Intern & Trainee Host Resources

These resources are intended to help answer any questions you have about hosting international interns and trainees for U.S. businesses.

Frequently Asked Questions

General Program Information

What does InterExchange Career Training USA do?

InterExchange Career Training USA helps U.S. businesses benefit from hosting international internship and training programs. InterExchange is designated by the U.S. Department of State to provide J-1 Visa sponsorship to international interns and trainees who meet our J-1 program requirements.

What is the purpose of the program?

The primary objectives of InterExchange Career Training USA are to enhance the skills and expertise of exchange visitors in their academic or occupational fields through structured and guided programs that improve participants’ knowledge of American techniques, methodologies, and technology. Participation in our Career Training USA program must not be used as a substitute for ordinary employment or work purposes nor may it be used to displace American workers.

Internship programs are work-based learning opportunities in students’ or recent graduates’ academic fields that enable them to develop practical skills that will enhance their future careers and bridge the gap between formal education and practical work experience. Trainee programs must include bonafide training and cannot simply be additional work experience.

The program increases international participants’ understanding of American culture, while also enhancing Americans’ knowledge of foreign cultures, customs and practices. Through this program, the U.S. Government builds partnerships, promotes mutual understanding, and develops relationships and extended networks that will last through generations as participants move into leadership roles in a broad range of occupational fields in their home countries.

Why should I host an international intern or trainee?

International interns and trainees bring an international perspective, foreign language skills, and a variety of other talents and experiences. Additionally, trainees can be part of your company longer than most American interns—up to 18 months—and can begin their program at any time during the year. Learn more about the benefits of international internships and trainee programs.

Won’t it be expensive to host an international intern or trainee?

The program is very affordable. There are no program, visa, or placement fees for employers to host an international intern or trainee.

If you are an employer with fewer than 25 employees and less than three million dollars in annual revenue, we are required by program regulations to perform a site visit at your organization. There is a one-time fee of $250 to perform a site visit. If your company is approved and you successfully host an intern/trainee through the program, no additional visits or fees will be required.

What is a J-1 Visa?

The J-1 Visa is a non-immigrant visa issued through the BridgeUSA Program. There are 15 J-1 Visa categories, and InterExchange Career Training USA offers the “Intern” and “Trainee” categories.

Once approved for J-1 Visa sponsorship by InterExchange, all Career Training USA participants, except Canadian citizens, will be required to interview at a U.S. embassy/consulate in order to be granted a J-1 visa.

I would like to host an intern or trainee. How do I know whether he or she is eligible?

Review our participant eligibility requirements on our website.

How do I know if my company is eligible to participate in the program?

Please review the host employer requirements on our website to determine eligibility.

Is my industry eligible?

InterExchange is designated to sponsor programs in a wide range of fields that fall under the following categories:

- Arts & Culture

- Information Media and Communications

- Management, Business, Commerce and Finance

- Public Administration and Law

- The Sciences, Engineering, Architecture, Mathematics and Industrial Occupations

- Hospitality and Tourism

If you are unsure whether the internship or training program you are offering falls under our list of fields, please contact InterExchange.

What types of training are prohibited?

Not all employers are permitted to host through InterExchange. We cannot approve participants for sponsorship at the following locations:

- Agricultural settings, such as farms or in wineries’ harvesting operations

- Arcades

- Behavioral health facilities

- Bridal companies

- Camps (Consider our Camp USA program for camp positions)

- Candy stores, mall kiosks, boardwalk booths, and stands

- Convenience and grocery stores or superettes/mini-markets (consider our Work & Travel USA program for seasonal positions)

- Call center, customer service, or phone operators, including tech and help desk support

- Farms

- Fast food or quick service restaurants or bakeries (consider our Work & Travel USA program for seasonal positions)

- Fitness studios, gyms, pools, dance studios, personal training, or coaching

- Garages

- Gardens or parks

- Gas stations or toll plazas

- Landscaping companies

- Pool management companies

- Real estate agencies

- Retail stores or locations and boutiques

- Schools and other instructional facilities

- Spas, salons, or dog grooming companies

- Staffing agencies

In addition, we are not able to sponsor programs in which interns or trainees would participate in:

- Animal care

- Child care

- Elder care

- Clinical work that involves any patient care or contact

- Sports or physical therapy

- Psychological counseling

- Nursing

- Dentistry

- Veterinary medicine

- Social work

- Speech therapy

- Early childhood education

If you require staff at one of the locations mentioned above or would like seasonal staff to assist with tasks that are not appropriate for Career Training USA participants, our Work & Travel USA program may be able to help meet your needs.

Are there special requirements for hospitality hosts?

Yes, the following requirements apply to hotel/hospitality management, hotel food and beverage management, restaurant management, and culinary arts.

- InterExchange does not permit business-only or non-hospitality programs at hotels, resorts, inns, or restaurants.

- Interns and Trainees wishing to train in hospitality or restaurant management positions must have hospitality or restaurant management education (interns) or work experience (trainees) in order to be able to rotate through various departments.

- At least three rotations for programs six months or longer is required by the regulations. No rotation may be more than three or four months long, and each department must have sufficient, qualified staff to offer adequate training.

- NOTE: InterExchange will not be able to sponsor Hospitality programs with Housekeeping Management phases.

- Per the U.S. Department of State regulations, all Hospitality Management, Restaurant Management and Culinary programs are limited to 12 months regardless of whether the individual is an Intern or Trainee.

- Hospitality Interns and Trainees may not return to properties at which they have previously worked on a Work and Travel program or other work visa.

- Education or work experience only in Tourism Management does not qualify Interns or Trainees for programs in Hospitality Management, as those fields are not interchangeable.

Eligible Locations

| Hotels | Restaurants |

|---|---|

| Should be rated 3-Diamond or higher by AAA, or rated 4-Star and above by Forbes. | Must be high-end, fine dining, sit-down restaurants OR full-service banquet halls. |

| All unrated properties will be considered on a case-by-case basis. | All properties will be considered on a case-by-case basis. |

Non-Eligible Locations

| Hotels | Restaurants |

|---|---|

| Motels | National chains, casual dining restaurants, pubs, pizza parlors |

| Hostels | Fast food, delivery/takeout restaurants, bakeries |

| Hotels that do not meet the above requirements | Kiosks, stands, food trucks |

Acceptable Types of Training

Remember that participants must rotate through departments and roles. Therefore, they may train in any given category for only one phase.

| Hotel/Hospitality Management | Restaurant/Food and Beverage Management | Culinary Arts |

|---|---|---|

| Front Desk | Restaurant/Food and Beverage Management | Kitchen equipment and food-handling safety training |

| Concierge | Restaurant Inventory or Management/Buying | Recipe development |

| Hotel or Restaurant Inventory/Buying | Catering/Event Planning | Inventory/food sourcing |

| Back Office/Business Management | Staff Training and Development | Different stations/food styles |

| Food and Beverage Management | Restaurant Business Areas | Menu planning |

For questions about other types of tasks, please contact InterExchange.

Prohibited training tasks or positions

| Hotel/Hospitality Management | All Areas |

|---|---|

| Valet | Cashier |

| Bellhop | Dishwashing |

| Dishwashing | Bussing Tables |

| Laundry | Bartending |

| Serving/Hosting | Delivery |

| Bussing Tables | Running Food |

| Bartending | Serving |

| Night audit or any training that occurs in the overnight hours | |

| Maintenance | |

| Housekeeping |

As part of an overall management training, participants may briefly train in hosting, waiting tables, food preparation, etc. to learn basic skills needed to pursue management-level training within a department. However, the combination of such basic tasks may NOT exceed 20% of the entire training program. For culinary participants, food preparation may constitute a larger percentage of their program but only for high-skill tasks contributing to their training.

