a refund via direct deposit, but this needs to be done before the refund is issued. In order to be eligible for direct deposit, you will need a U.S. bank account.

Speak with your U.S. bank and your home country bank to determine what options you have.

Please note: InterExchange staff are not tax experts and do not provide tax advisory services. The information provided here is merely a reminder to participants about basic information needed to file taxes and other resources available to them.

Frequently Asked Questions About Taxes

Will taxes be deducted from my paycheck?

Yes. U.S. law requires that you pay federal, state, and local taxes. Generally, your employer will deduct money from your paycheck every pay period. As an income-earning individual, you will be taxed on income from stipends, wages, and tips. Your employer will submit the amount withheld directly to the federal government. Deductions for state and local taxes will vary. Some states do not have a personal income tax; others may tax income as much as 8%. Similarly, local taxes will vary but will be significantly less. If no taxes are withheld from your pay, please contact InterExchange.

You do pay:

- Federal income tax

- State income tax

- Local or city income tax

You do not pay:

- Social Security (S.S.)

- Medicare tax (FICA)

- Federal Unemployment Tax (FUTA)

Can I get a refund for the taxes that were taken out of my paycheck?

No, you will only get a refund if you had too much deducted. You will not get a full refund for the taxes that were deducted from your paychecks. Anyone who works in the U.S is required to pay taxes regardless of the amount earned.

What if I return home without receiving a Social Security number?

As long as you have earned income in the U.S. you are still required to file a tax return for the year(s) during which you worked. If you have not been able to receive an SSN but do need to file a tax return, you can apply for an Individual Taxpayer Identification Number (ITIN) alongside your tax return by following the steps below.

Note: If you have a Social Security Number you will not need to apply for an ITIN

When mailing your application, alongside your Federal tax return, make sure to follow the IRS instructions and include the following:

- 1040-NR (Your Federal tax return)

- ITIN application (Form W-7, signed). The reason should be “B – Nonresident Alien Filing a U.S. Federal Tax Return” in the case that you have been unable to attain an SSN but need to file a tax return.

- Attach a certified copy of your passport.

- If including a photocopy of your passport, it must be certified by one of the following:

- Certified Acceptance Agent or IRS official

- The governmental department that issued the identification document (e.g., Home country passport office).

- The United States Embassy or Consulate (make a reservation before visiting).

- If including a photocopy of your passport, it must be certified by one of the following:

Insurance Information

Watch this video to learn about the healthcare system in the U.S.

Access your insurance documents and view coverage details.

Here is a Seeking Treatment Quick Reference Guide.

Insurance Options

InterExchange offers two plans to Camp USA participants. You can review each:

Extending Coverage for your travel period

Your insurance coverage begins one day before your program start date and ends one day after your program end date as listed on your placement offer and DS2019 form. Insurance for your 30 day travel period is not included. We highly recommend you have medical coverage for any travel periods before/after your program dates and you may extend your coverage at any time for an additional cost. Please contact InterExchange directly for payment details and date modifications.

Upgrading Coverage

Included as part of your Camp program, you will be enrolled in the “Standard” Camp insurance plan providing you with all the core benefits you will need when abroad. If you would like to increase your insurance coverage you have the opportunity to upgrade your insurance plan to the “Premium” Camp insurance plan, which offers a much higher level of coverage and lower out of pocket expenses.

Benefits of upgrading:

- Lower deductible from $150 to $25 per injury/illness!

- Increase your coverage to $1,000,000

- 100% coinsurance, even outside of the PPO network

- A range of additional benefits, not included in the Standard plan like trip delay, personal liability, mental illness and more!

If you would like to purchase the Premium Plan, you can do so anytime before you depart your home country. This plan gives you insurance for 4 months, so your travel period should be covered!

To upgrade or extend your insurance, please contact us at [email protected] for cost and payment details.

Prescription Medication

Bring any medications you are currently taking with you, as the cost for prescription medication can be very expensive in the U.S. You should bring with you a valid prescription or doctor’s note-written in English and bring no more than you need for your personal use during your stay. Pre-existing conditions are not covered, but medication for sickness and accidents that occur during your program can be filled at any pharmacy and paid upfront directly to the pharmacy. Keep copies of your receipts and the prescription label to submit a claim for reimbursement!

Workers’ Compensation

Workers’ Compensation is insurance that provides benefits for workers who are injured or become ill as a direct result of their job. InterExchange does not provide workers’ compensation coverage for their participants, but this is something that will be provided by your employer to cover you if you are to get sick or injured during working hours.

