Frequently Asked Questions

Once you register, you’ll be able to review highly qualified, enthusiastic pre-screened applicants in our online system and search by country, age, skills, and more. We take care of J-1 Visa sponsorship, setting up interviews, assisting with travel arrangements, accident and sickness insurance, orientation, and support throughout the season.

Who are Camp USA Participants?

With the help of our network of international cooperators, our Camp USA program is represented by almost every country in the world. Each applicant goes through a thorough screening and interviewing process, and we only accept the very best applicants into our program. All InterExchange participants are:

- Between the ages of 18 and 28 during the summer of their participation.

- International students, teachers, youth workers or individuals with specialized skills.

- Proficient in English.

- Highly motivated and committed to the program for 8 to 15 weeks.

What is the difference between your Camp Placement, Self Placement and Returning Placement programs?

- Camp Placements – These are applicants who have been recruited to participate in the Camp USA program by InterExchange or one of our international cooperators.

- Self-Placements – These are first time international candidates who have accepted a job offer from a specific camp prior to submitting their application to InterExchange.

- Returning Placements – These are participants who have worked at your camp in a previous year.

How do my returning counselors apply?

Your returning counselors can start their application at https://app.interexchange.org/programs/camp-usa/signups/new/.

Do you sponsor Support Staff?

No, we no longer sponsor Support Staff.

How do I know if my camp is eligible to apply?

For eligibility details, please review our requirements.

About InterExchange

InterExchange is a nonprofit organization with more than 50 years of experience dedicated to promoting cultural awareness through a wide range of affordable and exciting work & travel, professional training, internship, au pair, camp, language learning and volunteer programs within the U.S. and abroad. InterExchange is designated by the U.S. Department of State to sponsor a variety of J-1 Visa Exchange Visitor programs.

As a proud J-1 Visa sponsor and cultural exchange organization, we encourage our participants and professional colleagues to learn about The Fulbright-Hays Act of 1961 also known as the Mutual Educational and Cultural Exchange Act of 1961. This important act enables the Government of the United States to:

- increase mutual understanding between the people of the United States and the people of other countries by means of educational and cultural exchange;

- strengthen the ties which unite us with other nations by demonstrating the educational and cultural interests, developments, and achievements of the people of the United States and other nations, and the contributions being made toward a peaceful and more fruitful life for people throughout the world;

- promote international cooperation for educational and cultural advancement; and thus assists in the development of friendly, sympathetic, and peaceful relations between the United States and the other countries of the world.

InterExchange Camp USA helps participants between the ages of 18-28 experience the uniquely American tradition of “summer camp”. The Camp Counselor J-1 visa allows participants to work as “camp counselors” at an American summer camp (between May 15th and September 15th). Once camp has ended, there is a 30-day grace period that allows participants to travel though the U.S and experience American culture.

Other InterExchange Programs

Au Pair USA is a 12-month program that gives young people, ages 18-26, the opportunity to experience the U.S. by living with an American host family and providing child care. In return for their services, au pairs receive room, board, a weekly stipend, accident and sickness insurance, airfare and an educational allowance to use toward college-level courses. This program can be extended for an additional 6, 9 or 12 months after successfully completing the original 12-month program.

Career Training USA assists international students and young professionals, ages 18+, with J-1 Visa sponsorship for internships and practical training programs in the U.S. Candidates may apply for the J-1 Intern or Trainee Visa if they have already secured an appropriate position in the U.S. International students and recent graduates may apply as Interns and pursue an internship for up to 12 months in a field related to their academic field of study. International working professionals may apply as Trainees and pursue training programs for up to 18 months in a field related to their occupational background. To be eligible, participants’ education and work experience must have been earned outside the U.S.

Work & Travel USA offers international university students ages 18-28 the opportunity to live and work in the U.S. for up to 4 months during their breaks from university classes. Students work in seasonal and temporary positions in hotels, inns, amusement parks, national parks, retail stores and ski resorts, among other types of businesses. They receive a wage, assistance with housing, accident and sickness insurance, program support and an optional month for travel to explore the United States. Work & Travel USA also offers a 12-month program for citizens of Australia and New Zealand.

Working Abroad enables U.S. citizens, generally ages 18-30, to build diverse work experiences overseas. Opportunities include Au Pair, English language instruction, work and travel, and volunteer abroad placements. We offer programs in Australia, Africa, Asia, South America and numerous European countries.

The InterExchange Foundation was established in 2007 to provide grant funding to motivated young Americans who contribute to worthy work or volunteer projects abroad. The Working Abroad Grant supports participants of select InterExchange Working Abroad programs, and the Christianson Fellowship supports individuals who have sought out and arranged their own long-term work abroad programs. Many students study abroad every year, but far fewer take advantage of the opportunity to work, intern, or volunteer overseas. By providing financial assistance to talented candidates, we encourage young Americans to discover and contribute to the world and benefit from the unique and enriching insights one can only gain from living and working abroad.

International Cooperators

InterExchange is proud to work with International Cooperator (IC) companies and organizations in more than 60 countries. Our IC network represents a cross-section of the most exceptional and trusted companies involved in promoting and recruiting for cultural exchange programs.

Our ICs introduce InterExchange programs to prospective participants in their home countries and emphasize the benefits of spending time in the U.S. to expand their knowledge of U.S. culture and personal experiences. ICs collaborate with us to fulfill the goals of cultural exchange, so our international participants can enjoy learning opportunities in the U.S., while host employers and families can meet and learn about people from all over the world. One of the key responsibilities ICs fulfill is to recruit, pre-screen and select applicants who meet visa eligibility requirements and are prepared to make the most of the cultural exchange experience when working with host employers, families and host communities.

In addition to providing ICs with detailed information and guidance for marketing our programs in their home countries, we also provide content for orientations to teach participants about life in the U.S. and prepare them for adapting to a new culture and country. Each in-bound international participant is interviewed by either InterExchange staff or an IC to evaluate the candidate’s ability to be successful on the program. InterExchange maintains the exclusive responsibility of final acceptance to the program, as well as program monitoring. Every IC is an important part of the process for making sure that all participants are equipped for the challenges and educated on the benefits of joining one of our cultural exchange programs.

Participant Rights, Protections and Program Understanding

InterExchange makes it a priority to ensure that all our participants enjoy a safe, healthy and well monitored cultural exchange experience in the U.S.

The following information describes a baseline for conduct that our participants can expect from InterExchange and their hosts as well as their responsibilities during their visits to the United States through InterExchange programs. We’re happy to say that the majority of our participants and hosts regularly make an extra effort beyond these standards to create a truly memorable, life-changing cultural exchange experience for everyone involved.

During Their Programs, InterExchange Participants Can Expect:

- A safe, healthy and legal work environment.

- A safe, healthy and legal living situation.

- Opportunities to interact with Americans on a regular basis.

- Protection of their legal rights under United States immigrant, labor, and employment laws.