Host employers who require wait staff, housekeepers, bellhops, short order cooks, etc., are encouraged to learn more about our InterExchange Work & Travel USA program.

About Interns & Trainees

What’s the difference between an intern and a trainee?

Review the differences and requirements for the intern and trainee categories on our website.

When can interns and trainees start their programs?

Interns and trainees may begin their programs any day of the year.

How long can they stay at my company?

Interns can train for up to 12 months. Trainees can train for up to 18 months, except for Hospitality and Tourism Trainees, who may only train for a maximum of 12 months.

From which countries can I recruit interns and trainees?

We can provide visa sponsorship for applicants from any country in the world, provided the candidate meets program requirements.

I need to hire permanent staff. Can I hire an intern or trainee?

No, the J-1 Intern and Trainee Visas are temporary exchange visitor visas designated for the purposes of training—not for regular employment. For more information regarding work visas, please visit www.uscis.gov.

Can interns and trainees have more than one job?

No, per the J-1 Visa regulations, interns and trainees are not allowed to have second jobs. They are only permitted to intern or train for the organization on their DS-2019 Form.

Application Process

Do you have a pool of intern and trainee candidates?

No. InterExchange Career Training USA does not offer placement services so we do not have candidates that we can recommend.

How long does the process take?

We recommend that you and your participants begin the application no less than 6 to 8 weeks before the intended program start date. Our review time is approximately 10 days once we receive both a complete application and full payment. We cannot review your application until all documents and payment have been submitted.

If a site visit is required, the review process may take longer. Please note that wait times for visa appointments can be longer than average during the summer months, so make sure to plan accordingly.

I have found a candidate(s). How do we begin the application process?

You can either sign up and invite your interns/trainees to the online application or ask them to apply online and then invite you to the application.

What is required for the Training/Internship Placement Plan (DS-7002)?

The training plan should include a detailed outline of what the internship/training program involves, including what the interns/trainees will be doing and how they will be trained by your organization. There should be a rotation or phase for every 3-4 months of training, and each phase must be different and build off the previous phases.

The training plan you create for your participants is a legally binding document, and the training you offer during the program should match what’s outlined in the plan. Keep in mind that the training program cannot include unskilled labor or more than 20% clerical work. Your interns or trainees should be doing professional-level tasks, with ongoing training and supervision by your team. Remember that the participants are here for cultural exchange and training and are not meant to be viewed as normal employees or assistants. Misuse of the program is considered visa fraud.

Please see our Guide to Developing a Successful Training Program.

Do I have to create a new Training/Internship Placement Plan (DS-7002) everytime I want to host a J-1 intern or trainee?

Once you have successfully hosted a J-1 participant through our program, you can visit an existing training plan and copy phases to your new participant by using the Copy Phases button.

What cultural exchange opportunities should I offer my participants?

Check out our suggestions for cultural activities, including company activities and traditions, sporting events, happy hours, and holiday parties.

What documents is my company required to provide for the application?

All host employers must provide the following required documents:

- Proof of a workers’ compensation policy or equivalent insurance that covers J-1 participants (or proof of exemption)

- Either a DUNS number or copy of your business registration

- Obtain your business registration here

- A Federal Identification Number

How can I pay the program fee on behalf of my interns or trainees?

You can make a payment on our website. Please remember to select Career Training USA as your program and to list the name of the applicants in the Description. Once the payment has been made, please send the receipt so we can mark the participants off as paid and begin the application review process.

If InterExchange approves our application, are my interns/trainees guaranteed to get a visa?

The decision to grant a visa is the U.S. Embassy’s/Consulate’s alone. While visa denials are rare, they do occur. InterExchange has no control over the U.S. Embassy’s/Consulate’s decision to grant or deny a visa application, but we will discuss options with you and your participants if they are denied a visa.

What types of training are prohibited?

Not all employers are permitted to host through InterExchange. We cannot approve participants for sponsorship at the following locations:

- Agricultural settings, such as farms or in wineries’ harvesting operations

- Arcades

- Behavioral health facilities

- Bridal companies

- Camps (Consider our Camp USA program for camp positions)

- Candy stores, mall kiosks, boardwalk booths, and stands

- Convenience and grocery stores or superettes/mini-markets (consider our Work & Travel USA program for seasonal positions)

- Call center, customer service, or phone operators, including tech and help desk support

- Farms

- Fast food or quick service restaurants or bakeries (consider our Work & Travel USA program for seasonal positions)

- Fitness studios, gyms, pools, dance studios, personal training, or coaching

- Garages

- Gardens or parks

- Gas stations or toll plazas

- Landscaping companies

- Pool management companies

- Real estate agencies

- Retail stores or locations and boutiques

- Schools and other instructional facilities

- Spas, salons, or dog grooming companies

- Staffing agencies

In addition, we are not able to sponsor programs in which interns or trainees would participate in:

- Animal care

- Child care

- Elder care

- Clinical work that involves any patient care or contact

- Sports or physical therapy

- Psychological counseling

- Nursing

- Dentistry

- Veterinary medicine

- Social work

- Speech therapy

- Early childhood education

If you require staff at one of the locations mentioned above or would like seasonal staff to assist with tasks that are not appropriate for Career Training USA participants, our Work & Travel USA program may be able to help meet your needs.

Are there special requirements for hospitality hosts?

Yes, the following requirements apply to hotel/hospitality management, hotel food and beverage management, restaurant management, and culinary arts.

- InterExchange does not permit business-only or non-hospitality programs at hotels, resorts, inns, or restaurants.

- Interns and Trainees wishing to train in hospitality or restaurant management positions must have hospitality or restaurant management education (interns) or work experience (trainees) in order to be able to rotate through various departments.

- At least three rotations for programs six months or longer is required by the regulations. No rotation may be more than three or four months long, and each department must have sufficient, qualified staff to offer adequate training.

- NOTE: InterExchange will not be able to sponsor Hospitality programs with Housekeeping Management phases.

- Per the U.S. Department of State regulations, all Hospitality Management, Restaurant Management and Culinary programs are limited to 12 months regardless of whether the individual is an Intern or Trainee.

- Hospitality Interns and Trainees may not return to properties at which they have previously worked on a Work and Travel program or other work visa.

- Education or work experience only in Tourism Management does not qualify Interns or Trainees for programs in Hospitality Management, as those fields are not interchangeable.

Eligible Locations

| Hotels | Restaurants |

|---|---|

| Should be rated 3-Diamond or higher by AAA, or rated 4-Star and above by Forbes. | Must be high-end, fine dining, sit-down restaurants OR full-service banquet halls. |

| All unrated properties will be considered on a case-by-case basis. | All properties will be considered on a case-by-case basis. |

Non-Eligible Locations

| Hotels | Restaurants |

|---|---|

| Motels | National chains, casual dining restaurants, pubs, pizza parlors |

| Hostels | Fast food, delivery/takeout restaurants, bakeries |

| Hotels that do not meet the above requirements | Kiosks, stands, food trucks |

Acceptable Types of Training

Remember that participants must rotate through departments and roles. Therefore, they may train in any given category for only one phase.

| Hotel/Hospitality Management | Restaurant/Food and Beverage Management | Culinary Arts |

|---|---|---|

| Front Desk | Restaurant/Food and Beverage Management | Kitchen equipment and food-handling safety training |

| Concierge | Restaurant Inventory or Management/Buying | Recipe development |

| Hotel or Restaurant Inventory/Buying | Catering/Event Planning | Inventory/food sourcing |

| Back Office/Business Management | Staff Training and Development | Different stations/food styles |

| Food and Beverage Management | Restaurant Business Areas | Menu planning |

For questions about other types of tasks, please contact InterExchange.