Participants who become sick or injured while performing the duties of their employment should file claims with the worker’s compensation plan first. We would also suggest filing a claim with your InterExchange plan as secondary, in case worker’s compensation does not apply. For any questions regarding worker’s compensation requirements, we suggest contacting your employer directly.

Traveling and Health Insurance

Your health insurance plan does not cover you if you go on vacation back to your home country and get sick. The insurance plan does cover you if you get sick while on vacation in all other countries. Additionally, the Standard Plan only covers you during your contracted work dates. This does not include your 30 day travel period. If you would like to extend your coverage, please contact us for information about the cost and plan options.

Seeking Treatment

- Teladoc. Your plan includes Teladoc virtual telemedicine. This should be your first option when seeking non-emergency care from the comfort of your camp. Learn more here.

- In- Network. For all other conditions, you need to visit providers that are part of the UnitedHealthcare Network (UHC). Search online at UHC Network Search

- Appropriate Care. If you cannot use Teladoc, ALWAYS visit an Urgent Care, Walk-in Clinic or local doctor as your primary method for seeking medical care. The Emergency Room (ER) is only to be used in REAL emergencies, and you will have to pay more to seek treatment from the ER.

- Claims. It is your responsibility to make sure your claims are paid! Please complete a claim form and submit that to the claims team for each new condition you seek medical care for.

Student Zone

You can find more information about your insurance plan, how to seek treatment and tracking your claims online in your Student Zone.

Insurance Basics

What is a co-pay?

Depending on where you seek treatment, you may be required to pay a copay, instead of your plan deductible. The copay will apply per visit if you visit an Urgent Care Center or Walk-in Clinic. Please review your plan details through your Student Zone to confirm the copays included in your plan.

What is a deductible?

This is the amount you must pay out of your own pocket towards medical expenses before the insurance company is obligated to pay – outside of the USA, this is also known as excess.

Under your insurance policy, you have a deductible that you’ll be required to pay once per injury or illness. This amount will depend on your plan. Your plan also includes an additional deductible for visiting the Emergency Room. This is waived if you are admitted as an inpatient overnight. Make sure to review your policy documents to confirm your plan deductibles before seeking treatment. You can access your plan details through your Student Zone.

If your bill exceeds your deductible/Emergency Room deductible, you will have to pay the entire bill; if it is more than your deductible, then you will only pay the deductible and the insurance company will pay the remaining amount of qualified expenses.

When I telephone the doctor to make an appointment and they request the name of my insurance, what do I tell them?

The plan utilizes the UnitedHealthcare Network, so when calling or talking with providers, please mention this name or show the provider a copy of your insurance ID card with the UnitedHealthcare logo on it for network recognition. Alternatively, or if any issues arise, please call International Medical group using the phone number on the back of your ID card immediately for assistance.

Can I go to any doctor?

Yes, you are free to visit any provider you wish. When going to an in-network provider that accepts the UnitedHealthcare Network, the doctor’s office should be able to send the bill to the insurance company directly for payment, meaning you won’t have to pay upfront for your visit (with the exception of your plan deductible or copay).

If you visit an out-of-network provider, you will likely need to pay for the services upfront and then file a claim to be reimbursed for your eligible medical expenses.

You can find providers that accept your insurance plan through your Student Zone.

What does my insurance not cover?

Common exclusions on your insurance plan include dental (teeth), vision (eyes), pre-existing conditions, birth control pills, long-term treatment, and regular exams/check-ups. However, please visit the Student Zone for a copy of your insurance brochure that will contain a full listing of the plan exclusions, or contact International Medical group directly to verify your benefits

What should I do if I am feeling suicidal?

Some, but not all, mental health expenses will be covered by your insurance plan. Mental health care can be expensive and not all doctors or clinics offer these services. If you are feeling suicidal, we suggest you contact one of the following organizations:

- National Suicide Prevention Lifeline

- Mental Health America

- NYCWell (for participants in New York City)

Your plan also includes access to DialCare Virtual Emotional Wellness. You can learn more about this service here.

Should I go to a hospital emergency room?

We generally recommend that you visit a doctor’s office or urgent care clinic for treatment. You will likely have a shorter wait time, and urgent care clinics tend to be much less expensive than hospital emergency rooms. Generally, you should ONLY visit a hospital emergency room if you are experiencing a serious injury or a life-threatening illness.

Please keep in mind that your plan includes an additional Emergency Room deductible that you will be responsible for paying if you are not admitted as an inpatient, so we only suggest visiting the ER in a true emergency.

Can I access telemedicine?

Yes. Your insurance plan includes access to Teladoc Virtual Telemedicine at no cost to you.

Telehealth visits are great to use if you are not sure what kind of doctor you need to see and for non-emergency situations. They are available 24/7 and can connect you to doctors all over the U.S.