- Fair treatment and payment practices.

- Right to keep passport and other documents in their possession.

- Right to report abuse without retaliation.

- Right to contact the J-1 Visa Emergency Helpline of the U.S. Department of State.

- Right not to be held in a job against their will.

- Right to end their programs and return to their home countries.

- Right to request help from unions, labor rights groups and other groups.

- Right to seek justice in U.S. courts if warranted.

Participants Can Also Expect the Following Support From InterExchange Throughout Their Programs:

- 24 hour emergency assistance while working at camp.

- Resources and guidance throughout the application process and while in the United States.

- At a minimum, monthly contact and monitoring.

- Vetting and conducting due diligence to verify each host employer or host family.

- Available staff with extensive international experience and language skills.

- Available staff who can provide support for special situations if needed.

- Acting as a neutral advocate to help resolve any disputes that occur.

- Accident and Sickness insurance that meets or exceeds J-1 Visa regulatory requirements.

Participants in Our Programs Acknowledge That:

- The primary purpose of InterExchange cultural exchange programs is to interact with U.S. citizens, practice the English language, travel and experience U.S. culture while sharing their culture with Americans.

- They will abide by the laws of the United States as well as all state and local laws.

- They will abide by all rules and regulations applicable to U.S. Department of State Exchange Visitor programs.

- They have not come on a J-1 Visa program seeking permanent residency or employment in the U.S.

- They are expected to follow the guidelines of employment provided by their host employer or host family.

- InterExchange is their visa sponsor. A U.S. host employer or host family is not a visa sponsor.

- Any wages earned during the programs are only meant to help defray living expenses during the programs. Earning money is not the primary purpose of cultural exchange programs.

- Host employers and families may terminate their employment relationship with participants.

- Host employers and families do not have the authority to cancel the J-1 Visa. Only the U.S. Government or InterExchange has that authority.

- They must contact InterExchange in the event of an emergency or if any problems occur during the program.

- They will respond to all requests and inquiries sent from InterExchange.

- They are required to leave the United States at the end of their programs.

Camp USA Program for Hosts

Program Overview

InterExchange Camp USA helps participants connect with a U.S camp where they will be working alongside Americans as “camp counselors”. Camp USA applicants apply to one of three program categories: Camp Placement, Self Placement, or Returning Placement. While many of the details covered in this handbook are specific to Camp Placement participants, Self Placement and Returning Placement participants will also find many of the issues covered to be useful.

Our Role

As a J-1 Visa sponsor, InterExchange serves as the central contact point for U.S. camps, international participants and ICs. We take great pride in running our program with a personal approach, which is why your camp will have a specific point of contact on our team. During the summer, we visit as many camps as possible to evaluate the success of our participants and gain a better sense of each host camp’s environment and staffing needs. When you choose to work with us, you can expect:

- Personalized service from dedicated InterExchange Camp USA program professionals.

- Your own placement specialist who will identify candidates truly appropriate for your camp.

- Thoroughly screened applicants, interviewed by an InterExchange Camp USA placement specialist or a trained International Cooperator.

- DS-2019 Forms and visa application support for all of our participants.

- 24-hour program support throughout the summer.

InterExchange Camp USA Participant Requirements

InterExchange Camp USA recruits applicants who are:

- Between the ages of 18 and 28 during the summer of participation.

- Students, teachers, youth workers or individuals with specialized skills.

- Fluent in English and able to attend an orientation and interview in their home country.

- Experienced and/or enthusiastic about working with children in a camp environment.

- Highly motivated and committed to the program for 8 to 15 weeks.

InterExchange Camp USA is committed to selecting and matching the most qualified candidates to prospective camps. We understand and appreciate the importance of camper safety; we work with you to address your safety concerns by maintaining strict standards and procedures throughout the selection process and to address questions during your participation in the program.

Program Options

All InterExchange Camp USA candidates participate in one of three placement types: Camp Placement, Self Placement or Returning Placement. Camp Placement participants are screened and placed in a U.S. camp by InterExchange Camp USA. Self Placement participants are first time international candidates who have accepted a job offer from a specific camp prior to submitting their application to InterExchange. Returning Placements are participants who have worked at a camp in a previous year and have decided to return for another summer. Regardless of the placement type selected, all participants must submit the required paperwork in order to be considered for participation in our program.

Please note: InterExchange is limited in how many third year or more Return Placements we can sponsor per year. This quota is usually reached in early January. Please encourage your returning staff members to apply as early as possible to secure a spot in the program.

The Participant Experience

Regardless of which placement type a participant chooses, InterExchange and our ICs thoroughly screen and prepare each participant for the camp experience. When an IC representative receives a completed application, the documents are reviewed to determine if the applicant is an appropriate candidate for the program.

Online Application

Each participant will receive and complete a written online application. The content of the Camp Placement application is different from the Self and Return Placement application. All applications collect biographical information along with a participant’s education, work history, and medical history. Camp Placement participants will also discuss their skills and experience, and they will complete an ‘About Me’ section discussing their motivations for participating in the Camp USA program. As part of their online application, each participant will invite references and upload required documents.

Camp Placement participants are required to have at least two references for their application. At least one reference will come from an employer or teacher of theirs. Whether the reference is regarding their skill level to instruct an activity, their experience working with children, or a general character reference, all will need to speak to their suitability to work as a camp counselor for children. In addition to the references, Camp Placement participants are required to upload a Police Background check and a photocopy of their valid passport. We also encourage participants to upload skill certificates, videos or photos showcasing their personality and skills, or other documents they believe make them a stronger candidate.

Self and Returning Placement participants are required to have at least one reference for their application. This reference MUST come from an employer or teacher of theirs. For returning placements, the reference cannot come from someone associated with camp. In addition to the reference, these participants must upload a Police Background check, a photocopy of their valid passport, and a copy of their placement offer. This offer can be in the form of a contract with camp, or it can come as a letter on camp letterhead. It should include the scheduled dates of employment, position, and stipend. Self and returning placements are also required to upload any requested documents showing their eligibility for the program as set by the U.S. Department of State.

Interview and Language Assessment

Once a participant has completed their written applications, InterExchange or an IC will contact eligible applicants to arrange an interview. During an interview for a Camp Placement participant, the interviewer inquires about the applicant’s relevant skills and experience with children and evaluates the applicant’s reasons for applying. At the same time, the interviewer critically assesses each applicant’s language speed, comprehension, fluency and clarity. Throughout the conversation, the interviewer records his or her observations on a written report. During an interview for a Self or Returning Placement participant, the interviewer assesses the participant to ensure their eligibility for the program and to ensure they understand the role they have been hired for and the process to obtain the visa. The same language assessment occurs as well.

Accepting an Applicant

Once the participant’s application is completed, including the interview and required documents, the IC submits the application to InterExchange. An InterExchange representative will then review and assess the application. After considering the applicant’s attitude, skill level, maturity, availability and English level, our program staff decides whether or not to accept the applicant into the program.