Prohibited training tasks or positions

| Hotel/Hospitality Management | All Areas |

|---|---|

| Valet | Cashier |

| Bellhop | Dishwashing |

| Dishwashing | Bussing Tables |

| Laundry | Bartending |

| Serving/Hosting | Delivery |

| Bussing Tables | Running Food |

| Bartending | Serving |

| Night audit or any training that occurs in the overnight hours | |

| Maintenance | |

| Housekeeping |

As part of an overall management training, participants may briefly train in hosting, waiting tables, food preparation, etc. to learn basic skills needed to pursue management-level training within a department. However, the combination of such basic tasks may NOT exceed 20% of the entire training program. For culinary participants, food preparation may constitute a larger percentage of their program but only for high-skill tasks contributing to their training.

Host employers who require wait staff, housekeepers, bellhops, short order cooks, etc., are encouraged to learn more about our InterExchange Work & Travel USA program.

Compensation & Taxes

Should I pay my intern or trainee?

Trainees must be paid at least the local, state, or federal minimum wage, whichever is highest. Interns must be paid at least minimum wage if their program will be longer than 6 months or if it does not meet the Department of Labor’s test for unpaid interns (for programs of any length). Compensation and benefits should be determined with participants prior to their arrival in the U.S.

Do interns and trainees have Social Security numbers?

Most interns and trainees will need to apply for a Social Security Number after they arrive in the U.S. The application process could take 4-6 weeks, but participants should be allowed to continue training and get paid while they wait for their card to be issued. They will need to provide you with a receipt from the SSA that shows that they have applied for their Social Security Number. If interns or trainees have previously earned income in the U.S., they should have a Social Security number and card already.

How do I put my interns/trainees on our payroll before they have a Social Security Number?

You should first consult your payroll administrator or an HR professional.

If your company uses E-Verify, and your participants have not yet received a Social Security number, make a note on their Form I-9 and set it aside. The participants are still allowed to continue to train. As soon as your participants receive a number, you can create a case in E-Verify.

You can also follow these instructions on W-4s provided by the IRS:

- Paper Filers: If the participants applied for a card but didn’t receive the number in time for filing, enter “Applied For” in Box a. (Reference: IRS Instructions for Forms W-2/W-3)

- Electronic Filers: If the participants applied for a card but didn’t receive the number in time for filing, enter all zeros in the field for the Social Security number. (Reference: Specifications for Filing Forms W-2 and W-2c Electronically)

Am I required to provide housing for my intern or trainee?

You are not required to provide housing, but we do encourage you to offer some assistance to your interns/trainees as they seek housing in the U.S. InterExchange Career Training USA provides participants with a number of general resources on housing, transportation, and U.S. culture, but since we have participants located all across the U.S., you will be your participants’ best resource on finding housing and getting around in your local area. Consider offering your participants advice on the best neighborhoods, typical housing prices, and the best websites to use to look for housing.

Am I required to pay transportation costs?

No. Interns and trainees are able to arrange their own transportation independently, though you may offer assistance if you wish.

Do I have to provide health insurance?

All InterExchange Career Training USA participants have basic accident and sickness insurance that meets U.S. State Department requirements. This covers medical care if they get sick or injured while in the U.S., but it does not cover preventative care or pre-existing conditions. If you would like to add them to your health insurance plan so they can seek general care in addition to emergency care, you are welcome to do so, but they cannot waive their coverage of the accident and sickness coverage included in their program fee. This plan provides some required benefits mandated by the U.S. State Department that normal health insurance plans do not.

Are interns and trainees required to pay taxes?

Yes, both interns and trainees who are paid by their host employers are required to pay income tax. However, participants on a J-1 Visa are considered non-resident aliens, so they are exempt from paying Social Security (FICA), Medicare, and federal unemployment (FUTA) taxes and these should not be withheld from their paychecks. Please consult a tax professional to find out if participants are exempt from state unemployment taxes in your state.

Do interns and trainees have to file taxes?

Participants who are paid must file a U.S. tax return for the calendar year during which they trained with your company, even if they are no longer in the U.S. Make sure to send the participants their W-2 forms when it is time to file a tax return.

Support During the Program

What level of support does InterExchange Career Training USA offer throughout the program?

We offer 24-hour support throughout the entire program to hosts, interns, and trainees. We are open M-F 9:30am-5:30pm ET for general questions and concerns.

Our emergency line is (917) 373-0994 for any after-hour emergencies that arise. Call or email us us with any questions you may have regarding the program.

What if I want to hire additional interns and trainees for my company?

First ensure that your business still meets all program requirements, including the J-1 exchange visitor to full-time employee ratio, and then invite your intern or trainee candidate(s) to your application.

What do I do if I am not satisfied with my intern or trainee?

If you feel that your interns or trainees are not meeting your expectations, we ask that you first talk to the participants to make your expectations known and develop a performance improvement plan. We have found that a frank discussion about workplace issues often solves the problem. However, please do keep in mind that this is a training program. Your expectations for work and performance should be different than they are for normal employees.

Career Training USA is also available to talk to the interns or trainees to help resolve any issues. If the situation does not improve and you need to terminate the interns or trainees, please notify InterExchange Career Training USA as soon as possible so that we can assist your participants with any questions regarding visa status.

I’m really happy with my interns/trainees. Can they stay at my company longer?

If your participants have not yet met the maximum program length, you may be able to extend their programs. The maximum duration of the Internship program is 12 months and the maximum duration of the Trainee program is 18 months (12 months for Hospitality/Tourism). Extensions must demonstrate a plan for new and advanced training, which should build off of the initial training program.

Can I hire my participants for permanent positions after their programs end?

No. Participants must leave the U.S. at the end of their J-1 Visa programs, as this is a temporary cultural exchange program. Leaving the U.S. at the end of the program is a necessary part of completing the exchange, and this is specified in the federal program regulations for the J-1 Visa. It may be possible for the participants to return on work visas in the future but we are unable to assist or advise on this.

Welcome to InterExchange

Thank you for your decision to host an international intern or trainee through the InterExchange Career Training USA program! InterExchange brings more than 50 years of experience, as well as knowledge and enthusiasm, to the world of international cultural exchange, and we look forward to working with you throughout the program.

As a host employer, you play a very important role in ensuring that the goals and objectives of the J-1 Intern/Trainee exchange visitor program are met.

Remember to keep us updated about any changes to your email address or phone number so you can be sure to receive important program-related updates.

Welcome to the Career Training USA program. We wish you a very successful program!

The Goals and Objectives of the J-1 Intern/Trainee Exchange Visitor Program

Per the program regulations, the primary objectives of the Intern and Trainee programs are to enhance the skills and expertise of exchange visitors in their academic or occupational fields through participation in structured and guided work-based training and internship programs, and to improve participants’ knowledge of American techniques, methodologies, and technology.

Such training and internship programs are also intended to increase participants’ understanding of American culture and society and to enhance Americans’ knowledge of foreign cultures and skills through an open interchange of ideas between participants and their American associates.

A key goal of the Fulbright-Hays Act is that participants will return to their home countries upon completing their programs and share their experiences with their countrymen.

The Intern/Trainee J-1 Visa (together with the DS-2019 Form) allows the participant to:

- Intern/Train in the U.S. during the dates listed on the DS-2019 Form

- Apply for a Social Security number

This visa does not allow the participant to:

- Perform unskilled labor or provide medical patient or child care

- Extend his or her work eligibility or program participation past 12 months for interns or hospitality trainees and past 18 months for all other trainees

- Intern/train for more than one host employer at the same time

- Intern/train for fewer than 32 hours a week or perform more than 20 percent clerical work

Applying for J-1 Visa Sponsorship

We’re thrilled that you are interested in hosting an international intern or trainee at your organization! The resources below will help to guide you through the program.