Paperwork

What if I lose my insurance confirmation card?

Please visit the Student Zone to access an electronic copy of your insurance card. You may also reach out to the Envisage Global Insurance Contact Us page to request that a new card be emailed to you.

What do I need to take with me when I go the doctor’s office?

You should take with you:

- Insurance confirmation card with your Individual Policy Number

- Passport (to use as identification)

- DS-2019 Form (just in case they need to see it)

Who/where do I get my individual insurance policy number from?

Your insurance ID card contains both your Member ID, which is unique to you and is your individual policy number, as well as your Group ID, which is the same for all participants under the plan. If the doctor’s office has any questions about your coverage, they can contact the insurance company using the phone number on the back of your insurance ID card.

Claim Forms

What is a claim form?

It is a form you must fill in after going to the doctor in order for the insurance company, International Medical Group (IMG), to pay your medical bills. If your visit was the result of an accident, you’ll also want to complete the accident questionnaire. You can download your claim forms through the Student Zone, or submit this through your online claims account.

Who has to file a claim form?

All participants who go to the doctor must file a claim form, even if you did not have to pay for your visit upfront. This form needs to be completed once per condition.

When should I file the claim form?

As soon as possible after going to the doctor’s office. If you wait too long to file a claim, your medical expenses may not be covered by your plan.

What does the insurance company need from me in order to process the refund?

If you were required to pay out of pocket for your visit, you’ll need to submit a signed and dated claims form, and a fully itemized statement of charges from your visit (a complete list of everything the doctor’s office has charged you), with the diagnosis written on the attending physician’s (that is, the doctor whom you saw) letterhead. You’ll also want to include a copy of the receipt showing you paid for the services upfront.

(If my medical provider sent the bill directly to the insurance claims department, do I still have to fill out a claim form?

Yes. Even if you did not pay for your visit, you will still need to submit a claim form so your medical bills can be processed as quickly as possible. We would suggest also submitting any documents you received during your visit with your claim to ensure your claims are processed as quickly as possible.

How do I find out the status of a claim?

You can check on the status of your claim through your online claims account, or by contacting the IMG directly. You can view this information through your Student Zone.

International Medical Group can be contacted at:

- Phone: (855) 731-9445 (24/7 toll-free) or +1(317) 927-6806 (24/7 Direct Dial)

- Email: [email protected]

I received an unpaid bill from the doctor’s office I visited. What should I do?

First, call the doctor’s office to ask if they have submitted the bill to the insurance company. If they did not receive your correct insurance information, you may give them your insurance details from your insurance ID Card so that your claim can be processed. If the bill was submitted but has not yet been processed, please log into your online claims account to check the status of your claims or contact International Medical Group in order to find out why it has not yet been paid.

I am unhappy with the results of my insurance claim. What steps can I take?

If a claim has been processed and you are not happy with the results, you can request that International Medical Group review the claim again. You can submit your appeal with supporting documents to [email protected]. Please note the appeal process normally takes 90 days to complete, and you’ll receive an email from IMG with the outcome of the review.

Life at a Camp in the USA

Every summer, more than 7 million American children go to one of more than 12,000 summer camps throughout the United States. While there, they learn about themselves and the world around them. Even more importantly, they grow both as individuals and part of a team. Camp is designed to help children mature socially, emotionally, intellectually and morally by providing them with a structured environment where they can live and play with positive role models. Experts in the field of child development recognize that camp provides children with an invaluable experience. Regardless of your role, you will be able to make a positive impact on children’s lives at camp this summer!

Every camp is different. Each camp has distinct goals, philosophies, programs, policies and types of campers. Though we expect everyone’s summer to be great, we know everyone’s summer will also be different. Get to know the specifics of your camp before you arrive in the United States by looking at its website or emailing your camp with questions.

Here are examples of how camp policies may differ:

- Camps may ban smoking. Some camps will allow smoking only at certain times and specific locations while others do not tolerate smoking at all. Make sure you are familiar with your camp’s policies before the first week of camp is over and do not disobey their policies. Failing to comply with a camp’s policy may result in you being fired and/or required to return home at your own expense.

- Most camps offer one 12 to 24-hour period off per week. Some camps will give staff days off from evening to evening while others will give time off from morning to evening. Additionally, some camps may give an hour break per day. It is important to understand that working at an overnight camp is an all day job. Your breaks will be your time to yourself, but understand that your days will likely consist of long hours and sometimes into the night. Take your breaks as a time to rest, contact your family, or even shower. It is important you allow yourself to recharge for whatever is next.