Orientation

All Camp USA participants will attend either a virtual or in person comprehensive orientation. During these orientations, participants will receive detailed information regarding their health insurance plans, travel planning, camp expectations, emergency situations, visa rules and regulations, and many other topics. The purpose of this orientation is to prepare our participants as best as possible for the program, and we hope you will prepare them for your specific camp as well. In addition to the online training, some ICs will host an in-person orientation event where soon-to-be counselors get to practice their skills and camp life in a modified learning environment.

What Participants Receive

All participants pay program fees to InterExchange or the International Cooperator. Please note that the visa application fee that all participants pay directly to the U.S. Embassy or Consulate is in addition to the fees listed.

What InterExchange Provides:

- For Camp Placement participants: a minimum stipend of $2,000, access to our database of camp/employers, room and board for the duration of the placement.

- An interview to ensure each participant is eligible for the program

- Online orientation.

- Documents to obtain a J-1 Visa (DS-2019 Form).

- Accident & sickness insurance for the duration of their program dates that meets or exceeds the U.S. Department of State requirements.

- InterExchange Camp USA Participant Handbook, Inside the USA Guide, certificate of completion,

- 24-hour program support throughout the summer.

- Access to events, training and educational opportunities

What the Camp Is Responsible for Providing

- Pay and benefits commensurate with a similarly situated American counterpart

- Workers’ compensation insurance for any work related injuries.

- Room and board (including linens).

- Training for the specified position.

- Ensure the safety and well-being of the participants while on the program.

- Cultural exchange opportunities.

- Access to transportation for off-site activities and when medical attention is needed.

- Transportation to hotel, train/bus station, or airport in the event of early departure

How to Host: Pre-Arrival

Now that you understand the purpose of the program and how InterExchange selects and approves participants, it is time to discuss your role as a host of Camp USA participants.

Registration and Program Eligibility

In order to host Camp USA participants, each camp will fill out an online Host Application. This application collects information about your camp and your specific hiring needs for the upcoming season. This information should be adjusted annually to ensure participants are receiving the most accurate information. You will also need to agree to the InterExchange Terms and Conditions in the Host Agreement. Before enrolling your camp for the current program year, an InterExchange representative will review your application to ensure camp is eligible to be a host on the program per the State Department regulations. All Camp Host Employers must be either:

- Accredited;

- A member in good standing of the American Camping Association;

- Officially affiliated with a nationally recognized non-profit organization; or

- Have been inspected, evaluated, and approved by InterExchange

Once you are enrolled for the season, an InterExchange representative will contact you to discuss your hiring needs and our matching system.

Camp Host Agreement

The InterExchange fee scale is outlined in our Camp Director Program Agreement and can be found on our website (program fees subject to change). When a camp hires a participant, it agrees to pay all related fees. InterExchange will send an invoice on July 1st of each program year. Payment is due by September 15th and monthly interest will begin to accumulate at 1.5% for any balance unpaid 30 days after this date.

The fees that camps pay to InterExchange cover participant related costs such as:

- Recruitment, screening, interviewing and placement.

- Pre-departure orientation.

- DS-2019 + visa paperwork.

- Government reporting and administrative expenses.

- 24-hour program support for the duration of the summer.

Late Payment Charges

Any outstanding balance as of September 15th will be subject to interest at a rate of 1.5% per month.

Tax Status

InterExchange is recognized as a tax-exempt 501(c)(3) nonprofit organization by the Internal Revenue Service.

Tips for Setting Up Your Camp Account

While setting up your camp account or re-enrolling for the new hiring season, there are a few things to keep in mind:

- Information from the Camp Description, Staffing Criteria, and Staffing Needs sections will be included on your Camp Profile, which is a page that participants will view frequently.

- Make sure your Travel Information is accurate! This is the information your counselors will use to plan their flights to and from the U.S.

- More than one person can have a log in for your camp. Please contact your InterExchange representative in order to set up additional logins. If multiple people will be using your account, it is recommended that they each have their own login rather than sharing one.

- Keeping all of the camp’s information up to date and accurate is of the utmost importance. Please be sure to make updates regularly.

- You have the ability to be visible in matching, meaning participants can view your camp profile and apply, or if you are not actively hiring, you can disable your profile visibility. You can enable and disable this feature as often as needed throughout the hiring process.

The Matching Process

Once your camp has been enrolled for the current hiring season, you will have access to the InterExchange Matching System. You will also have a dedicated InterExchange representative for your camp. If you are unsure who this is, please contact us at [email protected] and they will reach out to you directly.

There are three primary ways that matching takes place.

- Browse our available participants yourself – There is a search page available to you once you have enrolled. All available Camp Placement participants will be shown on this page for you to review. If there are any you are interested in speaking with, you can put them On Review with your camp.

- Participants browse active camps – As part of your application, a Host Profile is created. Accepted Camp Placement participants are able to browse through the list of camps who have made their profile visible. You are able to enable or disable your profile visibility at any point during the matching season. We recommend leaving your profile visible so that the most motivated participants are able to find your camp!

- Share your hiring needs with your InterExchange representative – Your InterExchange representative can keep an eye on the incoming participants and send them to your review list as they become available. Your representative will also notify you as any Self or Returning Placements become available for you to review and confirm.

Review Periods

The On Review list will show the participants that you have on review. This will include both Camp Placement and your Self or Returning Placements. Any Camp Placement participants that you, InterExchange, or the participants themselves put on review with you will be there for a period of seven days. During this time, you will be the only camp who can access and view the application.

We recommend contacting them for an interview as soon as possible. If anyone is on this list you know you will not be moving forward with, please decline them and include a reason for doing so. InterExchange representatives will be able to see the reason, and we can use it to assist the participant in finding a better fit – and to ensure we know precisely what you’re looking for!

You also have the ability to extend review periods if needed. Please use this sparingly, as we want to be sure participants and other camps have plenty of time to match if needed.

Once your Self and Returning Placements are on your review list, they will remain there until you create an offer.

Confirmation and Job Offers

Once you have decided to hire a participant, you will be able to send them a Job Offer from the On Review list. You will enter the proposed position title, arrival date, contract start date, contract end date, and total compensation amount. Please note that this amount (and benefits) should be commensurate with a similarly situated American counterpart. The amount entered on this line is the amount paid to the participant. It should not include any additional benefits or deductions (i.e fee from InterExchange). The amount you enter here is what the counselor will expect to be paid, pre-tax, during their time at camp.

There is a minimum required stipend for Camp Placement participants. If the contract is for longer than 63 days of work, the participant will need to earn additional pay on top of the minimum stipend. This information is up to date on our costs page. You can calculate that amount or any additional amount the camp will be paying the counselor and include it in the Total Compensation line.