Applying for J-1 Visa Sponsorship

Watch the Host Employer Orientation:

- Watch the Host Employer Orientation.

- Ensure your company meets all of the Host Employer Requirements.

Create Your InterExchange Account:

- Sign up here.

- If you already have an account, log in here.

Complete Your Application and Create Your Participant’s DS-7002 Training Plan:

- Check out our guide on How to Create a Successful Training Program.

- View examples of acceptable Worker’s Compensation documents.

- Review the Department of Labor’s criteria for unpaid internships.

Before Participant Arrival

Read the Host Employer Resources:

Familiarize yourself with program requirements and tips for a successful program.

Help the Participant Prepare for their Program:

We encourage you to provide guidance to the participant on housing and transportation, as well as cultural resources in your local area.

Participant Arrival

Monitor the Participant’s U.S. Arrival:

Participants are permitted to arrive up to 30 days before their program start date (but they may not begin training until the start date).

Remind the Participant of SEVIS Registration:

- Once the participant arrives, they must contact InterExchange within 10 days to register in SEVIS.

- Participants can let us know they’ve arrived by submitting this Arrival Form.

Understand the Social Security Number Application Process:

- At least 5 days after their SEVIS record is activated, participants may apply for their Social Security Number.

- The wait time to receive a card could be 4-6 weeks, but participants may begin to intern/train and be paid before they have been issued a number, provided they provide you with the application receipt.

- Check out the following information from the Social Security Administration:

Complete Tax Forms and Understand Withholding Requirements:

- If you are offering a salary/stipend, have the participant complete W-4 and I-9 forms. Follow the special instructions for J-1 exchange visitors.

- J-1 interns/trainees are nonresident aliens for tax purposes and are therefore exempt from paying certain taxes like FICA and FUTA. Make sure you withhold the appropriate taxes.

Provide a Workplace Orientation:

- Orient the participant to your office and company culture upon arrival. Explain company policies like sick days or paid time off and provide a company handbook.

- Be patient with the participant as they acclimate to their new environment. Take the time to answer their questions and give them an introduction to the local area.

During the Program

Stay in touch with InterExchange:

Contact InterExchange if there are any changes to program details or if you or the participant have any issues or concerns.

Offer Cultural Exchange Opportunities:

Offer opportunities for the participant to experience U.S. culture and to share their own culture with their coworkers, including company activities and traditions, sporting events, happy hours, and holiday parties.

Follow the Training Plan:

- Follow the Training Plan, provide challenging, professional-level tasks and responsibilities, and fully support your participant as they learn and ask questions.

- Remember that the participant is here for cultural exchange and is not meant to be viewed as a normal employee. Misuse of the program is considered visa fraud.

Provide the Promised Compensation:

- Compensate the participant per the terms outlined in their DS-7002 Training Plan.

- All trainees, as well as interns on programs longer than 6 months, receive at least the local minimum wage. If minimum wages rise during the program, you must provide at least the new minimum wage once the law goes into effect.

Be Prepared to Handle Culture Shock and Language Barriers:

Be on the lookout for signs of culture shock or difficulties adjusting to living and training in the U.S., and be patient with the participant if English is not their native language.

Complete Program Evaluations:

InterExchange will email you links to State-Department-required program evaluations to complete at the end, and sometimes the middle, of the program.

Consider an Extension:

If the participant has not met the maximum length of their internship or trainee program, an extension may be possible. Contact InterExchange for more details.

After the Program

Understand the Grace Period:

- Participants can remain in the U.S. up to 30 days after the program end date as listed on their DS-2019.

- They may not intern or train during this time, but they are welcome to travel the country and get their affairs in order before they depart.

Send the Participant’s W-2 and Provide Guidance on U.S. Taxes:

- Send the participant their W-2 form when it is time to file a tax return.

- Participants who are paid must file a U.S. tax return for the calendar year during which they trained with your company, even if they are no longer in the U.S.

Invite Future Participants:

- Host another intern/trainee through InterExchange! Once you have a new candidate, log in to your InterExchange account to invite them to the application.

- If your new candidate will be completing a similar program as a prior participant, you can even copy the previous training plan and edit it as necessary.

Host Employer Orientation

Congratulations on starting your InterExchange Host Employer Application!

You’re one step closer to hosting an international intern or trainee, and we’re excited to assist you with the J-1 Intern/Trainee visa sponsorship. If this is your first time working with InterExchange, you will need to complete a mandatory 10-15 minute Host Employer Orientation.

IMPORTANT: You must complete the orientation before the participant can be approved for visa sponsorship.

Please join one of the Host Employer Orientation sessions listed below to discuss the Department of State’s program regulations/expectations and InterExchange’s application reviewal and program monitoring procedures.

- Wednesday, March 20th at 3:00pm EDT

- Friday, March 22nd at 2:00pm EDT

- Tuesday, March 26th at 11:00am EDT

- Wednesday, March 27th at 10:00am EDT

- Monday, April 1st at 11:00am EDT

- Wednesday, April 3rd at 2:00pm EDT

- Tuesday, April 9th at 10:00am EDT

- Friday, April 12th at 1:00pm EDT

- Monday, April 15th at 12:00pm EDT

- Friday, April 19th at 1:00pm EDT

- Tuesday, April 23rd at 3:00pm EDT

- Thursday, April 25th at 1:00pm EDT

- Monday, April 29th at 11:00am EDT

- Wednesday, May 1st at 2:00pm EDT

- Tuesday, May 7th at 10:00am EDT

- Friday, May 10th at 1:00pm EDT

- Monday, May 13th at 12:00pm EDT

- Friday, May 17th at 1:00pm EDT

- Tuesday, May 21st at 12:00pm EDT

- Wednesday, May 22nd at 3:00pm EDT

- Tuesday, May 28th at 1:00pm EDT

- Friday, May 31st at 11:00am EDT

- Tuesday, June 4th at 1:00pm EDT

- Wednesday, June 5th at 11:00am EDT

- Monday, June 10th at 2:00pm EDT

- Friday, June 14th at 2:00pm EDT

- Tuesday, June 18th at 10:00am EDT

- Friday, June 21st at 11:00am EDT

- Tuesday, June 25th at 11:00am EDT

- Wednesday, June 26th at 3:00pm EDT

Please let us know which session you will be attending by registering to the respective orientation time.

NOTE: Each session wil be hosted on GotoWebinar. Please let us know if you are unable to attend one of these orientation times, or if your intern/trainee is scheduled to begin their program less than three weeks before the next available orientation.

Feel free to reach out to [email protected] with any questions or concerns you may have.

Tips for a Successful Program

InterExchange Career Training USA interns and trainees come away from their cultural exchange experience in the U.S. with advanced skills in their career fields, and an expanded professional network. These successful experiences are due in large part to host employers like you who provide exceptional training.

Here’s a list of best practices for employers hosting international interns or trainees.

1. Provide an Orientation and a Company Handbook

A formal introduction to the company is necessary for participants to get familiar with the office environment and meet the staff they will be working with on a daily basis.

Familiarize the participant with office culture, how to use office equipment, how to handle emergencies and work-related injuries, and other information that will prepare them to be successful.

Include tips about the local area. Providing advice about the best local banks and shops or showing participants around town when they arrive will help them acclimate to their new environment more quickly.

Provide participants with access to information about the company and its policies if they have questions. They should understand their benefits as well, such as paid time off, sick days, or office perks.

2. Provide Professional-Level Assignments & Remain Sensitive to Participants’ Needs

Ensure that you are always providing challenging, professional-level tasks and responsibilities to your participants while also fully supporting them as they learn and have questions.

Not only will participants get more out of the experience, but your company will benefit as well.

The DS-7002 Training Internship Placement Plan serves as an additional resource for both you and your participants, as it details each of your roles and responsibilities and the training goals.