- Sleeping arrangements and cabin responsibilities vary from camp to camp. Some camps have tents while others have cabins or dormitories. Bathing facilities will differ, too. Some camps have large centralized shower or bath houses, while other camps have bathing facilities located within each cabin.

- Like any other place of business, every camp has a dress code. All clothing worn must be appropriate for working with children! This includes the graphics or words on clothing, as well as how much a bathing suit covers your body. Some camps will allow body piercings or large tattoos while others will expect all piercings to be removed and tattoos covered. Male counselors may be required to remain clean-shaven throughout the summer. Remember that you will be living in a community environment, and personal hygiene is essential to the health of the group. If your clothing in any way inhibits you from performing your job, leave it at home.

We want to hear about how things are going! Remember, you must check in with InterExchange at least every 30 days, but are welcome to do so as much as you’d like. Tell us about how things are going, and we love pictures but make sure you are following your camp rules about photos! Many if not all camps do NOT allow you to take photos of or with campers. You do not have the permission to take their pictures for your personal documentation. Feel free to show us pictures of camp, you and your new friends, or the travels you go on – we love that stuff!

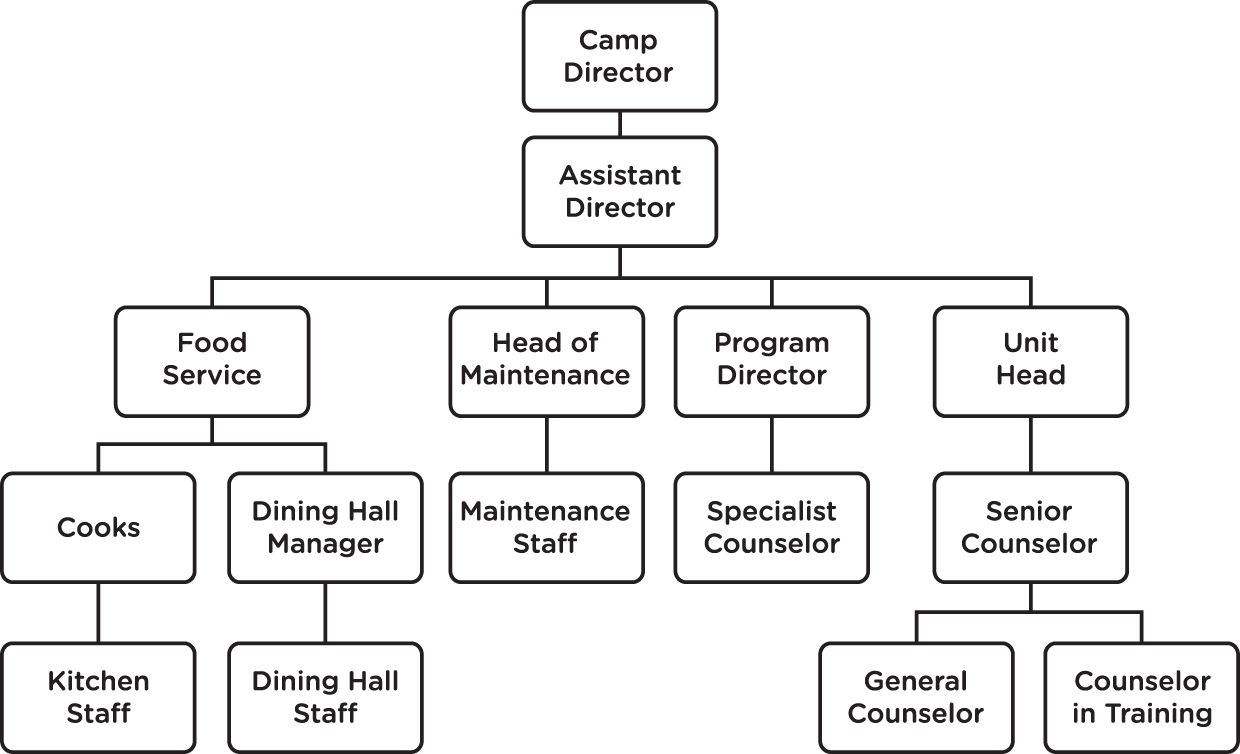

Typical Camp Hierarchy

Remember that camp is a team effort; no one person can run a camp alone, and every member of the camp team will need help from time to time. Your supervisor will often provide guidance on how you can contribute to the camp’s activities within your counselor role. If there is a responsibility that is assigned to you, but you do not understand it, find it to be too difficult, or if you just have questions in general, do not be afraid to ask your supervisor for help. They will be able to give you the advice, guidance and assistance you need to have a great summer!

Staff Roles

You will be participating at camp as a counselor, which is an essential role in ensuring that camp runs smoothly and effectively.

Counselors

General Counselor