You’ll see a basic camp counselor description on the job offer, and you may also include an additional description for anything specific about the role you would like to note in the offer. An example of helpful additional information: “the role of lifeguard also includes evening duties and responsibilities of a general counselor”. There is also a Typical Camp Counselor Work Hours section that you may edit as needed. The more information you put in the job offer, the more prepared your staff member will be, and the easier it is for InterExchange to help mediate any discrepancies.

Once you confirm the offer, your InterExchange representative will review it and then send it out to the participant to review and sign.

Roles that are Suitable for the Camp Counselor Program

It is important to note that the J-1 Camp Counselor Program is a cultural exchange program by nature. Per Section Section 22 CFR 62.30(a) of the regulations, these participants should be:

…serving as counselors per se, that is, having direct responsibility for supervision of groups of American youth and of activities that bring them into interaction with their charges. While it is recognized that some non-counseling chores are an essential part of camp life for all counselors, this program is not intended to assist American camps in bringing in foreign nationals to serve as administrative personnel, cooks, or menial laborers, such as dishwashers or janitors.

Your InterExchange representative will be reviewing your job offers to ensure the roles fall within these guidelines and will reach out with any clarifying questions.

Pre-Arrival Information

The period between hiring a participant and their arrival at your camp is critical! During this time, InterExchange and our ICs will assist your counselor as they apply for and obtain the visa, plan their travel to camp, and prepare for a successful program. It’s important that camp also stays in touch with their hired participants. Building rapport and expectations during this time is vital to their success with you.

Obtaining Visas

InterExchange and our ICs will assist your participants as they apply for their visas. We will provide their DS-2019 form and instructions on how to sign up for their visa interview. We request that all participants inform us once they have booked their visa interview by adding that information to their InterExchange profile. You will have access to this information as well, via your Arrivals list.

Once a participant has attended their visa interview, we request that they log in to inform us how the interview went. In most cases, they will simply report that their visa was issued. Again, you will be able to see this information through your Arrivals lists.

If their visa was denied, they will have the option to say whether they were denied or are reapplying. InterExchange will work with our ICs to determine if a participant may have a chance at being approved if they reapply. We know that denials are frustrating for everyone involved, and that you are relying on the counselors you hire to make it to camp. It is impossible to foresee which counselors may get denied, and difficult to understand what their odds of approval are on a second attempt. Please keep in mind that each time a participant signs up for an interview at the embassy, they must pay an additional interview fee of $185. This may make it impossible for them to apply for a second interview.

Your InterExchange representative will contact you immediately once we are aware of any visa denials. Additionally, participants can be sent into Administrative Processing, meaning the embassy needs more time to assess the application. Often, the embassy will inform the counselor what is needed to move their application forward, but sometimes they are held in this limbo for long enough that they may miss out on camp. We will keep you as informed as possible in these situations.

Travel Directions to Camp

Camps are responsible for providing clear directions for how and when participants should arrive at camp. The “Travel Arrangements” section of your camp application and profile should be detailed and can be updated at any time. Placed participants will see this information and book their flights based on the information you provide. Participants can fly directly into the airport that is closest to your camp. Please stay in touch with your participants regarding arrival information especially regarding pick up times and locations.

All participants are responsible for purchasing their own flights to and from camp.

Pre-Camp Contact

Let your staff know you’re excited about working with them! Send a welcome letter and camp brochure, plus any relevant forms. InterExchange highly recommends sending international staff your standard camp contract with start and end dates and any important camp rules. You may also want to include a packet from your local Chamber of Commerce. Having contracts signed and returned and copies of certificates and medical reports on file before your staff is physically at camp reduces your paper chase once the summer begins. Remember, your international participants are just as excited as you are and they want to be prepared. This is also a great time to connect your international staff with your domestic staff, so that the first day is not too overwhelming. Social media groups, email chains, and virtual hangouts can go a long way!

Pre-Arrival Orientation

We do our best to ensure your counselors are ready for a summer in the US by the time they arrive to camp. InterExchange has a mandatory orientation that all of our participants must watch prior to travel. If you’re interested in viewing it, you can do so here. This orientation covers topics such as who InterExchange is, what they can expect on the program, information on SEVIS and Social Security, understanding pay and taxes, along with various other challenges they may face.

Because every camp is different, we do rely on you to provide any additional information that may be unique to your camp. Packing lists, detailed arrival instructions and/or staff policies are always helpful so be sure to share those with your arriving counselors.

Here are a couple other quick topics we cover with all participants prior to their arrival:

- Participants are given their insurance information and access to their insurance documents

- Participants are aware that they will need to apply for a Social Security number and taxes will be deducted from their paycheck.

- We encourage all participants to review their offers and ask questions about pay/compensation prior to arrival to avoid any confusion during the summer.

Handling Last Minute Complications

As we screen participants, we do everything we can to ensure they are dedicated to the program and committed to arriving and remaining at camp for the duration of the summer. However, last minute complications can always arise – whether that is through visa denials or global situations. You know this as a camp director – but always be prepared for last minute changes! Here are some tips for preparing to handle any last minute complications that may arise.

Diversify, Diversify, Diversify.

Seek out diversity in every element of your staff. For international staff, hire from different countries and different regions of the world. That way, if one country presents a problem in terms of visas, you won’t lose half of your counselors. Hiring a diverse group not only helps you avoid visa issues but also allows your staff to improve their English as they communicate with one another.

Seek Out Staff With a Range of Skills.

Finding a horseback-riding specialist is great, but finding a horseback-riding specialist who can help out in arts and crafts is even better! Keep in mind that you may need to do some shifting of responsibilities at first, before staff become comfortable with their roles. Prepare your staff for this possibility as well!

Hire Early and Often.

Unanticipated embassy issues can delay the visa process for weeks or even months at a time. Do not wait until a month before your camp opens to start looking at the holes in your staffing. Also, if at all possible, plan for more staff than you need. We recommend that you be over prepared, as appropriate candidates may not be available if you find you’re understaffed after your season has started.

How to Host: Arrivals, On Program, and Beyond

Your counselors have been selected, their visas have been approved, and they have traveled to the United States! What’s next?

Arrival to Camp

Your counselors will follow the travel instructions you wrote in your camp profile. If you will be sending someone to meet them at their arrival airport, we suggest that the staff member meeting them is easily identifiable. Provide the arriving counselors with as much information as possible about the person picking them up – and have them wear a camp shirt or have a sign welcoming them to camp! Remember, these are young people traveling across the globe alone – they need to be certain that they are connecting with the right person on arrival so they feel safe. If groups of staff will be arriving at similar times, or waiting in a designated pick up area, it is good practice to connect them with each other prior to travel so that they know they are not there alone.

The first few days at camp are critical for your international counselors. Please be sure to allow them the chance to connect with their families during times that make sense for the time zone in their home country. This will be the first time that many of them travel abroad, and they will want to be able to reassure their families that all is well and that they may have less access to their devices over the coming weeks.