Many employers comment on how impressed they are with their participants’ behavior and ability to adapt. However, if your participants are having trouble, try to imagine yourself in a similar situation.

Your individual participant may require some extra attention or extra assistance. If you welcome participants properly, treat them fairly and communicate openly, the experience should be mutually enjoyable.

3. Provide Participants with a Clear Set of Guidelines

By presenting your expectations in a straightforward and honest manner, participants will be more aware of what they should and should not do. The first impression often sets the tone for the rest of the program.

Regular communication with participants will enhance the internship experience for everyone. The majority of misunderstandings arise from poor communication or a cultural difference.

In certain cultures, it is not appropriate for subordinates to address concerns with superiors, so it is important to create a communicative atmosphere.

If you notice participants are having a difficult time, take the first step and open the conversation. Listen to their concerns, and let them know that it is okay to discuss any issues or concerns they are experiencing.

Set schedules and deadlines for participants.

- Clear schedules and deadlines will help participants know what to expect and can help avoid misunderstandings about their expectations.

4. Explain HR Processes and Payroll

Participants will not necessarily understand how to fill in their W-4 forms or what U.S. taxes they will be paying.

- If participants are being paid, we recommend you discuss all the on-boarding paperwork with them and let them know what to expect in their paycheck after taxes so that they have realistic expectations and can budget accordingly.

- Check our Tax Resources section for more information regarding Taxes.

5. Compensation

Living in the U.S. is expensive and we would advise you to compensate interns, in some way, even if their program qualifies as an unpaid internship.

If you are unable to provide a full salary, consider offering a stipend, monthly or hourly wage, or help with transportation, housing, or meal benefits.

Trainees at any program length and interns who do programs longer than six months or whose programs do not meet the Department of Labor’s test for unpaid internships must be paid at least minimum wage.

As outlined in the InterExchange Host Agreement, compensation must meet any federal, state, and local laws applicable to the position.

Participants must be paid at least the amount required for similar employees under federal, state, and local minimum wage laws.

If minimum wages rise during the participant’s program, they must receive at least the new minimum wage amount as soon as new laws go into effect.

6. Be Prepared to Handle Culture Shock

Bringing international interns or trainees into your office can cause culture shock from both the participants and your regular employees. Here are some tips on navigating this and creating something positive out of the cultural differences:

Ask your participants about the standard business practices in their home country so you understand their perspective.

Ask your participants about their home culture and get to know them. This will make them more comfortable.

Check in on your participants to ensure they are comfortable, happy, and adjusting to their new roles and the U.S. Some participants might be apprehensive about bringing up concerns or suggestions without prompting.

When everything goes well, the participants and your U.S. employees will benefit from the relationship, see new business perspectives, and learn about new cultures. Learn more about how to help the participants cope with culture shock.

7. Be Aware of Language Barriers

All interns and trainees are required to have English language proficiency to qualify for the program, but it’s important to keep in mind that communication in English takes some getting used to.

Many participants complete a J-1 Visa program because they are eager to practice and improve their English proficiency.

Be patient as they improve their skills, and be careful with idioms and slang, which take more time to learn and understand. Even native English speakers may take time to adjust.

If participants are reluctant to speak English upon first arriving, it is best to encourage them to practice using English as much as possible.

Participants who get into the habit of speaking in their native language tend to make slower progress. The more English the participants speak, the easier their time here will become. It may be difficult at first, but it is very important that participants challenge themselves to adapt to interacting in English to make the most of the exchange experience.

8. Integrate the Interns or Trainees into the Company

Activities encourage staff cohesion and provide an alternate setting for social interactions outside of the working environment. Group events also give participants a feeling for how people from the U.S. interact outside of work and give them a chance to educate you and your staff about different countries and cultures. These types of benefits have long been a secret of successful host employers everywhere.

- Include the intern in company activities and traditions, both in and out of the office. Some examples include office sports teams, group lunches, parties or picnics, or even a speaker series.

9. Provide Regular Evaluations

Particularly for longer training programs, evaluations (written or in person) allow you to touch base with the intern/trainee and assess the program and his or her performance.

- Weekly check-ins or one-on-ones are another way to track progress and provide feedback and guidance, and they also allow for a set time where participants can discuss any questions or concerns they may have.

10. Conduct an Exit Interview

Conducting an exit interview is a great way to gather feedback on participants’ experiences at your company so that you can improve the program for your future participants

It is also a great opportunity to assess what your participants have learned about U.S. business culture, as this may help to inform your practice if you move into a more global work environment.

Cultural Exchange In Action

Encouraging participants to interact with Americans and experience our culture in their free time is an essential part of your role.

Hosting your own cultural events and activities is often the best way to teach them about life in the U.S! To help you facilitate fun cultural activities for your international interns or trainees, we’ve outlined some ideas below.

InterExchange prioritizes giving our participants and hosts resources for exploring cultural learning opportunities, find them here:

- Read or share our online guide to U.S. culture called Cultural Compass

- The InterExchange Inside the USA guide contains many helpful recommendations and resources.

Beginning of Program

Making sure your international participants have a warm welcome can be the key to a successful program. Remember, they’ve just arrived in a new country and don’t know anyone! Events at the beginning of their program can be as simple as gathering employees together for introductions.

On their first day, orient participants to the workplace and allow time for them to get to know their colleagues. Consider hosting a welcome reception in the office for the participant to get to know colleagues in other departments or even just kick off the program by having a smaller team lunch.

Mid-Program Events

Throughout the participants’ program, cultural events and outings are a great way to make sure participants are experiencing American culture. Participants may feel homesick at some point during their stay, and facilitating fun activities can help remind them why they’re here. Their American colleagues will probably enjoy an office outing as well!

Sporting event: Organize an outing to a local sporting event. Help explain the rules of the game if the participant is unfamiliar.

Food events: Host an American-style barbecue or picnic or organize a potluck where staff and participants prepare their favorite dishes from their home countries or countries of origin.

- Enjoy typical American foods, such as s’mores, peanut butter, and Girl Scout cookies

- Share popular American/local restaurants and food trucks

- Tell your participants about brunch in the U.S.

- Share your favorite recipes with your participants and see if they have any for you

Government & Politics: Teach your participants how elections in the U.S. work and learn about the governing structure in your participants’ home country

- Find out if your statehouse gives free tours to the public

Celebrate an American holiday: Celebrate holidays like the Fourth of July or Thanksgiving to give participants a unique insight into American culture. Office potlucks work well for holiday celebrations.

- Pumpkin carving contest: Print out templates and have fun carving pumpkins

- Attend a local holiday parade or festival

- Teach your intern/trainee the story of Thanksgiving

Visit a local museum or concert hall: Encourage your participants to visit local museums.

Employee birthdays: For many participants, this may be their first birthday away from home. Help make it special by organizing a party or gathering with colleagues.

Volunteer event: Get coworkers together for a day or an hour of volunteering! Partner with a local volunteer organization for greater interaction with Americans.

End-of-Program

At the end of the program, consider hosting a going-away party to show your appreciation for your participants’ hard work. Their American colleagues may appreciate saying goodbye as well!

Culture Shock

International participants are likely to encounter some difficulties adjusting to living and working in the U.S.

A participant may soon realize that the familiar signs of home and their automatic responses for meeting situations of daily life may not be applicable in the U.S. Climate, food, landscapes, people and their ways of doing things may all seem strange. English ability may not serve the participants as well as they expected. They may feel the pressures of a fast-paced life in a busy city in the U.S.

Important Program Documents

Career Training USA program participants will receive an acceptance package that includes essential information and documents needed when applying for the J-1 Visa.

As a host employer, you must know about these documents and how they affect your relationship with your participant.

