Your exchange program in the U.S. is the adventure of a lifetime, but there’s one important administrative task that can’t be overlooked… taxes! All exchange participants who earn income in the U.S. will pay taxes and are required to file a tax return for the calendar year (or years) during which they worked. After you submit your tax return, you may get some of your taxes back.

We’ve created a timeline of what you’ll need to do for taxes throughout your program.

During your Exchange

- 1. Fill out a W-4 Form.

- 2. Review your first paystub.

- 3. Update your contact details with your employer.

After your Exchange

- 4. Receive your W-2 Form by January 31, 2025.

- 5. Complete your federal tax return by April 15, 2025.

- 6. Complete your state tax return by April 15, 2025.

- 7. Receive your refund.

- 8. Keep all your paperwork.

During Your Exchange

1. Fill out a W-4 Form.

When you arrive in the U.S., your host employer will give you a W-4 Form. Based on the information you provide on the W-4, your taxes will be calculated and deducted from your paycheck. You must fill this form out and give it back to your employer to get paid.

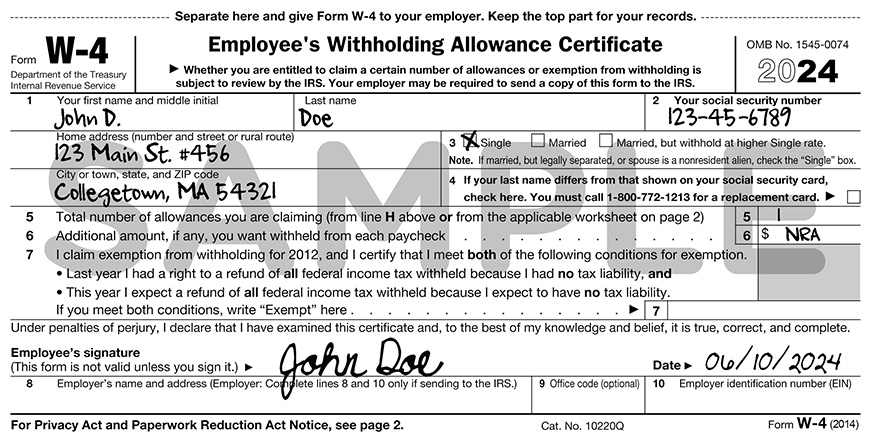

An example of a completed W-4 Form. Image courtesy of InterExchange.

W-4 Forms are designed for U.S. residents, not for visitors. So, there are a few special instructions you need to follow.

- Home address: Indicate your permanent U.S. mailing address.

- Box 2: Enter your Social Security number if you already have it. If you do not have your number yet, inform human resources at your host company that you applied for a number, and provide a copy of your receipt.

- Box 3: Mark or check “Single,” even if you are married.

- Box 4: Leave blank.

- Box 5: Write “1” (If you are a resident of Canada, Mexico, Japan, or South Korea, or India, please visit the IRS website for further instructions.)

- Box 6: Write NRA for “Non-Resident Alien”

- Box 7: Leave blank.

- Sign and date your form.

- Box 8-10: Leave blank.

- Do not complete the Personal Allowances Worksheet; this does not apply to exchange visitors.

2. Review your first paystub.

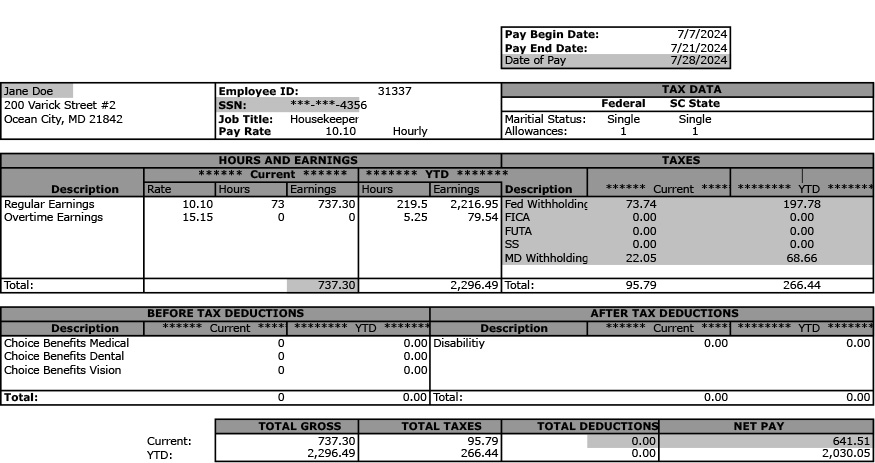

Once you give your employer your W-4 and you start your program, you’ll receive your first paycheck. The taxes will already be taken out of your pay. It’s important to review your paycheck to make sure you are paying the right taxes.