SEVIS Activation

Your counselors are responsible for informing InterExchange of their arrival to camp. Please remind them to log in to their InterExchange account to complete their arrival check in as soon as they get to camp! There are three simple steps, but they will need the camp’s physical address and phone number in order to complete this. Once they have completed all three steps, InterExchange will activate them in SEVIS as soon as possible.

Employment Verification

InterExchange has compiled the following information as a general resource. Tax laws are subject to change. InterExchange program staff are not tax advisers and cannot assume any responsibility for tax issues a camp might have with its international participants. We encourage all camps to contact the IRS or a tax adviser for assistance and more up-to-date information.

Work Authorization

- Each participant is authorized to work legally under his or her J-1 Visa status.

- This visa allows the participant to work only between the dates listed in Section 3 of the participant’s DS-2019 Form. These dates are taken directly from the offer you sent the participant through your InterExchange account. If any date changes occur, we need to be notified to ensure that all necessary documents are updated.

Note: An InterExchange participant is only authorized to work at his or her assigned camp and is prohibited from working anywhere else during the program.

Documentation for Your Records

Upon your international staff’s arrival, you should make photocopies of the following documents and keep them on file. We suggest allocating some time during your staff orientation to organize this paperwork.

- Passport photo page

- Electronic I-94 arrival record (Can be located and downloaded here)

- J-1 Visa (sticker on passport page)

- DS-2019 Form

- Completed I-9 Employment Eligibility Verification Form

The information collected will serve as verification of the participant’s identity and his or her eligibility to work while in the United States. Keep all records on file for at least three years or as recommended by the IRS and U.S. Department of Labor.

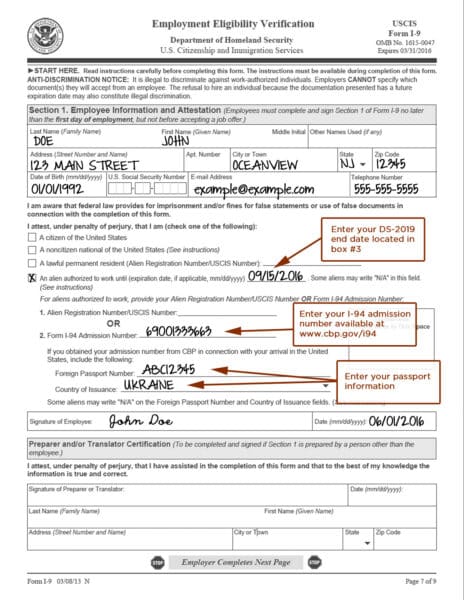

Form I-9

All participants should fill out an I-9 Employment Eligibility Verification Form after arriving at their camps. We have provided a sample of a typical I-9 for an InterExchange Camp USA student.

I-9 Section 1

All participants are legal aliens authorized to work. Admission numbers are located on their I-94 cards.

I-9 Section 2

Use a passport and electronic I-94 arrival record as a List A document. For List C documents, you should use the DS-2019 number and the program end date (DS-2019 form expiration date located in Box 3).

For complete information about filling out the I-9, please refer to the Handbook for Employers — Instructions for Completing Form I-9, published by the USCIS. You can download a PDF of the handbook from their website.

Taxes and Withholding

Federal, State, and Local Taxes

All InterExchange participants must pay federal, state and local taxes. They are not exempt. While they are here, participants of the InterExchange Camp USA program are exchange visitors in the non-resident alien tax category. Please consult a tax professional for the most recent tax regulations.

FICA and FUTA Withholdings

Under IRS Code Section 3121 (B)(19), all non-resident aliens on J-1 Visas are exempt from paying FICA (Social Security) and FUTA (federal unemployment taxes) taxes during their first two calendar years in the U.S. Since all of our counselors are only able to work for four months, all are exempt from these withholdings. Please consult a tax professional to see if counselors are exempt from state unemployment taxes in your state.

Completing the W-4 Form

All exchange visitors must fill out a W-4 (employee withholding allowance certificate).

When filling out the current W-4 form it is recommended that InterExchange Camp USA participants follow Supplemental Form W-4 Instructions for Nonresident Aliens as provided by the IRS.

Please provide guidance on when and how they will receive their W-2, and urge them to file a tax return as required by the IRS.

Filing a Tax Return

All participants are required to file for U.S. income tax by April 15 of the year following the year in which they work. To file for a federal tax return, participants will fill out and send a 1040-NR (non-resident aliens with no dependents) tax form along with copies of their W-2 forms.

Participants can obtain the 1040-NR and instructions from the IRS website. Refund checks are mailed to participants in their home countries.

If your participants have any questions regarding the process, they can view our participant resource page on filing tax returns.

W-2 Forms

Please send W-2 forms to students at their permanent addresses in their home countries. We recommend that you have students address envelopes with their permanent addresses at the time you have them fill out their W-4. You can also distribute these digitally.

For IRS publications please contact your local IRS office or download them on the IRS website.

IMPORTANT: Do not send W-2 forms to the InterExchange New York office. InterExchange is not responsible for sending this information to participants.

Social Security and Identification Numbers

In order for international J-1 staff to file tax returns at the end of the year, they should obtain a Social Security number. U.S. government regulations dictate that Social Security offices confirm each applicant’s legitimacy with USCIS (United States Citizenship and Immigration Services), which may delay processing. We ask that you allow your staff to apply as early as possible.

Your international staff are required to apply for a Social Security number. Counselors who have participated before should already have their numbers from previous years. For those that do not, please assist them with transportation to the closest Social Security office during the first week of camp. Use the Social Security Office Locator, to find the closest office to your camp. Social Security cards are mailed from the processing center to participants at the address provided on the application form approximately 4 to 6 weeks after applications are submitted. We recommend participants use their camp’s mailing address when filling out their Social Security Application.

Participants are allowed to work and be paid before their Social Security card arrives.

After applying, participants will be given a Social Security letter of receipt, which serves as proof that the participant has applied for a Social Security card. Participants should provide you with this letter of receipt and maintain a copy for their own records. Please notify your payroll company that participants may begin work with proof of application.

If a participant does not receive his or her Social Security card within 6 weeks, you should have them contact Social Security at 1.800.772.1213 to find out the status of the application.

Important: Participants will not be issued a Social Security number if they have not registered in SEVIS. They must register as soon as they arrive in the U.S. through their InterExchange online account. Participants need to wait at least 3-4 business days after registering in SEVIS before applying for a Social Security number.

There are sometimes issues or delays with a Social Security application because of security flags or issues with their name being correctly entered exactly as it is on their documents.

If your participant needs information on how to apply for their Social Security number, please have them visit our Camp USA Participant Resource page.

Frequently Asked Questions

What are an employer’s responsibilities when hiring international visitors who don’t have Social Security numbers?

Advise participants that they are required to apply for a Social Security number and card. If a participant applied for but has not yet received a Social Security number, ask to see and retain a copy of the receipt letter as proof of application. You should also get the following information as completely as possible: the person’s full name, address, date of birth, place of birth, father’s full name, mother’s full maiden name, gender, and the date he or she applied for a Social Security number.