In Summary

- DS-2019: Certifies program eligibility and identifies parties involved in the program (participant, host organization, and J-1 Visa sponsor)

- DS-7002: Outlines the training that will be offered by the host organization to the intern or trainee

- J-1 Visa: Allows the participant to enter the U.S.

DS-2019 Form - Certificate of Eligibility For J-1 Exchange Visitor Status

The DS-2019 Form is a U.S. government document that permits individuals to intern or train with a U.S. company.

The DS-2019 Form:

- Certifies the participant, host, and training program meet program regulations

- Identifies InterExchange as the program sponsor and serves as proof of InterExchange’s sponsorship of the J-1 Visa

- Describes the purpose of the program

- States the time period that the participant is legally permitted to intern or train in the U.S.

- Lists you as the host employer and indicates your office location is the site of activity

Participants are only allowed to intern or train with a valid DS-2019 Form and only during the dates listed in Section #3 of their form. Although participants may only intern or train within these dates, they may enter the U.S. up to 30 days prior to the program begin date.

Participants may also legally remain in the U.S. for up to 30 days after the program end date, unless otherwise specified. This is known as the “grace period. Participants may NOT continue to intern/train with you during their grace period.

DS-7002 Form - Training/Internship Placement Plan

The DS-7002 Form (Training/Internship Placement Plan) is a U.S.-Government document that includes a description of the internship or training program you will provide.

By signing the training plan you have developed, you are acknowledging that the tasks, activities, and objectives outlined in this document will be the training you will offer the participant throughout their program.

The training plan is a binding document, and it is absolutely essential that you follow this plan closely. Failure to do so is a violation of federal program regulations and may result in program termination.

If anything in the plan needs to be changed, either now or once the program has begun, you must discuss this with InterExchange prior to making any changes to the training. All changes must first be documented in a revised training plan signed by you, the intern/trainee, and InterExchange before the changes may officially be put in place.

The J-1 Visa

Once you and your participants are approved to participate in the J-1 Intern or Trainee program and participants have their DS-2019 Forms, they may then go to the embassy/consulate to apply for the J-1 Visa. If approved, a J-1 Visa sticker will be affixed to the participant’s passport by a consular official. NOTE: Canadian citizens are not required to obtain a visa and may travel with the DS-2019 Form alone.

Though InterExchange certifies eligibility to participate in the program, only an embassy or consulate can issue the J-1 Visa. InterExchange has no control over the decisions of consular officials. Though rare, a visa denial can occur. If the participant is denied a visa, please contact us immediately to discuss whether it may be appropriate for the participant to attempt to apply for the J-1 Visa a second time.

The J-1 Visa allows participants to enter the U.S. The expiration date on the J-1 Visa is the last day they may enter the U.S.—not the last day they can intern/train with your organization. The program end date on the DS-2019 Form is the last day participants may complete tasks or activities as an intern/trainee.

In Summary

- DS-2019: Certifies program eligibility and identifies parties involved in the program (participant, host organization, and J-1 Visa sponsor)

- DS-7002: Outlines the training that will be offered by the host organization to the intern or trainee

- J-1 Visa: Allows the participant to enter the U.S.

Arriving in the USA

InterExchange Camp USA works closely with both camps and participants to match appropriate candidates with available positions.

Clearing Customs and Border Protection

Upon arriving, participants will immediately go to Customs and Border Protection (CBP) to request admission to the U.S. At the border, they will be entered into a United States Citizenship and Immigration Services (USCIS) database and may also be fingerprinted and photographed. To facilitate their entry, participants should tell the CBP officer that they are J-1 Exchange Visitors and then present their DS-2019 Form and passport with a valid J-1 visa.

Entry to the U.S.

Once CBP’s inspection is complete, the officer will stamp the participant’s passport to record their entry. This stamp will show the place and date of the participant’s admission to the U.S. and the time frame he or she is authorized to stay in the U.S. In most cases, the officer will write the letters “D/S”. This means “Duration of Status,” which includes the program dates listed on the DS-2019 Form, plus 30 days of travel/personal time immediately after the program end date known as the “grace period.” (Note that participants are NOT permitted to intern or train during their grace period; this time frame is for settling one’s affairs and preparing for departure from the U.S.).

Though rare, the CBP officer may write an actual date instead of D/S. This is the date by which the participant is required to leave the U.S., even if it occurs before the program’s end date. Please notify InterExchange immediately if this occurs.

Problems Crossing the Border

It is rare for J-1 Visa holders to encounter difficulties when crossing the U.S. border. However, if participants are agitated, act suspiciously, or if they are missing any documents, CBP officials may detain them for further questioning. If participants do not have the DS-2019 Form available, they may be detained and may also be flagged in the computer system, thus causing delays on future trips to the U.S. CBP officials may also just deny entry into the U.S. if participants do not have their DS-2019 Form with them upon arrival to the U.S.

The best way to ensure smooth entry to the U.S. is to have all of the appropriate forms completed and ready to present to CBP, be friendly and patient in line and with the CBP official, and answer their questions honestly. If your participant contacts you from the border because they have encountered any difficulties, please contact InterExchange immediately or ask the participant or CBP officer to notify us so that we can assist with finding a resolution.

I-94 Arrival/Departure Record

If your participant is coming to the U.S. by air or sea, their arrival record, or I-94, will be recorded electronically by Customs & Border Protection.

Participants will need a copy of this record when applying for important documents like their Social Security number or other forms of identification in the U.S. Participants can access their electronic I-94 record by visiting the CPB’s I-94 website and choosing “Get Most Recent I-94.”

Visitors coming to the U.S. through a land border (most common with Canadian or Mexican participants) will receive a paper I-94 record from the CBP officer at the port of entry. Participants should keep this safe throughout their program, as they will need to turn this in when they depart the U.S. Failure to do so could make future border crossings more difficult, so it is important they do not lose this card.

Informing InterExchange of Participant’s Arrival

Once your participant has arrived in the U.S., they must contact InterExchange within 10 days to register with SEVIS.

Remind your participant to let us know they’ve arrived by submitting this Arrival Form, which will ask them to list their exact arrival date and their new U.S. contact information.

The Student and Exchange Visitor Information System (SEVIS)

The Student and Exchange Visitor Information System (SEVIS) is a database managed by the Department of Homeland security that collects and maintains data about international students and exchange visitors during their stay in the United States. SEVIS keeps track of all InterExchange Career Training USA participants in the U.S. and records their living address, contact information, and legal status on the Career Training USA program.

As a host employer, your organization’s name and address will also be listed in SEVIS as the participant’s “site of activity”, which is the location where participants will be interning/training throughout the program. Participants can only train at the office location listed on their DS-2019 Form and in SEVIS. They cannot move to a different branch of the company or train from a different office without first requesting InterExchange’s approval and providing the information required to update their SEVIS record.

Important SEVIS Information

All program participants must contact InterExchange Career Training USA within 10 days of arriving in the U.S. to activate their SEVIS record. If the participants do not send their information to us, they will not be permitted to remain in the U.S.

Participants also cannot apply for a Social Security Number until their record has been activated in SEVIS. To prevent delays in receiving a Social Security Number, please remind your participants to contact InterExchange immediately after arriving in the U.S. (SEVIS records cannot be activated before coming to the U.S.).

NOTE: Once they have been activated in SEVIS, participants will need to wait at least 5 business days before applying for their Social Security Number, so that their information will be available at the time of their SSN application.

Keep Your SEVIS Record Accurate

Maintaining accurate SEVIS information is essential, as is responding to all communications sent from InterExchange Career Training USA.

As a host employer, you should inform InterExchange of any changes to participants’ programs. Contact InterExchange in the event of:

- Changes to your business address (moved offices)

- Changes to your phone number or email address

- Supervisor change

- Company changes in ownership, name, etc.

