Filing Taxes

All individuals who have earned income in the U.S. are required to file a tax return for the year during which they worked. Your tax return should show your earnings for the previous year, the taxes you paid and the total amount of taxes owed or refunded.

The Internal Revenue Service (IRS) is the U.S. government agency that collects taxes. You can get forms, instructions, and information from their website.

Step 1: Review Important Tax Information

Read our resource page to understand how your taxes are calculated. Pay attention to the section titled New Tax Information to understand the recent changes in the tax regulations.

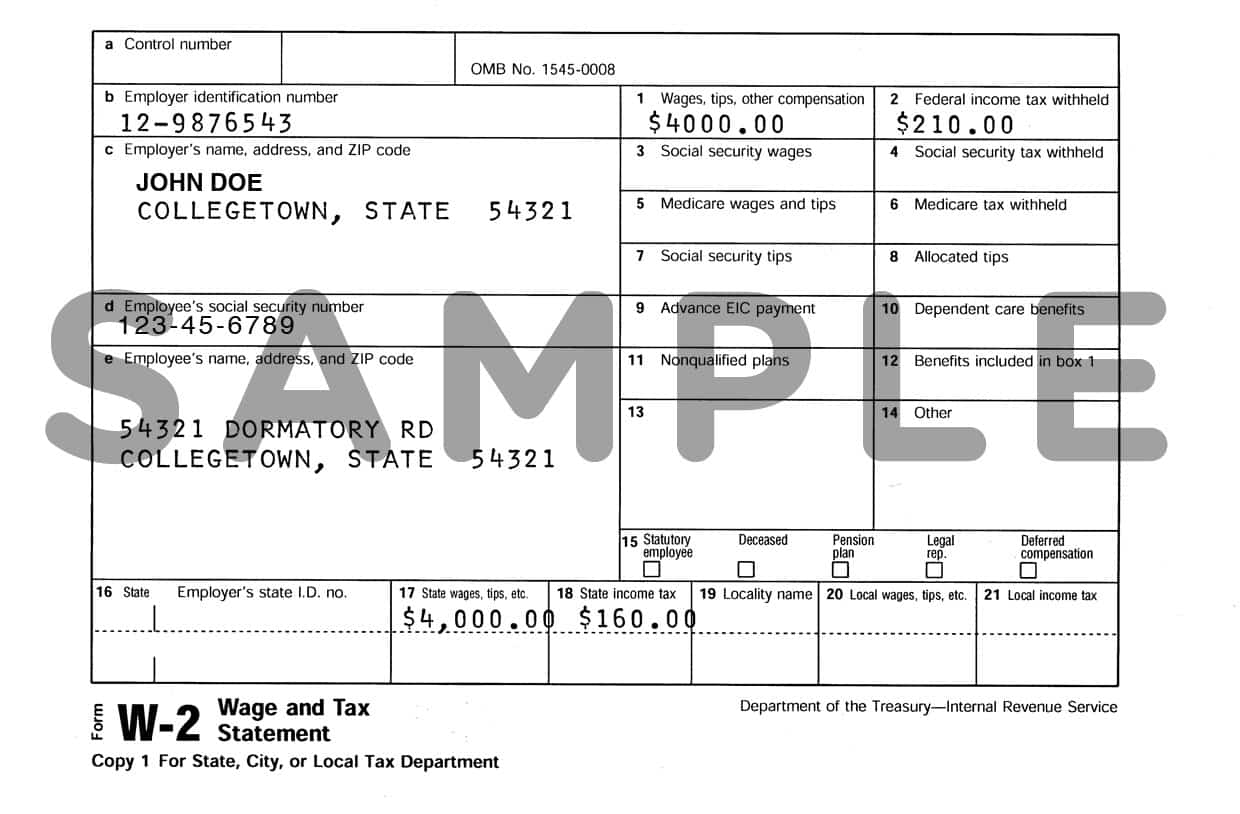

Step 2: Get your W-2 Form

The W-2 summarizes your earnings and the taxes withheld from your earnings during the previous year.

At the beginning of the year, your employer will send you a W-2 Form (your employer is required by law to mail your W-2 to you by February 15 following the year wages were earned). Please give your employer your home country address. If you don’t do so, your employer will not be able to send you the necessary forms to file for your tax return. If your employer sent your W-2 to InterExchange, we will send it to your local cooperator in your home country.

*Winter Participants

Students who participate in the winter program will receive two W-2 Forms: one in February while you are in the U.S. (for your work from the end of the previous year), and one in February the following year (for your work at the beginning of the current year). You will need to file taxes for each calendar year during which you worked in the United States.

Step 3: Complete 1040-NR Form

Upon receiving your W-2 Form, you’ll need to fill out a 1040-NR (Non-Resident Aliens with No Dependents) tax form.

Make sure to review the Instructions for Form 1040-NR to avoid any mistakes.

If the total amount of money withheld from your paychecks was more than you were required to pay the government, they will issue you a check. However, if the amount withheld from your pay was less than required, you must pay the government the amount of tax you still owe.

Your tax paperwork must be received by the IRS on or before April 15th of the year following the year when you earned the wages.

Note: In addition to Federal tax withholdings, most states also require that additional taxes be paid to the state. There are separate forms for state and local taxes. The forms and requirements are different for each state. Your employer should be able to help you locate the necessary forms online.

Step 4: Mail in Your Forms

Once you have completed the forms, mail them to the address on the 1040-NR instructions or use an e-file service, if available.

Before mailing in your tax return:

Keep a copy of all your documents including the tax return and check.

If you are enclosing a payment, mail your payment and the Form 1040-NR to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

If you are not enclosing a payment mail your forms to:

Department of Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

If you are owed a refund, you will be given a paper check issued by the U.S. Government. Keep in mind that you may not be able to cash this check in your home country.

You may have the option to receive a refund via direct deposit, but this needs to be done before the refund is issued. In order to be eligible for direct deposit, you will need a U.S. bank account.

Speak with your U.S. bank and your home country bank to determine what options you have.

Please note: InterExchange staff are not tax experts and do not provide tax advisory services. The information provided here is merely a reminder to participants about basic information needed to file taxes and other resources available to them.