| You Do Pay | You Do Not Pay |

|---|---|

| Federal Income Tax | Medicare Tax (FICA) |

| Local or City Income | Social Security Tax (S.S.) |

| State Income Tax | Federal Unemployment Tax (FUTA) |

*Please note: Some states may deduct state unemployment taxes, which you are required to pay.

Your paystub may look a little different, but in general, here’s how to understand it.

- Gross Pay: Total amount earned in the pay period before any tax deductions.

- Deductions or Withholdings: Amount of money the federal, state, and local governments take out of your paycheck

- Net Pay: Total amount of earnings you will receive after taxes have been taken out.

- Year To Date (YTD): The total amount of earnings and withholdings since January 1st of the current calendar year.

If you see deductions that say FICA, FUTA, S.S., or Social Security, please notify your employer and ask for a refund. If your employer is unable to issue a refund, contact the IRS and request Form 843.

3. Update your contact details with your employer.

At the end of your exchange, give your employer your address in your home country. Make sure this is a good address for receiving mail. Ask your employer if they need a prepaid, pre-addressed envelope. Your employer will need it to send you your W-2 Form, which is the form you use to file your tax return with the government.

After Your Exchange

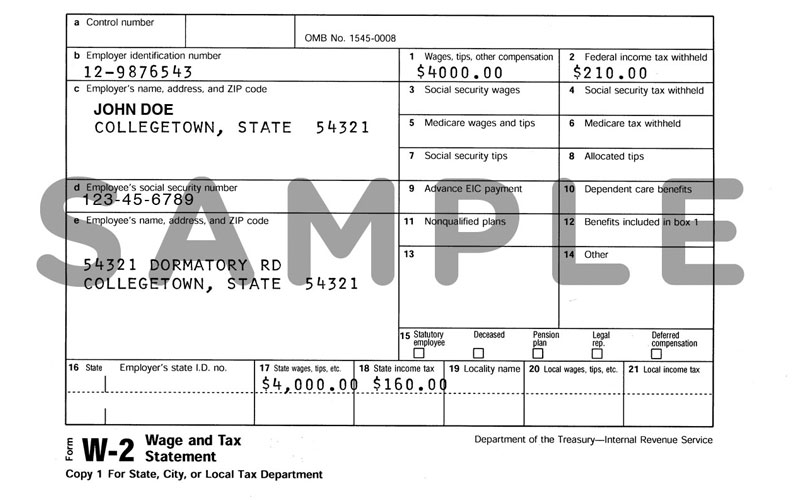

4. Receive your W-2 Form.

Your W-2 Form summarizes your earnings and taxes withheld from you the previous year. Your employer will mail your W-2 Form to you by January 31, 2025. If you do not receive it by February 15, 2025, contact your employer immediately.