Is it legal for participants on the Camp Counselor program to start working prior to receiving their Social Security number?

Yes. Participants may start working and can be paid prior to receiving their Social Security numbers. We encourage all participants to apply for their Social Security number as soon as possible, but wait at least 3-4 days after registering in SEVIS. They should provide proof of application (a copy of the application receipt and/or a copy of the Online Social Security Number Application confirmation page) to their employer.

What if my Camp Counselor employee doesn’t have a Social Security number when wage reports (Forms W-2) are due?

Paper Filers: If the worker applied for a card but didn’t receive the number in time for filing, enter “Applied For” in Box A.

Electronic Filers: If the worker applied for a card but didn’t receive the number in time for filing, enter all zeros in the field for the SSN.

Remember to ask your employees for the number and the exact name printed on their Social Security card when he or she receives it.

Learn more on the SSA website.

What if I receive the participant’s Social Security number after I have filed my wage report?

If you receive their Social Security number after you file your wage report, file Form W-2C (Corrected Wage and Tax Statement). Learn more on the SSA website.

What if my employee returns home without receiving their Social Security number? Is there a penalty for not reporting a worker’s Social Security number?

Yes, there is a penalty for not reporting a worker’s Social Security number, but this fine is usually waived if the employer can prove reasonable cause for not reporting the Social Security number. Employers will receive Notice 972CG — or a notice of proposed penalty — and will have 45 days to respond. The employer must prove that they acted in a responsible manner and that the failure to submit a Social Security number was not due to willful neglect.

To help prove reasonable cause:

- Collect employees’ proof of application, which can include a copy of their paper application Form SS-5 or a copy of their Online Social Security Number Application confirmation page, a copy of the application receipt (sometimes mailed after they have applied) or a signed statement from the participant stating that they have applied.

- Document the participant’s full name, gender, address, date of birth, father’s full name, mother’s maiden name, and the date of application.

- Make at least one solicitation for the correct Social Security number either by mail, telephone, electronically, or in person and document this solicitation and the results. Retaining a copy of Form W-4 can also be considered a solicitation for the correct Social Security number, but additional solicitations may be required.

Publication 1586 details the requirements of proving reasonable cause as well as answering additional questions regarding missing Social Security numbers. Section (m) in regulation 301.6724-1 details the procedure for seeking a waiver of the penalty.

What if my employee’s Social Security card arrives at my business after they have left?

If you have a forwarding address for the participant, please forward the card to them. At a minimum, ensure they receive the number.

What causes delays when Exchange Visitors apply for Social Security numbers?

When Exchange Visitors apply for Social Security numbers, the Social Security Administration (SSA) verifies their documents directly with the Department of Homeland Security (DHS). Exchange Visitors must be listed as active in SEVIS before the SSA issues a Social Security number. Most applications are verified immediately, but there can be delays. Social Security understands that this process may affect companies who hire Exchange Visitors, but direct verification from DHS is vital to ensuring the integrity of the Social Security number.

Requesting Government Forms and Publications

InterExchange understands the complexity involved with handling the various tax codes and responsibilities. As such, we have provided the following information to assist in the search for accurate information. We suggest contacting a tax adviser for the most up-to-date information.

Internal Revenue Service

1.800.829.1040 (for individual tax questions) 1.800.829.4933 (for business tax questions) www.irs.gov

Social Security Administration

1.800.772.1213 www.ssa.gov

United States Citizenship and Immigration Services (USCIS)

1.800.375.5283 www.uscis.gov

U.S. Department of State

202.663.1225 www.state.gov

Insurance Information

Insurance Coverage

All participants have InterExchange-arranged insurance while they are working at camp. InterExchange-arranged accident & sickness insurance meets U.S. Department of State requirements, which is part of the terms and conditions of the J-1 Visa. All participants should have information with their insurance details, including a toll free number they can call while in the U.S. regarding their coverage, claims, or recommended area physicians. The standard plan is included but participants can also upgrade to a premium plan and/or extend their coverage dates as needed.

You can find information about participant insurance here. Brochures for both insurance plans, and information on how to use it are located on that page. If your staff need to locate their insurance cards or find the contact information for the insurance company, you can help them find that on the Envisage Global Insurance Student Zone page. They will also be able to locate providers who accept their insurance at that site.

Note: Remind your staff to locate a doctor before they need one and always make copies of any bills and claim forms they submit to the insurance company.

Workers’ Compensation

As with any camp staff member, if an InterExchange Camp USA participant is hurt while working at camp, the camp’s workers’ compensation plan is expected to provide insurance coverage. Camps should assist any participant with filing workers’ compensation claims should this become necessary. InterExchange-arranged insurance will deny coverage for any claim deemed to be work-related.

InterExchange will terminate relations with any camp that does not properly file work-related injuries for participants, as false claims will negatively impact our claim ratios and force higher premiums or make the insurance difficult to obtain at reasonable prices for participants in the future.

Handling Health Issues

Please report any health issues or injuries to InterExchange as soon as possible! We want to be informed of their welfare throughout the program, and additionally, we are required to report any serious health issues to the U.S. Department of State in a timely manner. We understand that camp is hectic, but please have someone on staff notify us of any doctor or hospital visits.

It may be helpful to research the nearest in-network providers before the season starts in order to reduce the stress of a participant’s potential illness or injury. If you need more information, please contact an InterExchange representative.

Completed claim forms and the original bills can be sent by the participant, doctor, hospital or clinic directly to the insurance company. Please do not send them to the InterExchange office. InterExchange is not responsible for participants’ medical bills. Please settle all outstanding bills before participants leave camp.

Best Practices

Arrival & Orientation at Camp

Meet & Greet

First impressions are long lasting! Encourage returning staff to meet and greet new arrivals. An immediate support structure promotes smooth transitions and begins the orientation process in an effective manner. Ask your camp leadership (unit heads, program directors, etc.) to set an example by reaching out to international staff.

Orientation

Create effective orientation strategies. Use experiential exercises and role-playing examples, provide handouts and conduct meetings, rotate group composition and group sizes to encourage maximum exposure. Provide staff with enough time to process information between each orientation activity. Downtime also allows for greater participation, discussions and social interaction.

Play Time

Use traditional camp activities to educate staff further and to break up the potential monotony of orientation. It is possible your international staff members may not be familiar with popular games like capture the flag or Simon Says. This is a great time to teach them, so they can soon play with their campers! They may have a similar game they want to teach the group too.

Integrate

While you will need to set aside time to train counselors in their specific duties, you should try to conduct as much of the orientation with the entire staff as possible. Whenever you break down into smaller groups, double check that every group includes both American and international staff.

Throughout the Summer

Basic Needs

You are responsible for providing international staff with appropriate housing, three nutritious meals a day and a stipend for the duration of their contract dates. If your camp shuts down for weekends or for a few days between sessions, please make sure that participants are not left without food or shelter during this time.