- Compensation or hour changes

- Training plan changes or edits

- Major medical emergency or illness

- Participants quit or terminate their programs early

InterExchange will also email participants every 30 days with a link to a check-in form, asking that they verify all information we have on file. Participants must complete the check-in form within 10 days of receiving this email in order to continue their program and remain active in SEVIS.

Please remind your participants to check their email regularly and respond to all communication sent from InterExchange.

Social Security Numbers & Taxes

All paid interns and trainees are required to apply for a Social Security Number. If you are not providing any payment to the participant, he or she is not required to have a Social Security number, but we recommend that participants apply for one, as they may need it for opening a bank account, renting an apartment, or applying for a U.S. driver’s license.

The wait time to receive a card may take up to 6 weeks.

IMPORTANT: Participants may begin to intern/train and be paid before they have been issued a Social Security Number as long as they provide you the application receipt letter.

Please visit the Social Security website or see our tips below for more information on how to set up your participant’s payroll prior to receipt of their SSN.

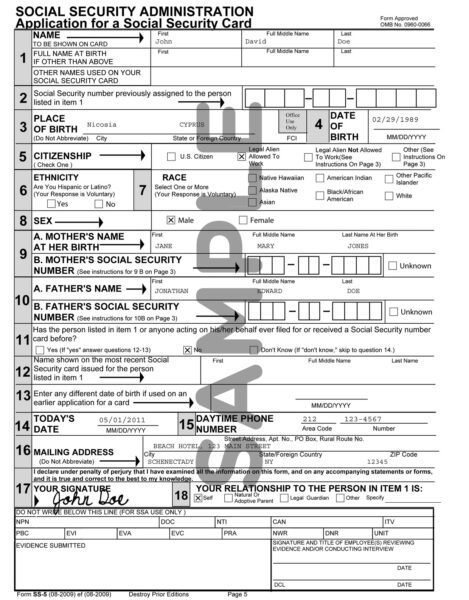

Applying for a Social Security Number

To apply for a Social Security number, participants must follow the steps below:

1. Inform InterExchange of their arrival in the U.S.: To avoid delays in obtaining a Social Security number, please remind participants to contact InterExchange Career Training USA immediately upon arrival in the U.S. to activate their SEVIS record—participants will not be able to get a Social Security number without an active SEVIS record.

2. Wait at least 5 business days: We recommend waiting at least 5 business days after SEVIS activation before applying for a Social Security Number, as it sometimes takes a few days for SEVIS information to be updated in the Social Security Administration’s database.

3. Complete the Social Security application: Participants may be eligible to begin their application online and then bring any required documents to their local SSA office to complete the application. Participants should visit the Social Security Number and Card webpage and answer the questions to determine if they are eligible to start the application process online.

If assisting participants with their applications, please use the following tips:

- Use your company address as the mailing address, especially if participants have not yet arranged permanent housing

- For an online application:

- For the question regarding the documentation the participant will provide, they should select Foreign Passport, I-94 with Unexpired Foreign Passport, DS-2019 Certificate of Eligibility, and Other.

- Participants should print and save the online control number page once they complete the online application

- For a paper application:

- For the question regarding CITIZENSHIP, check the box labeled “Legal Alien Allowed To Work”

- The questions regarding mother and father’s Social Security Numbers can be left blank

4. Visit a local Social Security Office to apply in person: If participants submit an online application, they must visit their local SSA office with their original documentation within 45 calendar days. To facilitate the application process, we recommend assisting participants with locating a Social Security Administration Office. Use the Social Security Office Locator, to find the closest office. Most Social Security offices are only open Monday through Friday from 9:00 am – 4:30 pm and are busiest between the hours of 11:00 a.m. – 2:00 p.m.

When applying for a Social Security number, participants must bring the following items:

- Social Security application (if they did not begin their application online)

- Printed online control number page from their Social Security application (if they submitted an online application)

- Passport, including the J-1 Visa

- DS-2019 Form

- Printout of I-94 Arrival/Departure Record

- ‘Dear Social Security Officer’ letter

Sample Social Security Application form

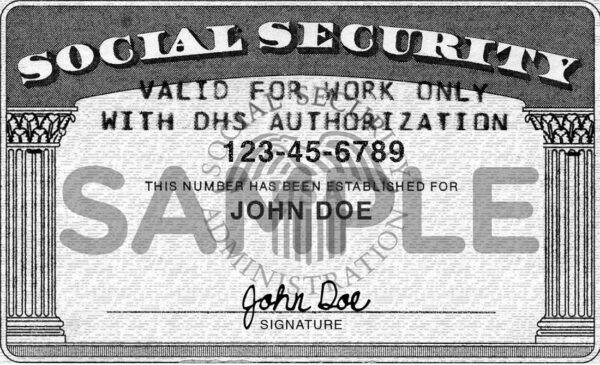

Sample Social Security Card

5. Ask for participants’application receipt: Instruct participants to keep the application receipt provided to them by the Social Security office. They should make a copy for their own records and provide you with the original. This allows participants to start training and be paid before their SSN is issued.

Read about 8 Quick Ways You Can Help Participants Get Their Social Security Number to avoid any mistakes or delays.

If you or your participants have any questions, please call the Social Security Administration’s toll-free number: 1.800.772.1213. Or, visit their website at: www.ssa.gov.

Pay & Tax withholdings

If you are offering a paid internship or training program, participants should typically be paid on the same schedule as your full-time employees. They must also be paid as regular employees and not as independent contractors (i.e. do not use IRS form 1099-misc).

All paid interns and trainees are required to pay income tax, but they’re exempt from certain other taxes. Please review the table below:

| Taxes to Pay: | Taxes to NOT Pay: |

|---|---|

| Federal Income Tax | Medicare Tax (FICA) |

| Local or City Income | Social Security Tax (S.S.) |

| State Income Tax | Federal Unemployment Tax (FUTA) |

As you can see, J-1 program participants do not pay Social Security, FICA, or FUTA Withholdings.

Under IRS Code Section 31.21. (B)(19), all non-resident aliens on J-1 visas are exempt from paying FICA (Social Security) and FUTA (federal unemployment taxes) taxes during their first two calendar years in the U.S. Since all of J-1 interns and trainee participants are only able to intern/train for 18 months or fewer, all are exempt from these withholdings. Please consult a tax professional to see if your participants are also exempt from state unemployment taxes in your state.

If FICA/FUTA has been withheld from your participants’ pay by mistake, please be sure to adjust the withholding amount for all future pay periods and issue a refund.

Onboarding Forms

I-9 Form

When participants arrive at your company, they must complete an I-9 Employment Eligibility Verification Form, which notifies the Federal Government that they are allowed to work in the United States. Participants will show you their:

- Passport with J-1 Visa

- I-94 Arrival/Departure Record

- DS-2019 Form

Participants will complete Section 1, using your company address, and you will complete Section 2.

If your company uses E-Verify, note that participants must have a Social Security number (SSN) in order to be verified. If your participant has not yet received a Social Security number, make a note on their Form I-9 and set it aside. The participant is still allowed to continue to train. Once your participant receives a number, you can create a case in E-Verify. More information can be found on the E-Verify website:

Employees must have a Social Security number (SSN) to be verified using E-Verify. If an employee has applied for but has not yet received his or her Social Security number (i.e., if he or she is a newly arrived immigrant), make a note on the employee’s Form I-9 and set it aside. The employee should be allowed to continue to work. As soon as the Social Security number is available, the employer can create a case in E-Verify using the employee’s Social Security number.

W-4 Form

Participants must also fill out a W-4 Employee Withholding Allowance Certificate as soon as they start a paid internship/training program. Based on the information provided on the W-4 Form, you must calculate the amount of federal, state, and local taxes to be withheld from the paycheck. Remember, J-1 participants are exempt from FICA/FUTA taxes, and these should not be withheld from their paychecks.