5. Complete your federal tax return.

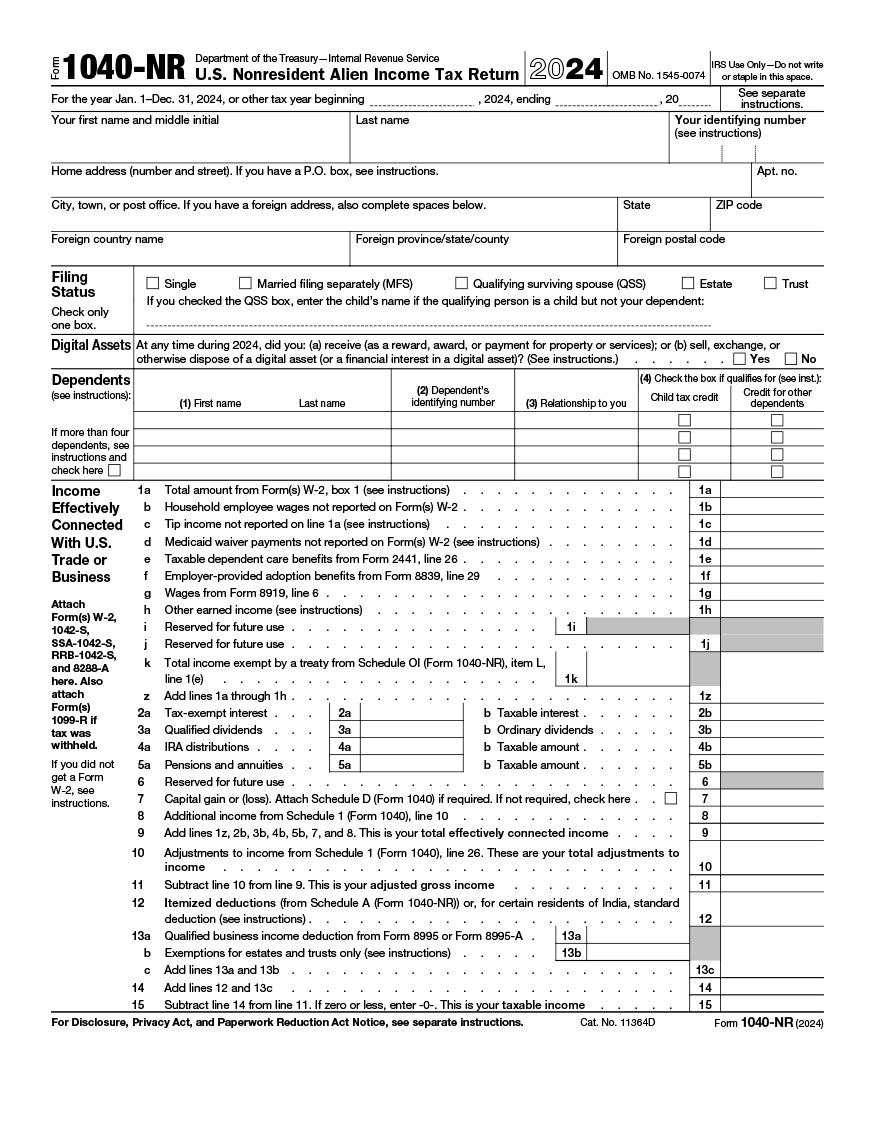

After you receive your W-2, fill out a 1040-NR (Non-Resident Alien) tax form. You can obtain this form at the U.S. Embassy in your home country or on the IRS website.

When you begin the 1040-NR Form, make sure to read the instructions. To avoid any mistakes, follow the instructions carefully.

If you paid too many taxes to the U.S. government, they will issue you a refund. If you did not pay enough taxes, you must pay the government the amount you still owe.

You must submit your 1040-NR Form by mail. Before mailing it in, keep a copy of it and all of your tax documents. You can send your form to the IRS branch in the state in which you lived.

The deadline to mail your taxes is April 18, 2025. The sooner you complete your taxes, the sooner you receive your tax refund, if eligible!

6. Complete your state tax return.

There are separate forms for state and local taxes, but they vary by state. You must request these state and local forms from your employer or find them here from the Federation of Tax Administrators. They are not available at the embassy. The IRS website has more information on filing taxes in your host state.

7. Receive your refund.

If you are owed a refund, you will be given a paper check issued by the U.S. Government. Keep in mind that you may not be able to cash this check in your home country.

You may have the option to receive a refund via direct deposit, but this needs to be done before the refund is issued. To be eligible for direct deposit, you will need a U.S. bank account.

Speak with your U.S. bank and your home country bank to determine what options you have.

8. Keep all your paperwork.

Store your tax paperwork in a safe place and make electronic copies as backups.

If you need more information about filing your taxes, refer to your participant resources or contact us, the IRS, or a tax professional.

InterExchange staff are not tax experts and do not provide advisory services. The information provided here is a tax reminder to participants about basic information needed to file taxes and other resources available to them.