Staff Meetings

Everyone appreciates having someone to listen to them. Set aside a specific time for staff to offer feedback about camp on (at least) a weekly basis. Let them know you’re there to guide them! Whenever possible, incorporate staff suggestions into camp life. Staff meetings are also an excellent time for you to address ongoing issues with your staff.

Personal Evaluations

Take a few minutes to sit down with each staff member after a reasonable adjustment period. Encourage each person to do a verbal self-evaluation, then add your own praise and/or constructive criticism. If you are not happy with a staff member’s performance, say so! Honest, diplomatic conversations prevent future conflicts and misunderstandings. Be sure to end the meeting by offering positive reinforcement and concrete suggestions for improvement, whether related to job performance, engagement in American culture or general interactions.

Staff Lounge

A space that is designated as “camp staff only” is a nice way for staff to meet peers, relax and take time to re-energize. This is a great place to allow staff to access their electronics, or other items that are usually limited throughout the work day.

Computer or Phone Time

Provide participants with access to devices where they can email or contact friends and family back home. Please try to accommodate them in the hours when their family will be awake! Not everyone will be able to contact their families between 10 and 12 PM EST.

Off-Camp Transportation

International staff generally do not have access to vehicles while at camp. Before the summer begins, have someone research the most time- and cost-effective ways to provide staff transportation.

Some possibilities:

- Run a camp van into town or to the nearest bus station once a week.

- Speak to a rental car company about discounted rates for the summer.

- Invite staff who are off-duty to join campers going on out-of-camp trips.

- If you provide use of bicycles, please confirm the safety of the roads and discuss bike safety with your participants. Helmets and lights must be provided if participants will use bicycles as a method of transportation.

Time away from camp relaxes and reenergizes your staff! Please try to be aware of if your International staff are getting left behind on time off. The number one complaint we see in our check ins with staff is lack of access to transportation off camp property, and an unhappy staff member may choose to leave camp early.

Laundry Services

If there is no laundry facility on camp property, please provide your staff with information on and transportation to the nearest laundromat.

At the End of the Summer

All staff members should receive any/all compensation prior to leaving camp. The compensation amount is listed on the job offer you sent to them and can be viewed at any time. Please look into the best ways to pay international staff so that they can access the money for their travels. This may be cash from their paycheck or a paycard of sorts.

Handling Staff Issues and Early Departures

Problems With InterExchange Camp USA Participants

While we arrange every placement with the best of intentions, we understand that no hiring system is foolproof. Should you experience a problem with an InterExchange participant, we ask that you take the following steps:

- Speak to the participant as soon as you feel there is cause for concern. Describe the problem in an honest and straightforward manner and then listen to what he or she has to say. Once you feel you completely understand the situation, tell the participant specifically how he or she can improve matters.

- Contact InterExchange immediately. Please do not wait to call us when you’re already at the point where you want to fire a participant. Regardless of how trivial or serious any situation may seem at the time, we like to know what is going on with our participants. If necessary, we may ask you to have the participant call us. Often, we are able to remind participants of their purpose at camp, help eliminate misunderstandings and resolve any problems.

- Document any and all conversations and incidents involving the participant. Have the participant sign off on all write-ups and evaluations so there is no question as to his or her understanding of the situation.

- Should you ultimately decide to terminate a participant, please let us know exactly when you are asking that person to leave camp. We need to speak with the participant before he or she leaves the grounds. Early, unexpected departures are a valid reason to call our emergency phone line, described below, so that we can ensure all procedures are followed and the participant is prepared for what’s next.

Early Departures

We understand that not every staff issue can be resolved, and also that sometimes participants choose to leave early themselves. In these cases, we ask that you contact InterExchange before the staff member has departed from camp. Participants should be paid for their time worked before departing camp. You will receive a refund for any placement fees based on their arrival and departure dates.

We know camps are unique communities and that you may want them to leave camp property as soon as possible, but please remember that they are young people in a foreign country and some time is required to ensure a safe transition. If at all possible, if you dismiss someone in the evening, please allow them to depart the following morning. We also ask that you allow them time to make plans for what they are doing next, and take them to a bus station, airport, or hotel upon departure from camp.

Please remember, these are young people who may be in the U.S. for the first time, and the prospect of suddenly being alone can be daunting. If you can provide advice on their travel, that would be appreciated. Consider how you would want your own child treated if they were abroad in a foreign country, and treat your former staff members with the same consideration.

Note: If you need any assistance calculating prorated compensation, please review the job offer you sent and they accepted and/or ask InterExchange for assistance. One way to calculate this is to divide the compensation amount by the number of days they were supposed to work. This will give you a daily rate that you can use to calculate the amount they earned for the actual number of days worked. At a minimum, participants must be paid $31.75 per day of work but please review the offer you sent them for the most accurate daily rate.

Re-placement after early departure

If a participant is leaving your camp early, they may have an opportunity to receive a new placement. This could occur when a placement does not work out due to no fault of the participant, or when you as their original host would recommend them for another camp. The participant is responsible for lodging until they have secured another placement. We do not guarantee that a participant, regardless of reason for leaving, will find a second placement.

Emergencies

The health, safety and welfare of participants is the primary concern of InterExchange and the U.S. Department of State. Do not place participants in positions that can endanger their well-being or adversely affect their impressions of the U.S. or American people.

If your camp experiences an emergency involving one of our participants (e.g., accident, illness, mental, nervous disorder or fatality), call InterExchange immediately. We will provide guidance to help you manage the situation. If the emergency occurs after normal office hours (9:30 a.m. to 5:30 p.m., Monday-Friday) or on a weekend or holiday, you can contact a member of the InterExchange Camp USA staff at our 24-hour emergency support number: 1.800.597.1722 and follow the directions or call 917.741.5057.

Emergency room visits can be very expensive. All participants who visit the ER but are not admitted as an emergency will be charged a $250 deductible. Please advise participants to visit a doctor or urgent care first and only visit the ER if it is an actual emergency.

Severe Weather Instructions

In case of emergencies (e.g., hurricanes, flooding, earthquakes, fires, terrorist attacks), you must advise participants to follow your guidance and/or that of local authorities if the guidance is different from InterExchange guidance.

The most important aspects of promoting safety are communication, preparedness and coordination. Make sure you have an emergency contingency plan and make your plan known to participants as part of their training and orientation. Timely communication with InterExchange throughout an emergency event is necessary and a requirement of hosting participants. Please always respond to InterExchange’s inquiries about the safety of participants as soon as reasonably possible.

Camps must issue emergency instructions to participants to prepare them in case of emergencies.

You must make participants aware of emergency and evacuation procedures issued by government authorities. Please also encourage compliance.