InterExchange Career Training USA participants are exchange visitors in the “non-resident alien” tax category. Please consult a tax professional for the most recent tax regulations.

When completing the W-4 Form, participants should NOT follow the instructions printed on the form, which are specific to U.S. residents—not exchange visitors.

How to Complete the W-4 Form:

As a non-resident, your participant should follow the instructions below. You can also view these instructions from the IRS online.

How to Complete the W-4 Form:

The participant should NOT follow the instructions printed on the form, as the instructions on the W-4 Form are for U.S. residents—not exchange visitors.

As a non-resident, please have the participants follow the instructions below. You can also check out the special instructions for nonresident aliens issued by the IRS online.

Do not complete the Personal Allowances Worksheet; this does not apply to exchange visitors.

Step 1(a): Indicate your legal name and permanent U.S. mailing address.

Step 1(b): Enter your Social Security number if you already have it. If you do not have your number yet, inform human resources at your host company that you applied for a number and provide a copy of your receipt.

Step 1(c): Mark or check “Single or Married filing separately,” even if you are married.

Steps 2 & 3: Leave blank.

Step 4: Write “nonresident alien” or “NRA” in the space below Step 4(c).

Step 5: Sign and date your form

If your participants have not yet received their Social Security Number, follow these instructions provided by the IRS:

- Paper Filers: If the participants applied for a card but didn’t receive the number in time for filing, enter “Applied For” in Box a. (Reference: IRS Instructions for Forms W-2/W-3)

- Electronic Filers: If the participants applied for a card but didn’t receive the number in time for filing, enter all zeros in the field for the Social Security number. (Reference: Specifications for Filing Forms W-2 and W-2c Electronically)

Remember to instruct participants to tell you the number and the exact name printed on the card when they receive it.

Filing Taxes

All program participants who are paid must file a U.S. tax return for the calendar year during which they trained with your company and follow the tax filing deadline for that year. Even if participants are no longer in the U.S., they must file a U.S. tax return for the time they trained. Reminding participants of this tax filing requirement is essential, especially if their program spans more than a year’s tax period.

Filing taxes as a non-resident alien differs from filing as a U.S. citizen or resident. You can find tips below on assisting your participants with their taxes.

Please also encourage your participants to visit the Tax Information page within our participant resources.

NOTE: If the participant has specific questions, they should contact the IRS or a tax professional, as InterExchange is not certified or licensed to provide individualized tax advice.

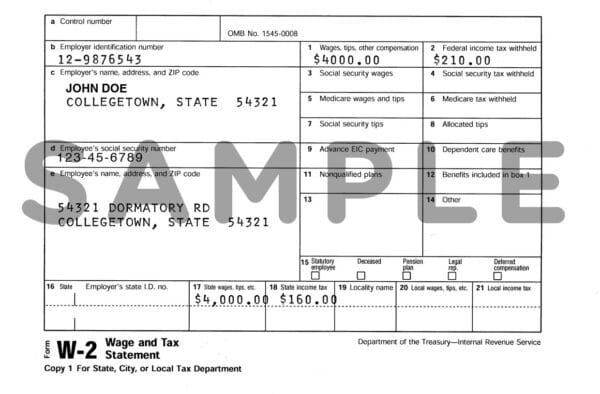

W-2 Form

If participants are still in the U.S. at tax time, please provide them with a W-2. If they have already returned home by the time W-2s are issued, we recommend that you have them leave a self-addressed envelope before departing the U.S. so that you will be able to mail the W-2 at the appropriate time or ensure that they continue to have access to an electronic W-2.

You must send a W-2 Form to your participant between January 1st and January 31st, documenting their wages and deductions from the prior calendar year.

NOTE: Do not send W-2 forms to our New York office. We are not responsible for getting this information to participants and cannot guarantee that they will receive it.

Filing Form 1040NR

If participants will still be in the U.S. at tax time, you may wish to assist them with filing a tax return. Upon receiving the W-2 Form, participants will need to fill out a 1040NR (Non-Resident Aliens) tax form.

NOTE: There are limited e-file options for non-resident aliens. J-1 participants must complete a paper copy of the form 1040-NR and mail it to the proper IRS branch. They may not use e-file options like TurboTax which are meant for U.S. residents only.

Once the form is completed, it should be mailed to the IRS address listed in the “Where to File” section of the 1040-NR instructions.

Further resources:

- IRS Website

- IRS Guide for Taxation of Non-Resident Aliens

- Interactive Tax Assistant

Filing an Amended Tax Return

If the participant has made an error on a previously filed tax return, they must file an amended tax return or Form 1040-X.

The most common error J-1 participants make is filing the wrong tax form. If they filed with TurboTax, for example, they probably filed Form 1040, which is for U.S. citizens and residents, rather than Form 1040-NR, which is for non-resident aliens like J-1 participants. The participants will need to file Form 1040-X along with a new 1040-NR to correct their return.

Once complete, they’ll need to mail the corrected forms to:

Department of the Treasury Internal Revenue Service Austin, TX 73301-0215

IRS Contact

Social Security Contact

Employer Responsibilities When Hiring Foreign Workers

www.ssa.gov/employer/hiring.htm

International Students And Social Security Numbers

Compensation

Minimum Pay Requirements

Compensation should be discussed with your participant upon their acceptance of your internship offer, and all compensation should be documented within the InterExchange application. The minimum pay requirements for both interns and trainees are listed below.

Internship Programs

- Internships may either be paid or unpaid.

- InterExchange does not permit unpaid programs that *exceed 6-months in program length.

- Shorter programs must meet the Department of Labor’s test for unpaid internships.

- If the program you will be offering does not meet this Department of Labor test, participants must be paid at least the amount required for similar employees under federal, state, and local minimum wage laws.

Trainee Programs

- Regardless of program length, InterExchange requires that all trainees must be paid at least minimum wage according to federal, state, and local laws.

If minimum wages rise during the participant’s program, they must receive at least the new minimum wage amount as soon as new laws go into effect.

The compensation you indicated on the training plan (DS-7002) is the amount you must guarantee your intern/trainee during the program. If you are paying your J-1 participants minimum wage and the minimum wage rises during their program, they must receive at least the new minimum wage amount as soon as new laws go into effect.

Non-monetary Compensation

You may also provide non-monetary compensation such as housing, transportation and/or meals as part of the participant’s overall compensation package. The value of any benefits such as these should be calculated on a monthly basis and documented within the participant’s application and DS-7002 Form.

If you will be asking the participant to pay a portion of provided housing or transportation, these charges should be billed to the participant rather than deducted from the participant’s paycheck.

Any deductions from compensation that are withheld must be made in accordance with labor laws, and participants must be notified at the time of internship/training program offer and indicate that they agree to accept the deductions. Please also inform InterExchange of any planned deductions.

If you are unable to offer housing but wish to offer some assistance to your intern/trainee, please review our housing guide. We generally recommend that participants secure temporary housing in a hostel or hotel so that they can look for permanent housing after they have arrived in the U.S. Any recommendations or assistance you can provide to help facilitate this process will allow the participant to acclimate to life in the U.S. much more quickly.

Hours and Overtime Pay

- ll J-1 Interns/Trainees are required to train a minimum of 32 hours per week, and they should train no more than 45 hours per week.

- It is expected that on a general basis participants should be training the number of hours listed on their training plan. However, if a participant does occasionally do overtime hours, they should be compensated appropriately according to federal, state, and local laws for overtime pay.

IMPORTANT: Please remember that this is a cultural exchange program. Participants should not be doing regular overtime as this indicates they are being used for regular employment and does not align with the purpose of the program. Misuse of the program in such a way is considered visa fraud.

Additional Employment