Cultural Exchange

InterExchange Camp USA is, first and foremost, a cultural exchange program. Participants travel a very long way to make new friends, learn about American culture and improve their English. As you welcome InterExchange Camp USA participants into your camp family, we ask that you stay focused on the purpose of the program and help participants to achieve these goals. We thank you for providing young people with this opportunity and offer the following suggestions to help maximize the positive impact of cultural exchange at your camp.

Helping Participants Gain a New Understanding of the USA

Cultural exchange occurs when people gain more in-depth understanding and knowledge about another country, its culture, its customs and its day-to-day practices through person-to-person contact. Our participants as well as our hosts embrace this aspect of InterExchange programs and understand its importance whether they’re part of a camp, a family, a seasonal business or a professional environment.

The United States is often described as a “melting pot” attracting people from countries all over the world. It is a culture that is continuously being reshaped and redefined as more people from other countries gain exposure to the country. It is also influenced by visitors who share their cultures during their time in the U.S., and by the deeper insights and favorable attitudes about American life they return to their home countries with.

InterExchange makes it a priority to give our participants and hosts resources to explore cultural learning opportunities together or independently. We’ve created an online guide to U.S. culture, including recommended sites and activities for everyone to enjoy during time spent in the U.S. We encourage everyone to discover new places and aspects of American culture, whether they’re visitors or natives!

The InterExchange Inside the USA guide also contains many helpful recommendations and resources.

Cultural Activities Toolkit for Host Employers

As a host employer with the InterExchange Camp USA program, you play an important role in helping our international participants learn about American culture and have a fantastic experience in the U.S. Encouraging participants to interact with Americans and experience our culture in their free time is an essential part of your role. Hosting your own cultural events and activities is often the best way to teach them about life in the U.S! To help you facilitate these fun cultural activities for your international staff, we’ve created the InterExchange Cultural Activities Toolkit. Below, we’ve outlined ideas for events and instructions on using the toolkit. Download the entire kit here. You’ll notice this Toolkit is designed with InterExchange Work & Travel USA host employers in mind. We think that summer camp can inherently be FULL of cultural exchange moments for our counselors – but the Toolkit can help you and your camp be more deliberate about ensuring your counselors are getting the best Cultural Exchange experience possible. You may even find ideas to incorporate into programming for your whole camp!

Also check out our Cultural Compass, a state-by-state guide to activities, culture and sites in the U.S., and share the link with your participants.

Below are some ideas for activities you can plan for your staff and ways to use the Toolkit:

Beginning of Season Events

Making sure your international participants have a warm welcome can be the key to a successful season. Remember, they’ve just arrived in a new country and don’t know anyone! Events at the beginning of the season can be as simple as gathering employees together for introductions or a name game. One idea to welcome your participants is an introductory reception.

Host a welcome reception for your international staff and introduce U.S. culture. Suggested materials: name tags, sign-in sheet, American culture speech balloon, icebreaker games, cultural bingo, flag frames, American culture trivia. Examples of each of these materials and games can be found in the above Toolkit.

Mid-Season Events

Throughout the summer, cultural events and outings are a great way to keep up enthusiasm and morale at your camp and to make sure participants are experiencing American culture. Participants may feel homesick at some point during the season, and facilitating fun activities can help remind them why they’re here.

Sporting event: Organize an outing to a local sporting event. Help explain the rules of the game if participants are unfamiliar. Suggested materials: Name tags, sign-in sheet, American culture speech balloon, baseball rules handout, “Take me out to the ballgame” (baseball only).

Food events: Host an American-style barbecue or picnic, or organize a potluck where students prepare their favorite dishes from their home countries. Suggested materials: Name tags, sign-in sheet, American culture speech balloon, recipe cards, ice breaker game, cultural Bingo, flag frames.

Attend a local holiday parade or festival: Suggested materials: Name tags, sign-in sheet, American culture speech balloon.

Celebrate an American holiday: Celebrate holidays like the Fourth of July or Thanksgiving to give participants unique insight into American culture. Picnics and potlucks work well for holiday celebrations. Suggested materials: Name tags, sign-in sheet, American culture speech balloon, recipe cards, icebreaker game, cultural Bingo.

Volunteer event: Get students together for a day or an hour of volunteering! Partner with a local volunteer organization for greater interaction with Americans. Suggested materials: name tags, sign-in sheet, American culture speech balloon.

End-of-Season Events

At the end of their work commitment, international participants are preparing to travel within the U.S. before returning home. Show your appreciation for their hard work during your busy season by hosting a going-away party!

Culture Shock—Helping Participants Adjust

Be aware of culture shock. Culture shock is described as the anxiety, feelings of frustration, alienation and anger that may occur when a person is placed in a new culture. Many of the customs here may seem odd or uncomfortably different from those of participants’ home countries. Being in a new and unfamiliar place can be challenging even for the experienced traveler, and some feelings of isolation and frustration are normal. It is important to acknowledge that not only are your participants likely experiencing American culture for the first time, but also they are new to the world of camp culture, which can be very different from what they know and are comfortable with back home. Participants experience culture shock to varying degrees; some hardly notice it at all, while others can find it very difficult to adapt to their new environment. Many may not attribute their problems to culture shock. Whatever the case may be, understanding these issues and why they happen will help.

Signs of Culture Shock

Common signs of culture shock may include:

- Participants may feel isolated and frustrated. They may become nervous and/or excessively tired. They may sleep a lot, even after they have recovered from jet lag.

- Participants may be excessively homesick. It is normal to miss home, family and friends; but if they can think of nothing else, call or email home all the time, or frequently seem depressed or cry, they are most likely suffering from culture shock. Normal, minor irritations may make an exchange visitor overly upset.

- Participants may become dependent upon other staff members from their home country. These friendships are important and are extremely supportive. However, if they spend time exclusively with friends from their home country, they deny themselves the experience of interacting with people from the U.S. and other countries.

- Participants may have deep doubts about their decision to come to the U.S. There may be anxieties with work. A participant may wonder: “Why does my boss speak so loudly and quickly?” “Will I be able to repay my parents the money they lent me?” This stress can become overwhelming and cause tension.

- They may feel reluctant to speak English or to associate with people.

Coping With Culture Shock

Almost all participants must cope with culture shock to some degree. We hope that you’ll be aware of this possibility and be able to help participants acclimate to living and adjusting to American customs. The following suggestions may help you in understanding and resolving any problems that arise:

- Maintain your perspective. Although the participants are your employees, they will occasionally need advice or encouragement. Usually participants just need to know they have someone on their side to help boost their confidence while adapting to their new environment.

- If a participant feels confused or disappointed, ask them what their expectations were. InterExchange Camp USA gives detailed descriptions during interviews to prepare participants for what to expect when they are in the U.S.

- Keep an open mind and a sense of humor. People in the U.S. may do or say things that people in the participant’s home country would not do or say. Try to understand that the participant is acting according to his or her own set of values, and that these values are born of a culture different from yours.

- Read our section on Culture Shock for more suggestions to help participants cope with the transition.

Get started today

It’s free to start an application and nothing is due until you accept a job offer.